COVID-19 has not only affected the way we live but has also changed the way we invest. We have seen an unprecedented infusion of liquidity by various central bankers and their unflinching resolve to do whatever it takes to support their respective economies.

While different countries are coping up with multiple waves of the corona, they are better prepared than the first wave which had caught them off guard.

A better understanding of the virus and the availability of vaccines has, to some extent, eased the situation. As nothing is permanent, we will eventually emerge as winners out of this situation.

The human resilience to bounce back from any adverse situation is reflected in the fact that while people are struggling with the loss of jobs, pay cuts, and uncertainty in the near future, we see some positive trends emerging as well.

At a broader level, the awareness of health and well-being, savings for rainy days, medical expenses, etc. have increased. At a specific level, the eagerness to participate in the future growth story of India through direct equity investment has also caught the fancy of retail investors.

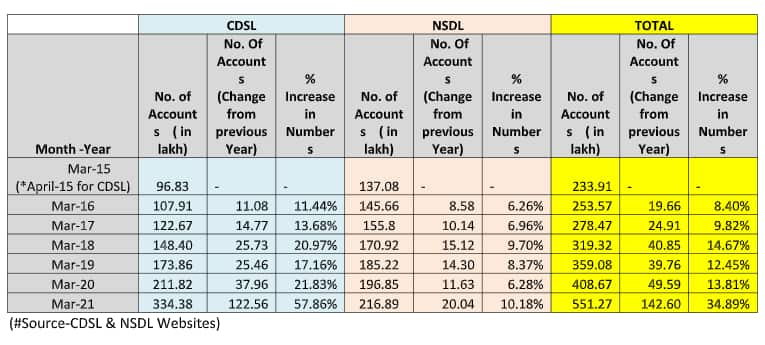

The number of demat accounts opened in the last few months is a clear reflection of the same. At an industry level, the number of demat accounts opened in the last year is more than the collective accounts opened in the previous 3 years collectively.

The same is visible in the steady increase in the number of folios and AUM of the Mutual Fund Industry. The monthly SIP contribution has also increased to about Rs 9,000 crore per month, which is a steady increase on a yearly basis.

Here are 8 factor which may have contributed to this spike:

- Tech-savvy new millennials find it very convenient;

- Equity broking has come a long way from an outcry system to internet-based, mobile-enabled trading platforms;

- The availability and reach of the internet have increased manifold, enabling tier-II and tier-III cities to also participate in equities;

- The competitive environment in the broking space has given rise to lots of innovative offerings for the clients. No frill accounts, discount brokerage, per trade brokerage, low maintenance cost and ease of doing trades will have further fuelled the aspirations of generating short term gains from the equity market;

- COVID-19 has accelerated the adoption of online culture across the spectrum, equity broking being no exception. Old traditional broking firms have also started focusing on delivering all services online as per the convenience of the clients, and in the process, are fighting to get their respective share from the pie of growing investors;

- TINA (There Is No Alternative) effect has further helped a lot of first-time investors to try their hands in equities. Relatively lower returns offered by traditional products like FDs, Bonds, Post Office MIS schemes has forced even conservative investors to look at alternative opportunities to enhance their overall returns on their investments;

- Awareness drive run by SEBI, AMFI and mutual fund industry has dispelled various myth and fears associated with equity investing;

- Quick and easy account opening process aided by technology-driven initiatives like e-KYC.

Most of the above factors have changed for the better and have become the new normal. The secular trend of a large number of people joining the stock market seems to remain intact as the overall share of household income in the equity still remains very low.

With the advent of newer products and technology, a larger population of investors will join the equity market going forward.

COVID-19 had thrown the economy out of gear and the economy is limping back to normalcy. The support as extended by RBI in terms of relaxing norms and creating frameworks to support various sectors of the economy has ensured that it bounces back without much disruption.

This also creates an opportunity for investors to invest in fundamentally strong stocks with a slightly long term horizon.

And finally, I would sign off with a word of advice to all new investors and those who are planning to get on the wagon. Equity trading and/or investing is a serious business. Not everyone ends up becoming a millionaire.

The best way is to gauge your risk tolerance and don’t put your entire investable surplus in a single asset class. There is a lot of information readily available all around you but it’s important to filter out the relevant information and act.

The concept of financial planning, risk diversification and goal-based planning holds more important today than ever.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.