The March quarter earnings season has been a mixed bag so far. Market participants are hoping for a quick turnaround in the COVID situation locally, which was evident from the three-day rally which took Nifty beyond 14,800 levels on April 28.

"ICICI Bank and Axis Bank earnings were better-than-estimated but HDFC Bank's were mixed. Overall, nothing to worry about as the market mostly priced in that first quarter earnings of FY22, which will get impacted by state-wise restrictions to control the spread of COVID-19. FY22 earnings estimates may also get cut," Shailendra Kumar, CIO at Narnolia Financial Services told Moneycontrol.

The current rally could also be a result of short-covering as participants expect the much-ferocious second wave to be contained rather quickly amid vaccination and restriction imposed by states.

The Nifty50 has rallied 4.6 percent from its recent low to surpass 14,800 levels, though it is still 4 percent away from its record high levels.

Overall, the experts feel FY22 would remain strong for the market and economy. "Going forward into FY22, whilst the demand would continue to see an uptick with the expected recovery in the economy especially in the real economy sectors, the manufacturing sector may see some cost pressures with increasing raw material costs unless they are able to pass it on to their consumers. Overall, the markets are expected to deliver sound numbers," said Ajit Banerjee, Chief Investment Officer at Shriram Life Insurance.

Anand Shah, Head of PMS and AIF Investments at ICICI Prudential AMC also feels if one were to look at macros, India is on a strong footing with record foreign reserves, stable currency and lack of inflationary pressure.

"In terms of corporate earnings, the outlook remains largely positive. The various reform measures introduced by the Government and the Reserve Bank of India’s accommodative stance is likely to aid in the country registering decent growth numbers. All put together makes India an attractive investment destination," he said.

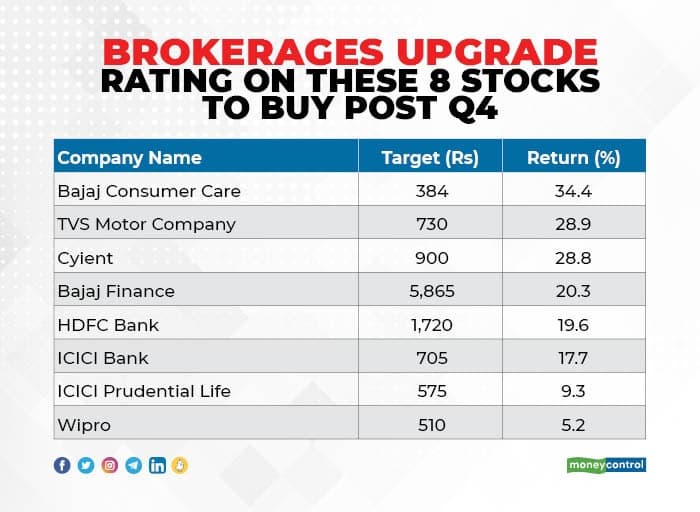

Brokerages have upgraded rating to buy on 8 stocks for a return of up to 52 percent after March quarter earnings

"Q4FY21 was a healthy quarter for Bajaj Finance. Disbursements have exceeded 90 percent of YoY levels across most segments. The initial asset quality performance of incremental disbursements is in line with or marginally better than pre-COVID levels. This bodes well for asset quality in the medium term. In the near term, we do not foresee any major asset quality disruption, unless the impact of the second wave is worse than expected," said Motilal Oswal.

"Margins are likely to see a sharp improvement in FY22 on a) lower cost of funds, b) a reduction in liquidity, and c) a favourable base due to interest reversals. We largely keep our estimates unchanged and expect the company to deliver around 4.8 per cent return on assets and 22 per cent return on equity over the medium term. Given the positive outlook, we upgrade the neutral rating to buy, with a target of Rs 5,865 per share.

TVS Motor Company: Buy | Target: Rs 730"Q4FY21 revenues were in line. EBITDA margin expanded to 10.1 per cent (estimates: 7.5 per cent), notably above estimates, mainly due to the lower-than-expected impact of commodity inflation, cost savings and inventory gains. The domestic 2-wheeler volume outlook is positive and premium motorcycles/Scooters could outperform. In addition, the export outlook is encouraging across most markets on higher commodity prices and better forex availability for importers. The volume CAGR is expected at 14 percent over FY21-24," Emkay said.

