India's IT bellwether Tata Consultancy Services (TCS) released a softer set of numbers for the July-September quarter of the financial year 2020, missing Street Estimates.

TCS reported 1 percent sequential decline in the September quarter profit at Rs 8,042 crore, against the profit of Rs 8,131 crore in the first quarter. The growth was impacted by increased volatility in financial services and retail verticals and miss on margins front.

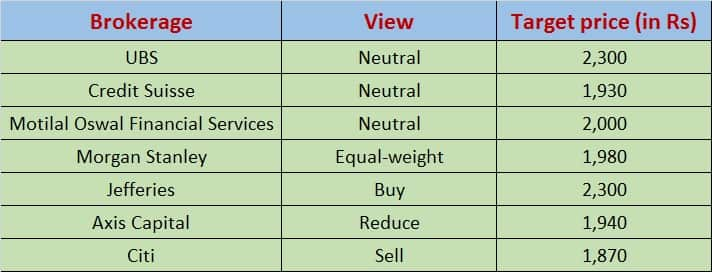

Brokerages have come out with mixed reviews and cut target prices after the company's uninspiring Q2 performance.

Global brokerage firm UBS has a neutral call on TCS with a target price of Rs 2,300 and cited that the revenue miss adds evidence to demand slowdown.

Morgan Stanley has maintained an 'equal-weight' view on the stock with an unchanged target price of Rs 1,980, underscoring that the Q2 revenue growth, margin and PAT was below estimate.

The global financial firm added that double-digit growth for FY20 is clearly unachievable. "We cut estimates as the second half of FY20 looks tough and management has low visibility," Morgan Stanley said.

Jefferies has a buy call on the stock but the brokerage has cut the target price to Rs 2,300 from Rs 2,500 earlier, citing that the weak Q2 signals a single-digit growth in FY20.

The brokerage cut its year-on-year (YoY) constant currency (CC) growth estimate to 8.4 percent and trimmed margin estimate as well to 24.3 percent to reflect a weak first half of FY20.

FY20-22 earnings per share (EPS) estimate was cut by 4-6 percent by the brokerage.

Nevertheless, Jefferies believes the IT major will outperform tier-I peers on growth and margin in the medium-term.

"Weak results could provide good entry opportunity into a strong long-term franchise," said the brokerage.

Citi has maintained a sell call with a target price of Rs 1,870.

"We lower our estimates further by 2 percent for FY20/21/22 and lower the target multiple to 21 times from 22 times, given growth and profitability challenges," Citi said.

The global financial firm said a 4 percent EPS CAGR target over FY19-21 against a 24 percent in FY19 will create near-term pressure.

Credit Suisse has maintained a neutral call on TCS, cutting the target price to Rs 1,930 from Rs 2,070. The global brokerage said TCS failed to recoup margin sequentially after a wage hike in Q1.

However, it added that the overall deal wins remained strong at $6.4 billion which is up 30 percent YoY.

Credit Suisse has trim revenue estimates by 1 percent and EPS estimates by 5-7 percent adding that the company has a high-quality franchise but is not immune to an uncertain environment.

Among the domestic brokerage firms, Axis Capital has a reduce call on TCS, with a target price of Rs 1,940.

The brokerage has cut FY20/21 US dollar revenue estimates by 2.2 percent and 3.4 percent respectively while cutting margin by 100 bps and 110 bps, respectively.

EPS estimate was also lowered by 5 percent and 6 percent.

"Sales engine continues with robust deal participation, resulting in strong deal wins. But challenges on margin front have been the bigger negative surprise. We remain watchful on growth momentum over FY19-21," said Axis Capital.

Motilal Oswal Financial Services has a neutral call on the stock with a target price of Rs 2,000.

The domestic brokerage firm has downgraded the operational earnings estimate by 2-4 percent and said that the growth performance this quarter only dampens the FY20 growth prospects further.

As per the brokerage, EBIT margin contraction of 250bp YoY is a reflection of high pressure on earnings growth. However, margins are likely to recover to an extent because of normalization of utilization.

"Demand outlook for the medium term remains healthy considering strong deal wins. We expect US dollar revenue and EPS CAGR of 7 percent and 7.5 percent, respectively, over FY19-21," said Motilal Oswal.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.