The Supreme Court’s decision on November 7 ordering the liquidation of Jet Airways, once India’s leading airline, has left creditors of the airline hoping to recover part of their dues, in a conundrum.

After spending five-years in courts around the country, the insolvency process of Jet Airways ended after the apex court rejected the takeover bid and ordered the liquidation of the airline's assets.

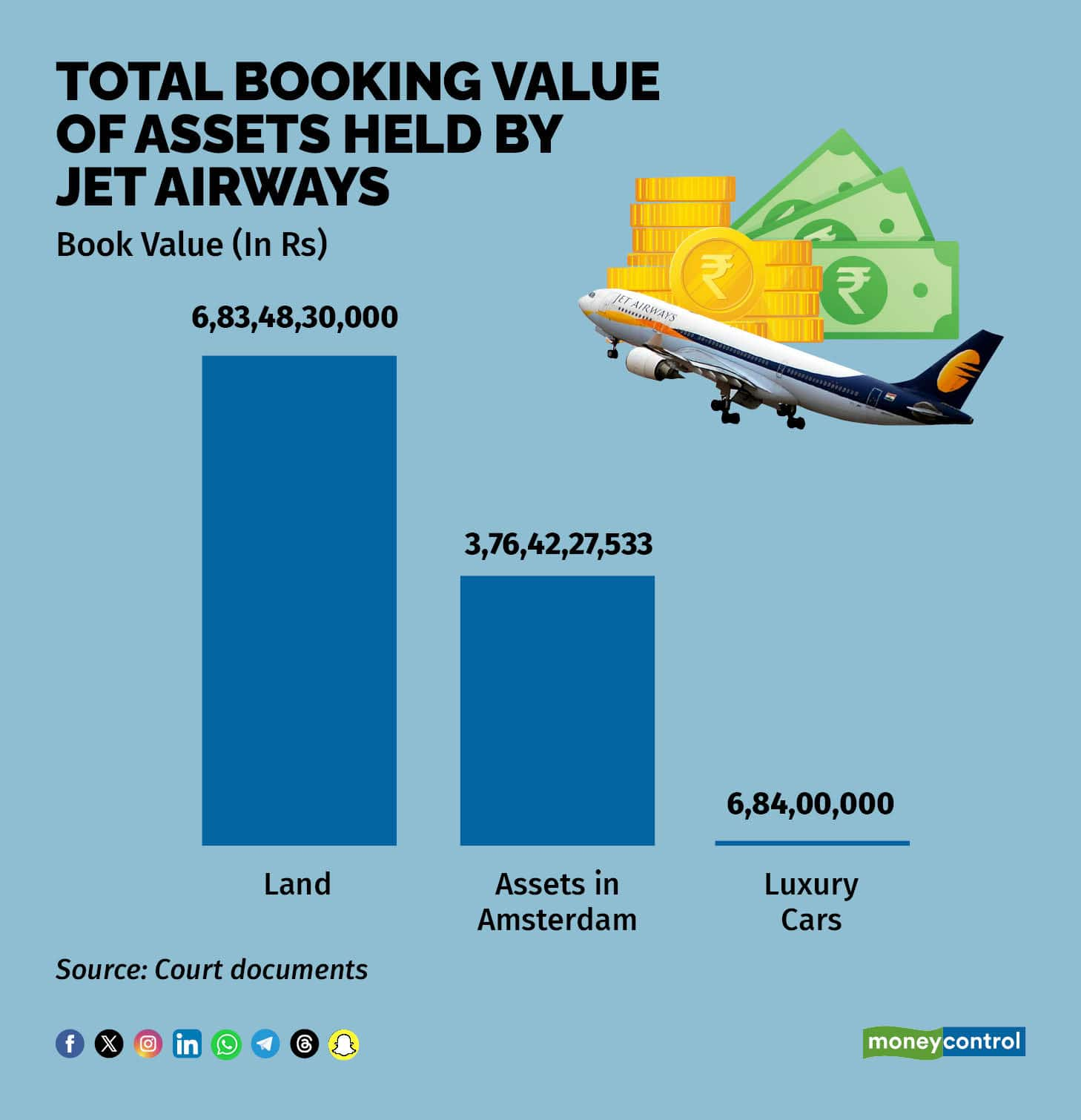

According to court documents seen by Moneycontrol the total book value of non-core assets held by Jet Airways is estimated to be worth Rs 1,066.75 crore, which includes six luxury cars in the name of the airline. Jet Airways' assets in Amsterdam include a Boeing 777-35 aircraft (VT-JEW), spare aircraft parts, catering items and trade receivables and land owned by the airline.

