The China+1 theme, which saw companies worldwide explore alternatives to supplies from China, was seen as a big growth opportunity for India. A few years on, however, those expectations have been belied, at least in the chemical sector. Indian chemical companies are struggling to cope with a demand downturn and the burden of aggressive capex plans. Their Chinese counterparts, meanwhile, are gaining market share by selling their products on the cheap.

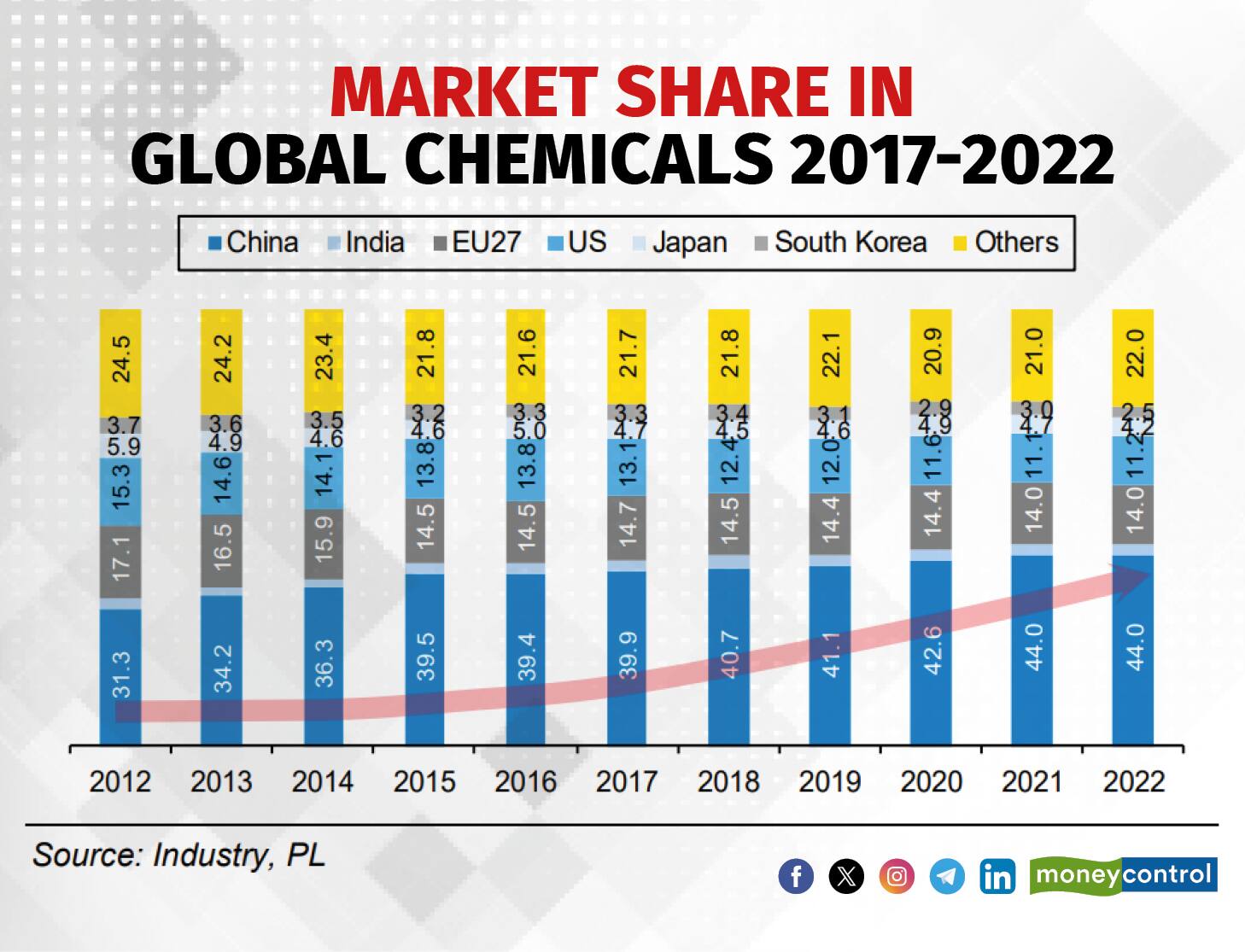

China's share in global sales of chemicals expanded to 44 percent in CY22, up from 40.7 percent in CY18. This expansion has come about despite the shutdown of around 40 percent of the country's chemical capacity in 2017, which led to the hysteria of China+1. It gained about 400 basis points market share over the CY17-22 period, at the expense of the US, EU27, Japan, and South Korea, as brokerage firm Prabhudas Lilladher noted.

Supported by large-scale state-aided expansions, China managed to raise its market share from 31 percent in 2012 to 39.9 percent in 2017. However, this came to a halt as uncontrolled expansion, along with a lack of safety and environmental controls, led to a series of industrial accidents and non-compliance incidents at the chemical plants. This culminated in a clampdown that saw about 40 percent of Chinese chemical capacity being closed in 2017, noted Prabhudas Lilladher.

