SEBI's new proposal is shaking things up in the options trading world by suggesting a major increase in contract sizes. Right now, you need between Rs 5 lakh and Rs 10 lakh to play, but soon, that could jump to Rs 15-20 lakh, and eventually Rs 20-30 lakh.

It’s a big leap designed to make it harder for retail investors to join in, like raising the bar on a game everyone thought they were already good at.

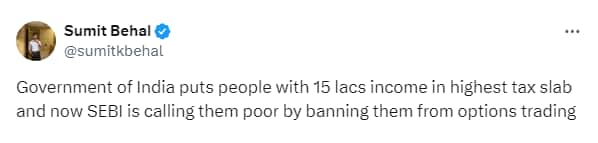

This move is quite the twist as X user Sumit Behal pointed out, "Government of India puts people with 15 lacs income in highest tax slab and now SEBI is calling them poor by banning them from options trading."

Follow our market blog to catch all the live action

So, you’re taxed like a top earner, but now SEBI is making it clear that you might not be quite rich enough to dive into options trading. It's a bit like saying, "You’re grown-up enough for big taxes but not quite ready for the big leagues."

It’s like Indian parents’ classic logic: you’re considered mature enough to handle heavy responsibilities, but when it comes to making big decisions like solo trips or moving out, suddenly you’re not quite ready.

SEBI’s new rules feel like a similar balancing act—acknowledging your financial status but keeping you out of the fancy trading game.

According to market experts, If SEBI’s proposal of around a 3-4x hike in contract sizes goes through, trading volumes are likely to drop significantly.

With higher margins required for options contracts, trading could become too costly for many retail investors, leading them to opt out of participation. This shift will likely have a notable impact on retail brokerages, which will face challenges adapting to the new requirements.

In an earlier report, analysts at Kotak Institutional Equities said that these steps will potentially curb accessibility for low-ticket retail (largely option buyers).

Also Read | Sebi again red flags households losing Rs 60,000 crore in F&O as 'macro issue'

While small retail (<Rs 10 lakh monthly premiums) make up less than 3 percent of system premiums, overall impact from their reduced participation can be magnified as they may be contributing to the profit pool disproportionately, according to Jefferies.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.