Total Booking Value of Assets held by Jet Airways

Total Booking Value of Assets held by Jet Airways

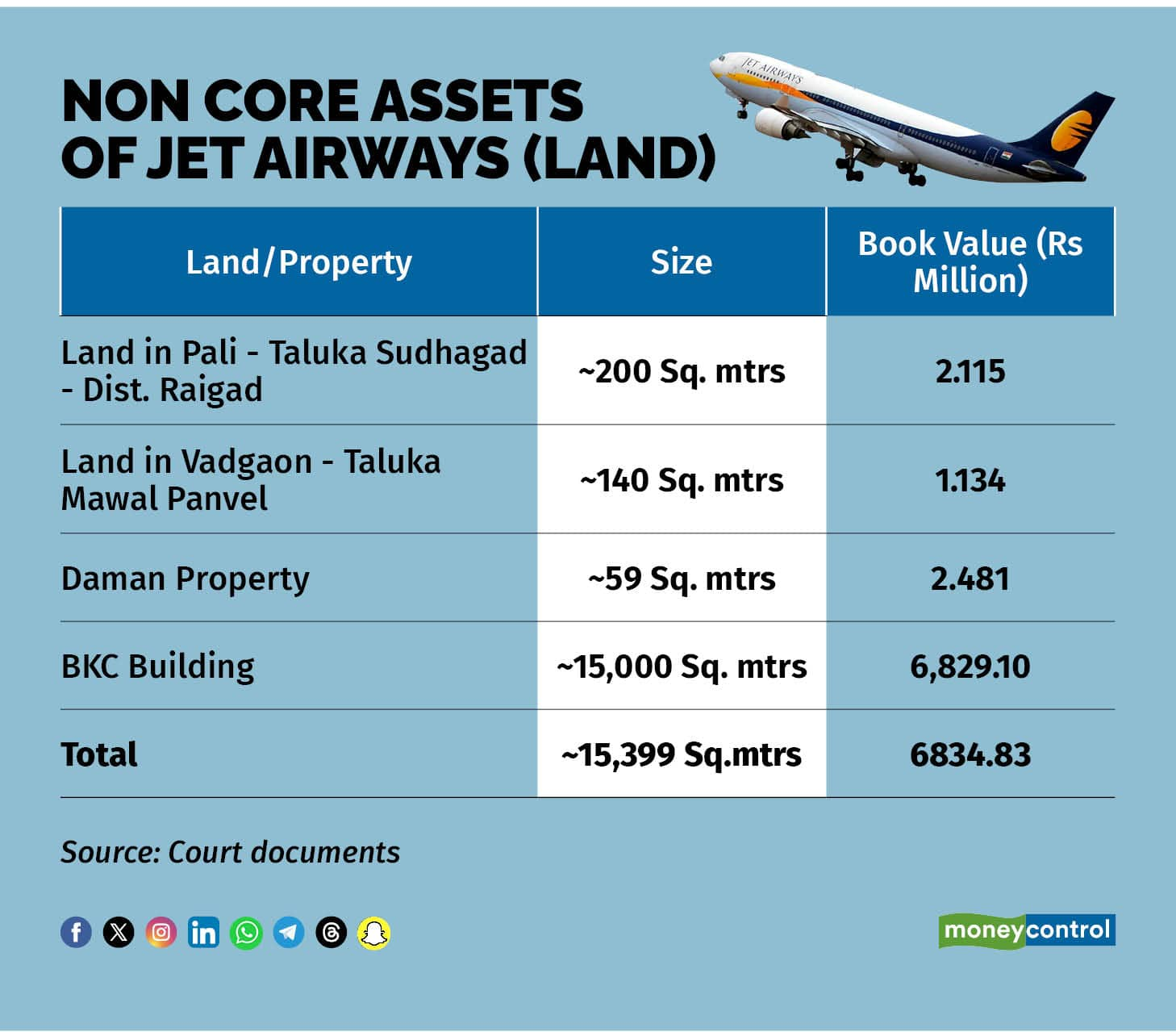

The biggest non-core asset that Jet Airways holds is the 15,000 sq. mtr floor in a commercial building in Mumbai’s Bandra Kurla Complex, valued at Rs 683 crore and the Boeing 777-35 valued at Rs 376.4 crore as of June 2019, according to court documents.

Other land assets the airline owns is a 200 sq. mtr land in Pali - Taluka Sudhagad valued at Rs 22 lakh, a 140 sq. mtr land in Vadgaon - Taluka Mawal Panvel valued at Rs 15 lakhs and a 59 sq. mtr property in Daman valued at Rs 25 lakh.