The brokerage increased FY22/23 EPS estimates by 15 per cent and 14 per cent to Rs 21.3 and Rs 28.4 due to the increase in volume and margin assumptions. Over FY21-24, the brokerage expects robust earnings growth (39 per cent CAGR), strong post-tax ROICs (around 62 per cent), and strong free cash flow generation (around Rs 900 crore per year).

Emkay upgraded TVS to buy with a revised target of Rs 730 (Rs 570 earlier), based on 25x FY23E EPS (22x earlier) and value of TVS Credit Services at Rs 25 per share.

ICICI Bank: Buy | Target: Rs 705"Q4FY21 results positively surprised us, and the company is witnessing healthy business momentum. The market share gains in advances, deposits and share of safer assets is positive. The higher credit cost is on account of caution and dependent on the pandemic outlook. Nevertheless, it is well-positioned across all factors versus peers," said KR Choksey.

"We have factored CAGR 33 per cent growth in profits over FY21-23 on a 15 per cent growth in advances and NII. We value the bank at 1.9x FY23E P/ABV, implying an SOTP valuation of Rs 705 per share. We upgrade the rating on the shares of ICICI Bank to a buy," the brokerage added.

Cyient: Buy | Target: Rs 900"Cyient's Services at $120 million (up 2.5 per cent QoQ organically, down 12 per cent YoY) started growing after five quarters. It is likely to persist as growth was broad-based in Q4 with A&D too returning to growth. Deal wins in services is showing traction," Anand Rathi said.

"The EBIT margin, at 12.7 per cent, was up 423 bps YoY on higher utilisation and reduced headcount in the services business. It also benefitted from rising DLM profitability. We raise FY22 and FY23 estimates 13 percent and 10 percent respectively and target to Rs 900 (from Rs 690), at 19x FY23e EPS, and upgrade rating to a buy," the brokerage added.

Bajaj Consumer Care: Buy | Target: Rs 384"Considering senior management team in place, we expect improved execution to drive sustained performance, though margins could be under pressure in the short term. We have increased our revenue and earnings estimates for FY22 by 11.7 per cent and 5.0 percent and FY23 by 14.0 per cent and 19.6 per cent," said Centrum Broking.

"Further Rs 10 dividend in FY21 (3.4 per cent dividend yield) could provide upside to long term investors. We upgrade to buy rating with DCF-based revised target price of Rs 384," the brokerage added.

HDFC Bank: Buy | Target: Rs 1,720"The operating income was largely in line with our expectation; however, the credit costs are higher. The impact of the second wave is unknown but the risk remains. While we do expect the credit costs to fall next year, it may remain elevated than otherwise. We expect a healthier advance growth on a relatively lower base and the bank remains well funded. We expect to witness improvement in NIMs," said KR Choksey.

"We expect CAGR in NII at 21.4 per cent; PPoP at 23.3 per cent and PAT at 29.66 per cent over FY21-23. It is currently trading at 2.9x FY23E P/ABV. Since our last update, the shares of HDFC Bank Ltd. has corrected by around 6.6 per cent. We maintain our target of Rs 1,720 per share, implying a P/ABV of 3.5x FY23E P/ABV. Accordingly, we upgrade the rating on the shares of HDFC Bank to a buy. We expect this valuation to continue for the bank’s market position and relatively stronger customer segment," the brokerage added.

ICICI Prudential Life Insurance: Buy | Target: Rs 575CLSA has upgraded ICICI Prudential to buy with a target at Rs 575 per share as Q4FY21 earnings were in-line with 27 per cent APE growth versus 27 per cent contraction in 9MFY21.

"FY21 saw multiple headwinds with a big contraction in ULIP business and value of new business (VNB) performance was managed well," the global brokerage house said.

Wipro: Buy | Target: Rs 510Citi has upgraded its rating on Wipro to buy and also raised target to Rs 510 from Rs 460 per share, as it increased EBIT estimates by 2-3 per cent.

"EPS changes are 1-2 per cent due to higher tax rate assumption. Valuations are at 30 per cent and 18 per cent discount to TCS and Infosys respectively," the brokerage said.

Disclaimer: The views and investment tips expressed by investment expert on Moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.