Billionaire Gautam Adani’s conglomerate is in talks with global banks to raise at least $1.5 billion through dollar bond sales, a further indicator of the group’s rebound from a short seller attack.

Proceeds would be used to refinance project debt, according to people familiar with the plans, who requested anonymity to discuss private details. Adani Group aims to complete the sales in multiple tranches by the end of February, two of the people said.

Bonds would mainly be issued under the Adani Green Energy Ltd. and Adani Energy Solutions Ltd. units and through special purpose vehicles, according to the people. The plans include sales of green or sustainability-linked instruments, and discussions are ongoing with more than 10 banks, including in Japan, Europe and the Middle East, they said.

Adani Group didn’t immediately respond to a request for comment.

Moneycontrol Report: Adani Group eyes $1 billion in foreign currency bonds for expansion

The conglomerate returned to the dollar bond market in March for the first time since a report by short seller Hindenburg Research in early 2023 which made accusations of fraud and stock manipulation. Adani has repeatedly denied the claims.

Since then, executives have attempted to rebuild investor confidence by trimming debt, advancing major projects and offering new details on the conglomerate’s future, including tycoon Adani’s retirement plans.

Prices of the 18-year notes Adani sold earlier this year have steadily declined in the secondary market since issuance, trading at around 96 cents on the dollar on Thursday.

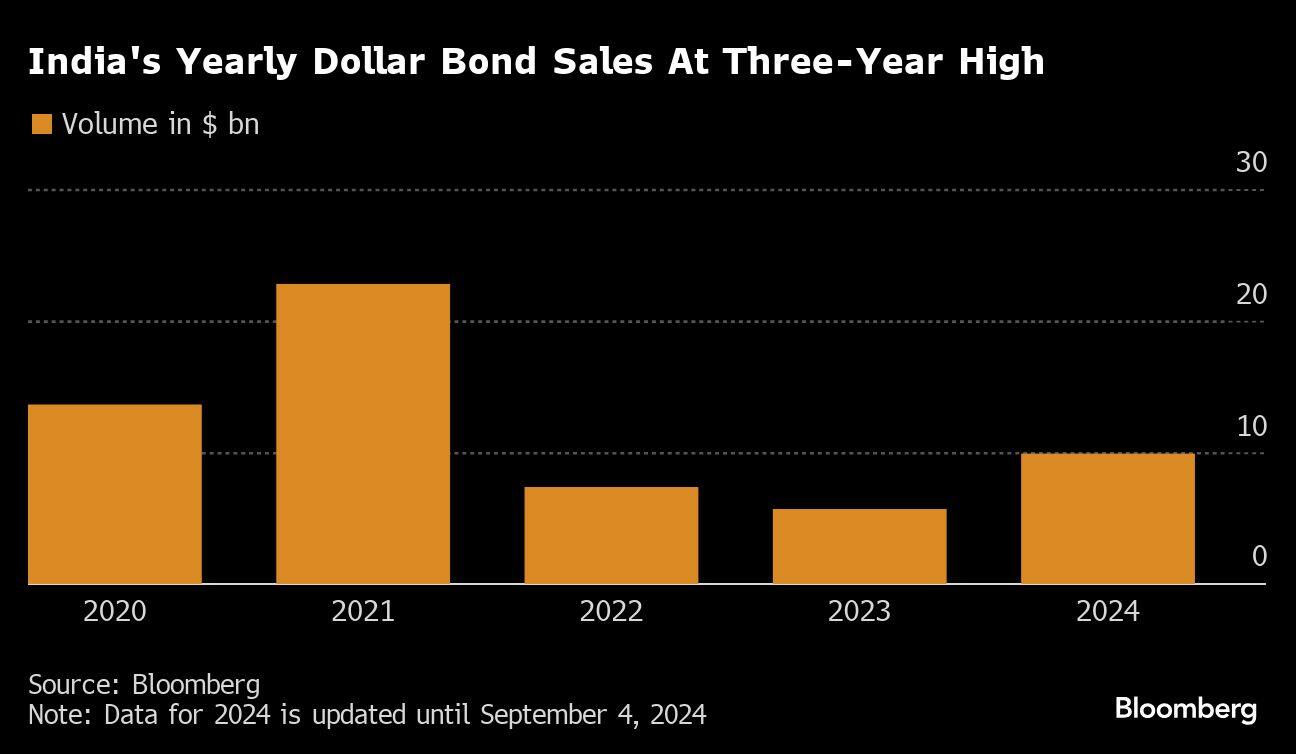

Indian companies have priced the highest amount of dollar debt in three years in 2024, raising almost $10 billion, data compiled by Bloomberg shows. Firms are likely to raise at least $4 billion more through the rest of this year, according to JPMorgan Chase & Co.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.