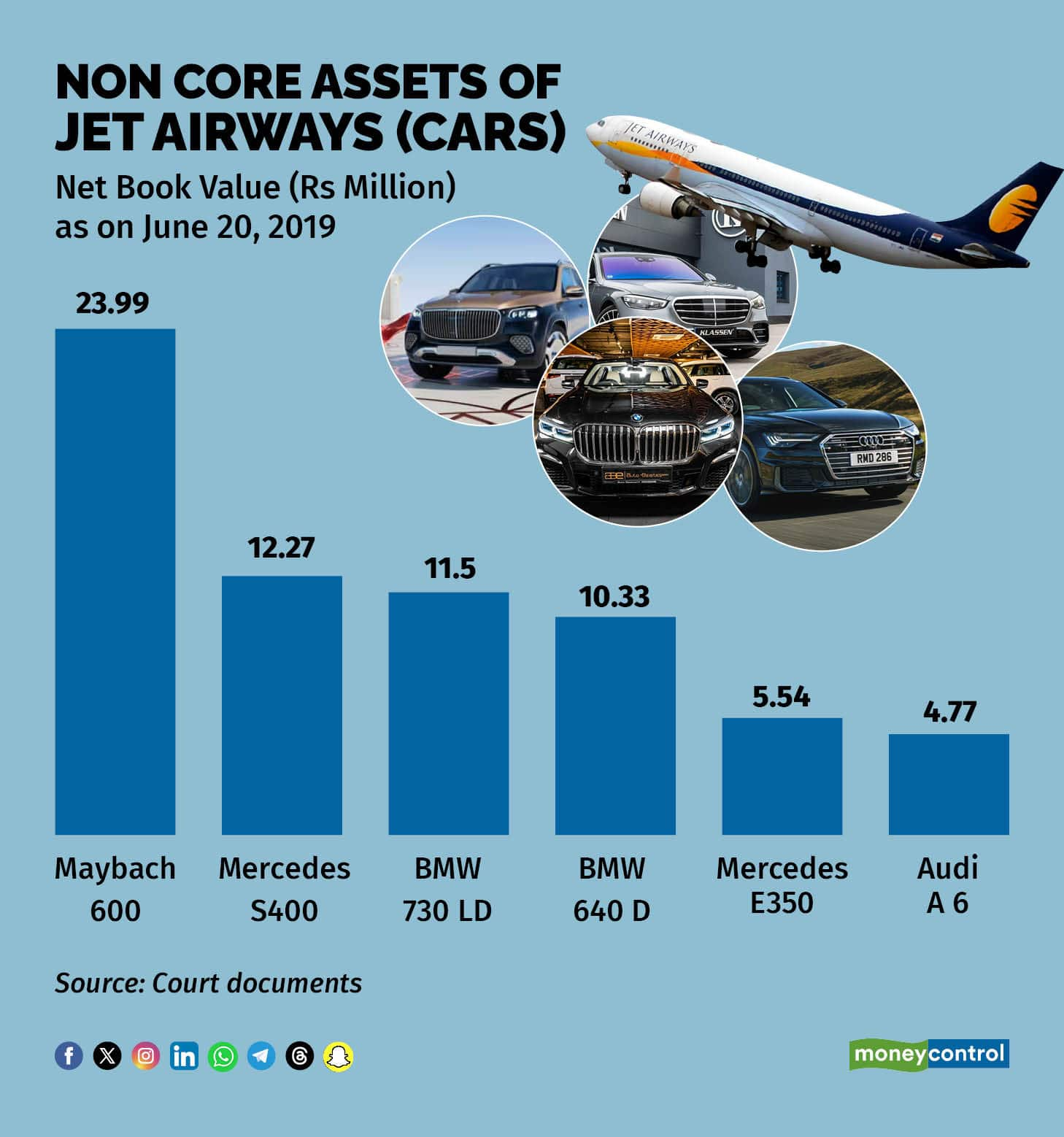

Non Core Assets of Jet Airways Cars

Non Core Assets of Jet Airways Cars

While the book value of all of Jet Airways assets may amount to around Rs 1,000 crore which is around 13 percent of the dues pending to its financial creditors and 6.4 percent of the total admitted claims against the airline, auctioning the assets is likely to fetch close to 50 percent of the total value of the assets.

Jet Airways Assets in Amsterdam

Jet Airways Assets in Amsterdam

The airline, founded by Naresh Goyal, was once considered India's best full service carrier, but stopped flying in April 2019 after it ran out of money and couldn't service its debt. Despite the attempts the UK-based Kalrock Capital and UAE-based entrepreneur, Murari Lal Jalan to restart the airlines, it won't take to the skies.

Non Core Assets of Jet Airways (Land)

Non Core Assets of Jet Airways (Land)

While Jet Airways is estimated to have owned its financial creditor around Rs 7,807 crore, a total of around Rs 15,723 crore was admitted as claims by the National Company Law Tribunal when the airline was first grounded in 2019.

Total outstanding debt of Jet Airways at the time of collapse

Total outstanding debt of Jet Airways at the time of collapse

The SC on November 7 also said that the Rs 200 crore given by the Jalan-Kalrock (JKC) consortium, as part of the initial tranche payment of Rs 350 crore, would have to be forfeited. Lenders can also invoke the performance bank guarantee of Rs 150 crore, it said.

The court set aside the March order of the National Company Law Appellate Tribunal (NCLAT) that directed transfer of ownership of the debt-ridden airline to JKC.