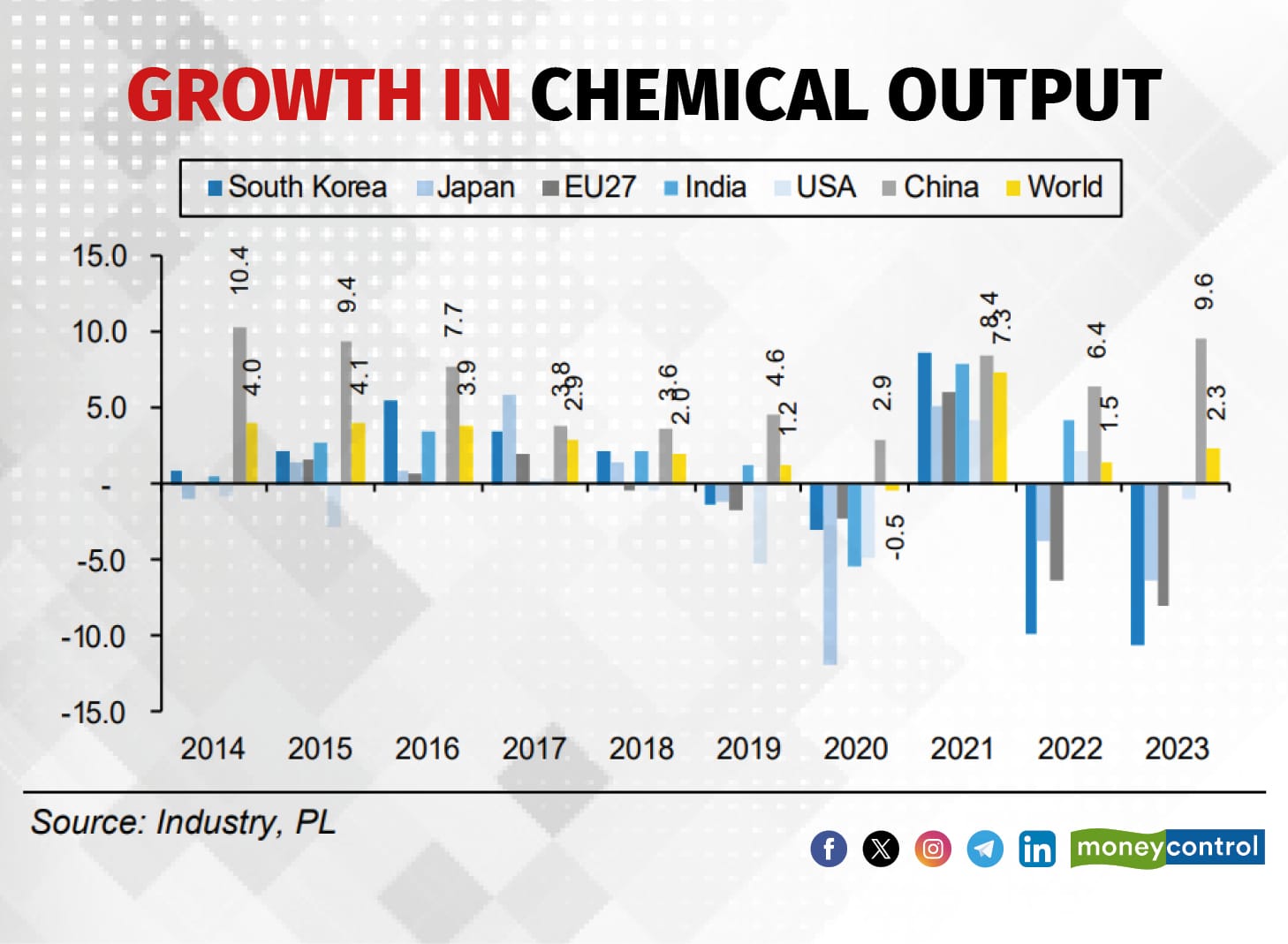

Regardless, the world's second-largest economy staged a strong comeback, increasing its chemical output to meet the shortage from reduced production in countries such as Japan and South Korea, as well as EU nations.

Indeed, Prabhudas Lilladher highlighted that Chinese output grew at a staggering 9.6 percent in CY23, the sharpest since CY15. On the other hand, South Korea registered a production decline of 10.7 percent, while the EU27 was down 8 percent and Japan, 6.4 percent. The decline in output from the EU was on account of higher gas prices and weak demand. The US has also witnessed a decline of 1 percent whereas India has barely grown, inching up a mere 0.1 percent in 2023.

"As the EU witnessed a sharp rise in gas prices post the Russia-Ukraine strife and EU utilisation started falling due to a rise in operating costs, China rose to the occasion, raising its market share ... from 14.6 percent in CY21 to 24.4 percent in CY22," Prabhudas Lilladher pointed out.

In light of continued weakness in demand, the dismal outlook of global giants, the expected comeback of Chinese capacity, and pressure from the aggressive capital expenditure by Indian chemical players, brokerages across the board anticipate worrisome times for the domestic players to continue in the near term.

Also Read | Cloudy outlook for Indian chemical firms as cheap Chinese imports flood marketWhat's more troubling is that expectations of a demand revival are being pushed back by chemical players even after three straight quarters of weak demand. The earlier expectations of a revival in demand in the second half of FY24 have now been pushed to the first half of FY25. However, brokerage Emkay Global Financial Services isn't too optimistic about that timeline. It expects demand to remain weak and anticipates a broad-based recovery only from the first half of calendar year 2025. On that account, a flurry of brokerages has kept a cautious stance on the chemical sector.

Earnings of Indian chemical players under pressureTo quantify the struggles of Indian chemical companies, let's take a look at their Q3 earnings report card. In Q3, eight of the 22 chemical companies reported their lowest-ever quarterly sales since the COVID-19 outbreak. The sales figures of four companies hovered near their lowest quarterly numbers since the pandemic. Also, 16 of the 22 companies reported an on-year decline in revenues, while 13 recorded a sequential fall.

Moreover, 12 companies reported a decline in gross margin on year in Q3 while eight posted a sequential gross margin decline. The situation was worse on the EBITDA margin front with 18 companies showing a year-on-year decline and 11 reporting a sequential contraction.

Also Read | Speciality chemical stocks: When will the pain end?Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.