An authorised person (AP) of stock broker Angel One was found to be sharing an office with an unregistered advisory and dealers of the AP were employed with the illegal advisory.

An authorised person works like a sub broker and the registered broker is held liable for its AP's violations.

In an order dated November 28, the Securities and Exchange Board of India (SEBI) fined Angel One Rs 6 lakh for not exercising due diligence over its APs, for failure to maintain segregation and demarcation in the office of the AP, and other violations.

Also read: Mindspace REIT's manager pays Rs 68.73 lakh to settle allegations of violation of SEBI normsThe illegal advisory named in the order, Ravindra Bharti Education Institute Private Ltd (RBEIPL), had been banned from the securities market by the regulator through an order issued on April 5.

The regulator's officials found that both the AP and the advisory were operating from the same premises, the dealers of the AP were employed with the advisory and the illegal advisory got contact details of the client associated with the AP to sell investment advice.

The order said, "On perusal of call recordings provided by the AP, it was observed that employees of RBEIPL used to contact clients associated with AP and asked them to execute certain trades. Subsequently, a call was made to the client from the AP's office seeking preconfirmation of the trade to suggest that the trades were being executed on the clients' instructions. Out of 92 pre-order confirmations sought from Noticee (Angel One), it was found that 48 confirmations were recommendatory / advisory in nature which was akin to unregistered investment advisory activities."

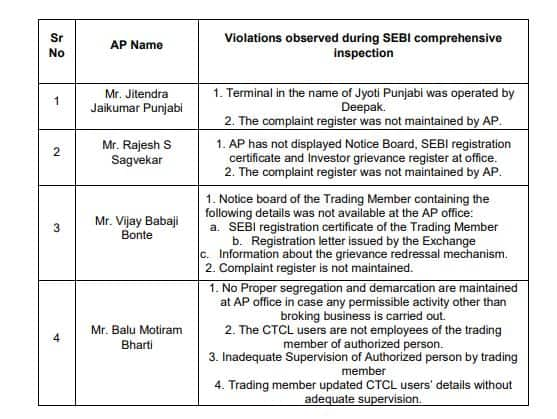

The order listed various instances where the broker had failed to exercise due diligence and control over its APs:

In the SEBI order, the Adjudicating Officer Barnali Mukherjee stated: "In the present matter, it is noted that no quantifiable figures are available to assess the disproportionate gain or unfair advantage made as a result of the defaults by Noticee (Angel One). Further, from the material available on record, it may not be possible to ascertain the exact monetary loss to the investors /clients on account of default by the Noticee. Further, as per the available records, it is observed that Noticee has not been penalised earlier for the aforesaid violation. Thus, violation is not repetitive in nature."

It added, "However, as a SEBI registered intermediary, Noticee was under statutory obligation to comply with the applicable circulars, rules and regulations. The very purpose of the said regulations is to deter wrong doing and promote ethical conduct in the securities market. Therefore, such non-compliance deserves and attracts suitable penalty. The penalty imposed by NSE is being taken into consideration while imposing penalty."

The broker had been fined Rs 50,000 by NSE for delayed reporting of a technical glitch.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.