Apart from Jet Airways' non-core assets the airline also owns 11 aircraft parked at airports in Mumbai, Delhi, and Hyderabad. Six aircraft, including three Boeing 777s, two Airbus A330s, and one Boeing 737, are parked at Mumbai airport, while Delhi airport hosts two Boeing 777s and one Boeing 737, and Hyderabad hosts one Boeing 737 and one Airbus A330.

Aircraft owned by Jet Airways

Aircraft owned by Jet Airways

The liquidation process, which is lengthy, will begin with the National Company Law Tribunal (NCLT) in Mumbai appointing a liquidator to identify and value the assets for sale.

Creditors will be asked to resubmit their claims, after which the liquidator will publish a fresh list of creditors and settle claims proportionately based on asset valuation.

According to the Insolvency and Bankruptcy Code’s (IBC) waterfall mechanism, former employees and secured financial creditors will be prioritised, followed by other creditors.

The lenders, led by State Bank of India (SBI), had challenged the NCLAT order, saying the consortium failed to implement its resolution plan which had been approved by NCLT on June 22, 2021.

The lenders said their total admitted claim was of Rs 7,800 crore, but JKC had offered Rs 4,783 crore, which was payable in parts over five years.

"The first tranche payment of Rs 350 crore was required to be made by March 21, 2022 (which has not been paid till date, despite several extensions given by NCLT/NCLAT/Supreme Court)," the lenders said in their appeal filed through counsel Sanjay Kapur.

According to the resolution plan, airport dues and parking charges of Rs 475 crore, which have ballooned to Rs 1,000 crore, were required to be paid upfront by JKC in 180 days. However, the March order had confined this liability to Rs 25 crore toward airport dues, SBI said. JKC had denied the allegations, arguing it had spent Rs 700 crore so far in trying to revive the airline, despite lenders objecting to every step it took and every move it made.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.