Highlights:

- Budget 2019 failed to bring cheer for the markets

- Neither consumption nor investment got a boost

- Fiscal discipline amidst a challenging environment a positive

- Monetary, not fiscal policy, the only saviour

- Budget numbers look credible only if we go by the budget document’s numbers

- Failure to prop up capital expenditure a let-down

The Budget has failed to live up to market expectations. The first budget of the Modi 2.0 government was presented against the backdrop of a serious economic slowdown that has started biting sectors ranging from cars to soaps and a section of the markets was looking to the Budget to take the economy out of this rut.

The Budget was widely expected to address the distress in agriculture, create jobs, revive private investment and provide a boost to consumption. However, it fell way short of expectations on all fronts. The only saving grace was that it did not overshoot the fiscal deficit target and the projected figure of 3.3 percent of GDP (gross domestic product) is actually lower than the interim budget, although it was achieved with no fillip to consumption and a cutback in capital expenditure.

The central bank has already done its monetary stimulus bit with an interest rate cut of 25 basis points (cumulative reduction of 75 basis points in the past three policies). However, the weak transmission of the cut might dilute the effect considerably.

A section of the market expected the budget to deliver a fiscal stimulus, but while that hasn’t happened, some of the issues have been addressed.

What did we like?

For the troubled NBFC sector, the regulatory mandate has been given solely to the central bank. So closer scrutiny and greater regulation for the shadow banking sector is on the anvil, which is in the long term interest of the financial system. The government would provide 10 percent credit guarantee when PSU banks are subscribing to well-rated pooled assets of NBFCs. While incrementally it will alleviate liquidity concerns, good quality NBFCs have been getting adequate liquidity support post the mayhem anyway.

No overt effort to kick start the investment cycle was initiated. Interestingly, the Economic Survey while stressing on the urgency of reviving investment also fell short of suggesting a modus operandi. The recapitalisation of PSU banks (Rs 70,000 crore), as well as the liquidity easing measures for the NBFCs, are early signals that the government is looking at these engines to propel credit growth.

The government’s fiscal discipline, alongside the government’s decision to perhaps look to overseas markets for borrowing, could have a sobering impact on interest rates. Should the monsoon turn out to be more or less normal, thereby putting the worries about food inflation at bay, further interest rate cuts from the RBI cannot be ruled out.

While a sluggish economy may fail to create the requisite number of jobs, the focus on key social areas like education, health, sanitation etc. can only improve the quality of the workforce. The significant increase in import duties on a number of products could provide tacit protection to the much publicised “Make in India” initiative.

Despite the market’s speculation about the Budget putting money in the hands of the people or start spending meaningfully to give a push to revival, we were sceptical. And the reason was simple--like a household struggling to meet ends, the government too is in a difficult spot in the face of falling tax revenue.

Are the budget numbers credible?

First and foremost there appears to be a gap between the provisional number of the government accounts at the end of March 2019 and the FY19 numbers that have been put out in the Budget. The tax collection, in particular, is 10.7 percent higher than the provisional figure that gives a different colour to the projected number of FY20.

For instance, if we consider the FY19 Revised Estimates as provided in the budget document, the growth assumptions look much more credible than if we use the provisional government accounts number for FY19. The provisional numbers, of course, are closer to reality.

Source: India Budget

Further, the assumptions on PSU dividend as well as disinvestment might pose challenges if the economy continues to remain in the slow lane.

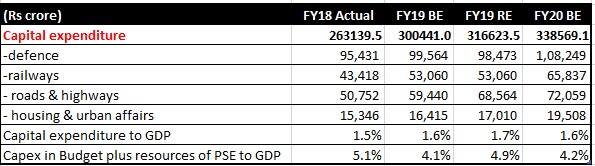

However, it is the expenditure side that should disappoint the market a lot more. While the total expenditure of the government is expected to rise, it is going to be driven by revenue expenditure. Remember, close to 88 percent of the government’s expenditure is in the nature of revenue expenditure (that doesn’t lead to the creation of productive assets). Interest, subsidy, defence revenue expenses, pension, support to education health etc. takes up the bulk of the expenses and by their very nature cannot be cut back.

The boost to capital expenditure that the market was expecting from the government took a back seat once again.

Source: India Budget

As the exhibit suggests, the overall capital expenditure to GDP has been languishing. However, a large part of the capital expenditure is done by Public Sector Enterprises (PSE). Even if we factor in the PSE contribution in FY20, the share of capital expenditure to GDP is much lower.

Source: Moneycontrol Research

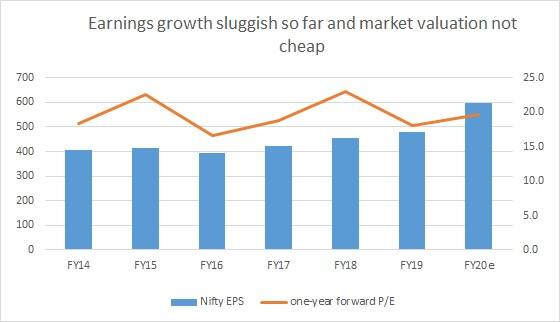

This Budget is unlikely to occupy the mind space of the markets for long. In a range-bound market that clearly has more downside than upside, and with valuations not cheap, the hunt for quality is important. Soon the focus will be back on finding the few high conviction ideas with solid earnings visibility.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!