Manali Bhatia

Balrampur Chini Mills has approved buyback of 84,38,327 fully paid up equity shares of face value Re 1 each representing up to 3.69 percent of the total number of equity shares. The buyback is fixed at a price of Rs 175 per equity share for an aggregate amount of up to Rs 147.67 crore via tender offer.

The record date for the said purpose is fixed as April 18, 2019. The company is buying back its shares at a premium of 29 percent to the current price of Rs 136.

Buyback strategy

As the public shareholding in Balrampur Chini is high. We expect handsome participation by several existing and new investors for this buyback. Therefore, we have estimated the acceptance ratio to be very low.

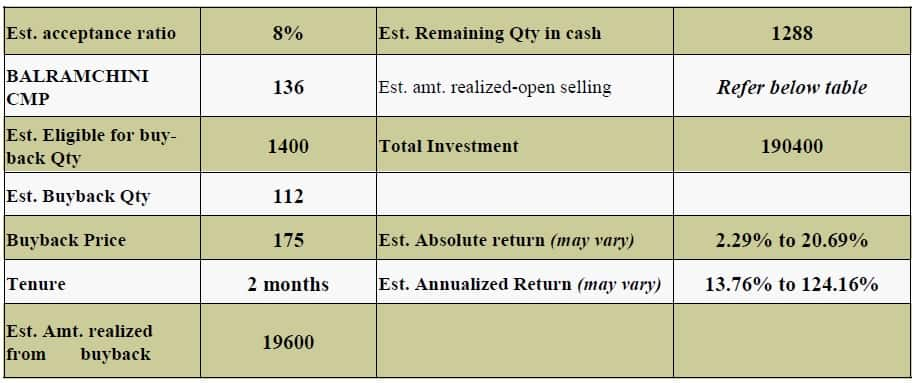

Upon calculations, the estimated entitlement ratio would be 5-6 percent. However, real acceptance ratio should be higher by 30-40 percent as many shareholders do not take part in buyback. So, we have estimated acceptance ratio to be around 7-8 percent.

Earlier also, the company had come out with buyback with around 8-9 percent acceptance ratio only. The maximum estimated tenure for completion is taken as two months.

We advise that traders who want to participate in the buyback can buy 1,400 shares at Rs 136 per share in the open market and offer them in the tender offer. Also, one has to monitor that shareholders holding value should be less than Rs 2 lakh as on the record date to qualify for this buyback.

As per SEBI regulations, 15 percent of the offer size will be reserved for retail shareholders (holding amount less than Rs 2 lakh). Therefore, Rs 22.15 crore (15 percent of Rs 147.67 crore) is set for retail Investors.

Expected returns and conclusion

As per our calculations, downside for the stock is expected. Also, we are not much positive for the sugar industry.

We recommend investors not to participate in this buyback through fresh investment. However, investors who already have their respective holding in the stock may participate in the stock with significant risk appetite.

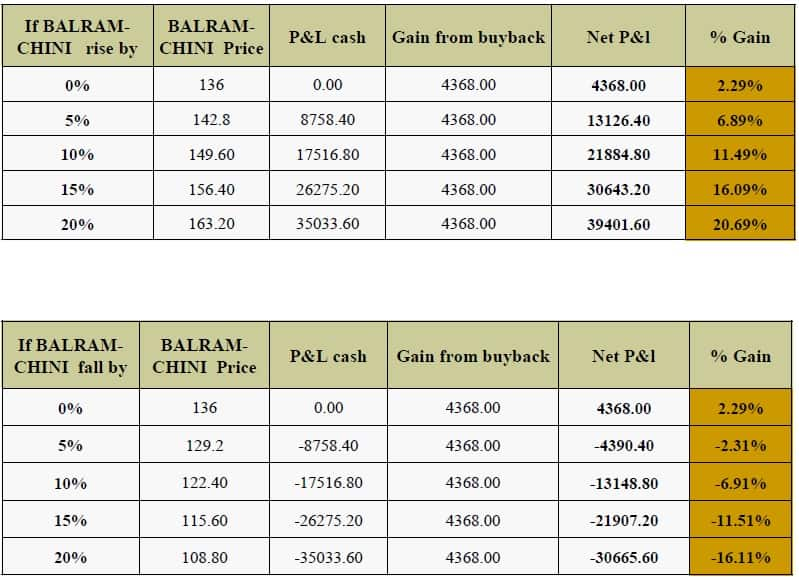

Returns under different situations are calculated in tables below:

The author is Senior Research Analyst at Rudra Shares & Stock Brokers Ltd.

Disclaimer: The views and investment tips expressed by investment expert on Moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.