Total loans written off by Indian banks stood at a seven-year low in 2024 on the back of better asset quality and clean-up of a large chunk of big corporate loans after the Asset Quality Review (AQR) initiated by the Reserve Bank of India (RBI) in 2015, analysts said.

Banks typically write off loans when there is little chance of recovery through usual channels, and need to make 100 percent provisions on such debt. Loan write-offs help banks clean up their balance sheets and show lower NPA on their books.

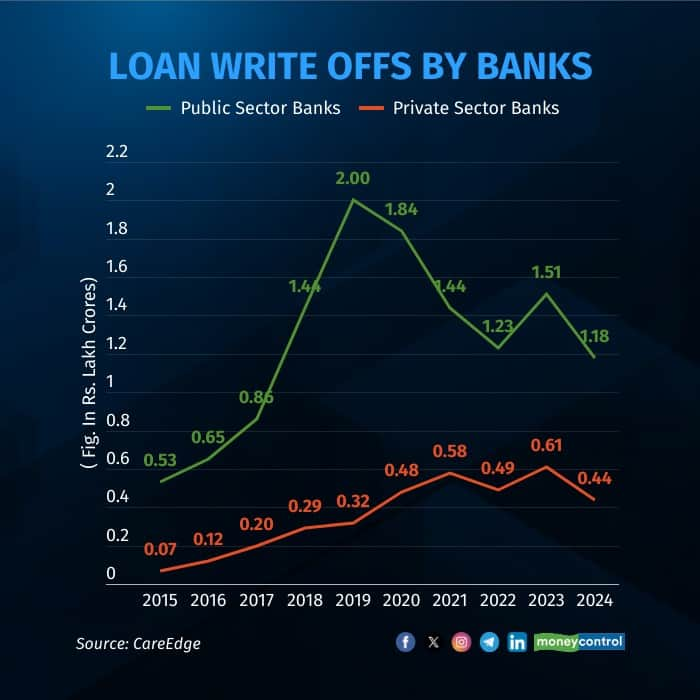

Indian banks’ total written-off loans stood at Rs 1.62 lakh crore in 2024, which was lowest since 2017. Compared to 2023, the amount was down 24 percent this year.

“Most of the big loan accounts in the NPAs have been cleaned up during the AQR initiated by the RBI in 2015, and now whatever has been done were largely some old large accounts in sectors such as metal, infrastructure, and power. Most of these accounts has been in to the NPAs of banks before AQR,” said Sanjay Agarwal, senior director of banking, financial services and insurance at CareEdge.

Public sector banks have the highest share in total written off loans, pegged at Rs 1.18 lakh crore, which is almost 73 percent of the pie in 2024. For their private peers, the amount was Rs 44,000 crore.

State-owned banks and private banks have seen a reduction in written-off loans by 22 percent and 28 percent on-year in 2024.

Even though the total write-offs have fallen to seven-year lows, but still remains over three times higher than it was before AQR.

Even though the total write-offs have fallen to seven-year lows, but still remains over three times higher than it was before AQR.

Over the last few years, the lenders have written off a huge number of loan accounts, especially after the RBI, under then governor Raghuram Rajan, implemented the AQR system in 2015, which forced banks to declare all bad loans and make provisions for debt that had extended beyond certain benchmarks.

In the 10 years, Indian banks wrote off over Rs 12 lakh crore of unpaid loans.

As per Moneycontrol’s analysis, net NPA (non-performing asset) ratio of the state-owned bank remained in the range of 0.20-0.98 percent. While for the private banks, it has stayed in the range of 0.2-1.50 per cent in Q2FY25.

In August, Finance Minister Nirmala Sitharaman acknowledged the efforts made by the banks to improve the asset quality and advised them to optimise the scope of resolution and recovery offered by NCLT (National Company Law Tribunal) and NARCL (National Asset Reconstruction Company Ltd).

Going ahead, analysts are of the view that loan write-offs of banks is expected to come down to pre-AQR levels in 2025 or 2026, backed by better asset quality.

"In 2025-2026, we expect that the write-offs by banks will come down to pre-AQR levels, considering the health of the banks, especially the asset quality which is lowest in many years," Agarwal said.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.