Kshitij Anand

Moneycontrol News

The S&P BSE Sensex which hit a record high last week came under selling pressure and was now trading below its crucial support level of 31,000 but there was greater damage seen in the broader market as over 70 stocks hit fresh 52-week low on the BSE.

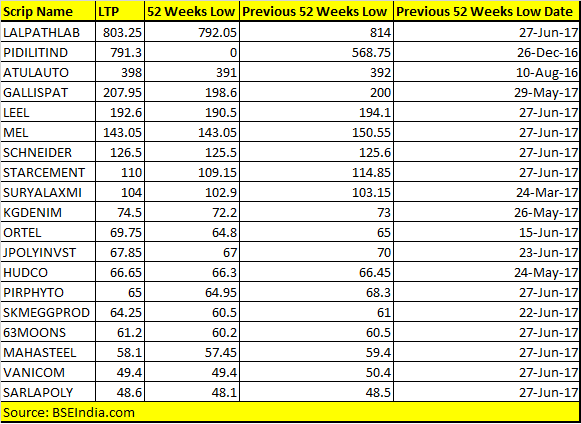

Stocks hit fresh 52-week low include names like Dr. Lal Pathlabs, Pidilite Industries, Atul Auto, Gallantt Ispat, Leel Electrical, Meenakshi Enterprises, Schneider Electric Infrastructure, Star Cement etc. among others.

As much as 20 stocks hit fresh record low in Wednesday’s session on the BSE which include names like Ortel, Housing & Urban Development Corporation, Vani Commercials Ltd, Mandhana Industries, ACME Resources, Layla Textiles etc. among others.

“GST implementation risks, F&O expiry, need for consolidation are driving the correction. Of course, the risk of markets going ahead of potential earnings acceleration has been persistent for some time,” Shashank Khade, Chief Equity Advisor and Co-Founder, Entrust Family Office Investment Advisors told Moneycontrol.

“With regulatory changes such as GST, RERA and many others executed by the government simultaneously, some degree of demand setback is expected in the near term. However, it is expected to a short-term blip, which may not last long,” he said.

The Nifty was trading around its crucial support level of 9,500 and over 50 stocks hit fresh 52-week low on the NSE.

Stocks which slipped to a fresh 52-week low include names like Dynamatic Technologies, Dr Lal Pathlab, L&T Technology Services, Alembic Pharma, S Chand & Company, Atul Auto, Cupid, Lloyd Electric, Jindal Poly, HUDCO, IDBI Bank, etc. among others.

The Nifty made sixth consecutive bearish candles in a row on Tuesday and a close below 9473 (Tuesday’s low) could fuel further selling pressure.

Traders are advised to tread with caution and as long as Nifty50 trades below 9,560 further weakness cannot be ruled out which could take the index towards 9450-9480 while on the upside 9580-9600 is likely to act as a crucial resistance level for the index, suggest experts.

“Although, it will be too early to call Tuesday’s low of 9473 as bottom, wave structure is suggesting one more leg on the upside i.e. beyond 9709 levels which may result in much bigger correction going forward and hence there can be higher probability of this correction getting completed sooner than later,” Mazhar Mohammad, Chief Strategist – Technical Research & Trading Advisory, Chartviewindia.in.

“In case if Nifty slips below 9,473 then immediate support can be expected around 9,430 levels whereas a close above 9,600 levels shall suggest strength in near term,” he said.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.