Saudi Arabia's Public Investment Fund (PIF) has become the latest investor express interest to invest over Rs 11,000 crore for a 2.32 percent stake in the Jio Platforms and join a global group of reputed technology and private equity investors ranging from Facebook to L Catterton.

This has pushed Reliance’s digital unit’s investment mop-up to over Rs 1.15 lakh crore.

Here are five key things to know about the deal:

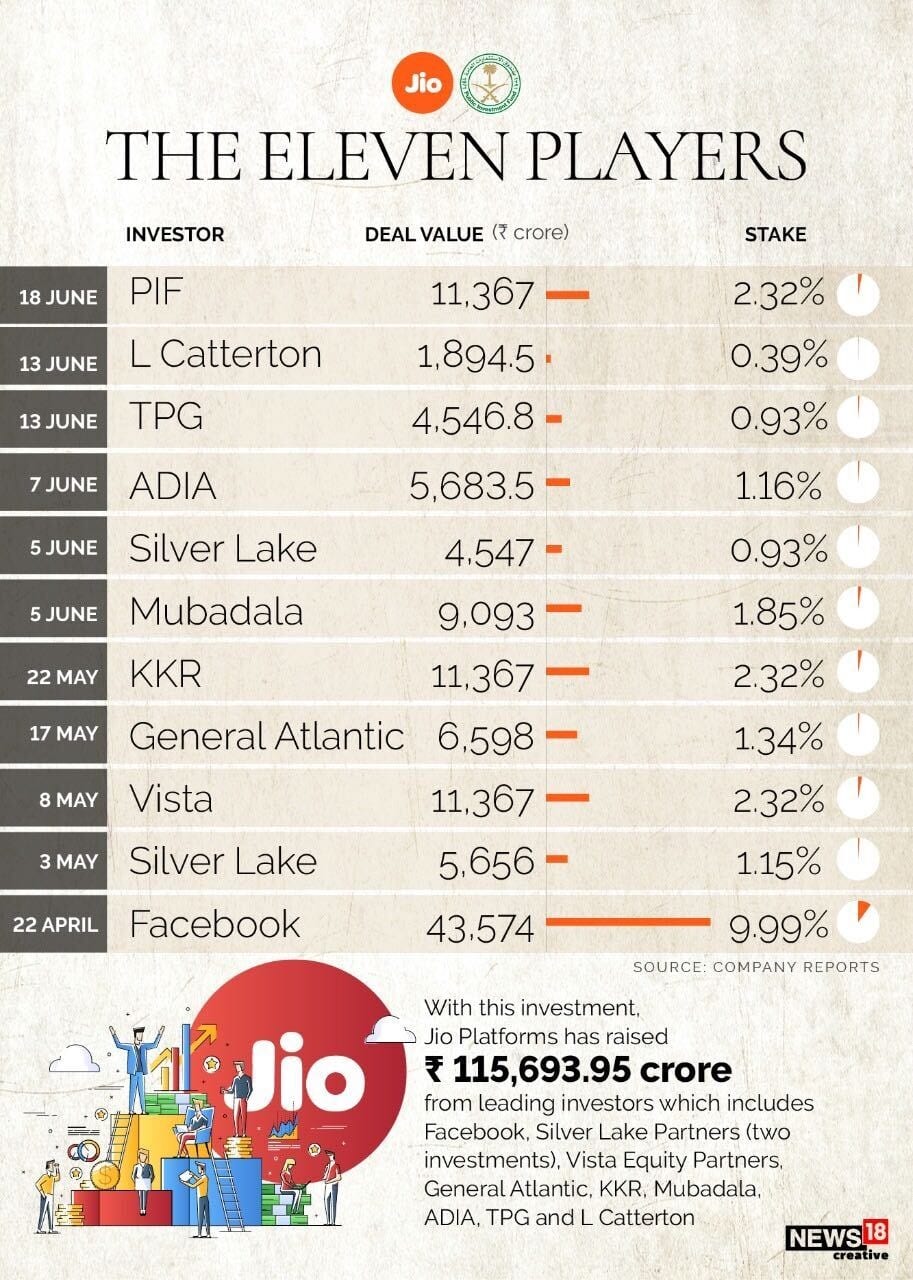

> Saudi Arabia’s PIF, one of the world’s largest sovereign wealth funds, will invest Rs 11,367 crore for 2.32 percent of Jio Platforms.

>PIF's investment is a historic eleventh investment in the Reliance Industries (RIL) digital unit in nine weeks.

> After PIF's investment, RIL, the oil-to-retail-to-telecom conglomerate, has now shed 24.7 percent stake in Jio.

>The investment by PIF in Jio Platforms is at an equity valuation of Rs 4.91 lakh crore and an enterprise valuation of Rs 5.16 lakh crore.

Also Read: Jio-PIF deal: All you need to know about Saudi Arabia's PIF, the latest investor in Jio Platforms

> With this investment, Jio Platforms has raised Rs 115,693.95 crore from leading global investors including Facebook, Silver Lake, Vista Equity Partners, General Atlantic, KKR, Mubadala, ADIA, TPG and L Catterton, since April 2020.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.