Fundraising through commercial paper and certificates of deposit fell in September, which development experts attributed to a sharp increase in borrowing cost and tightening liquidity.

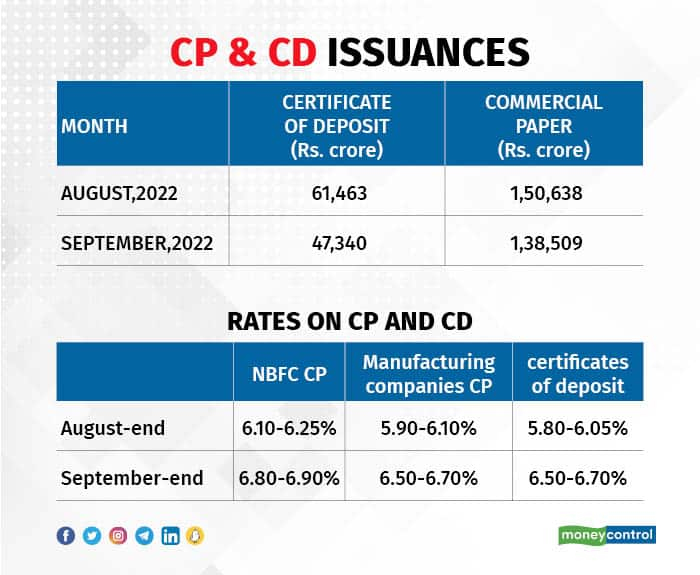

According to Prime Database, commercial paper worth, Rs 1.39 lakh crore was issued by companies, down 8% from August. And certificates of deposit worth Rs 47,340 crore were issued by banks, down 23% month-on-month.

Commercial paper is an unsecured, short-term debt instrument issued by companies for meeting temporary liabilities. A certificate of Deposit is a negotiable money-market instrument issued in a dematerialised form for funds deposited at a bank or other financial institutions for a specified period.

Interest rates on both instruments rose sharply last month ahead of the September 30 announcement of the Reserve Bank of India (RBI) monetary policy, in which the key repo rate was hiked by 50 basis points. One basis point is one-hundredth of a percentage point.

Surplus liquidity in the banking system turned into a deficit for the first time since 2019 on account of tax payments, dollar sales by the RBI to protect a falling rupee, and a pick-up in bank credit.

"After the US Fed rate hike (by 75 basis points), the expectation was that the RBI may also hike more than what the market was expecting and there was a wait-and-watch for what RBI does,” said Mahendra Kumar Jajoo, Chief Investment Officer-Fixed Income, Mirae Asset Investment Managers (India) Pvt Ltd.

“During this time the surplus liquidity from the system started narrowing, and mutual funds were also preparing for usual quarter-end redemption pressure,” he said. “So there was less demand, hence rates went up ahead of the monetary policy and may have led to many issuers holding back, leading to lower issuances in the month."

Liquidity in the banking system turned to a deficit of around Rs 20,000 crore by the end of September from a Rs 2 lakh crore surplus in the start of the month, according to a bank dealer.

MF demand slows

MF demand slows

Demand from mutual funds was low in the face of redemption pressure on their debt schemes at the quarter-end, a dealer at a Mumbai-based fund house said. Usually, investments by mutual funds slow at the end of the quarter because of redemptions that lead to an increase in rates. Mutual funds are the largest investors in CPs and CDs.

"Besides tight liquidity and advance tax outflow, the market was correcting itself in line with the expected MPC (Monetary Policy Committee) rate hikes. Further, the main money market investors like banks have diverted funds and started deploying funds to fuel growth," said Venkatakrishnan Srinivasan, founder and managing partner, of Rockfort Fincorp, a Mumbai-based debt advisory firm.

In September, rates on commercial paper issued by non-banking finance companies maturing in three months were at 6.80-6.90%, up 50-60 basis points from the previous month, and those on paper issued by manufacturing companies were t 6.50-6.70%, up 30-40 basis points on-month.

Rates on certificates of deposit were at 6.50-6.70%, 60 basis points higher than rates in the previous month.

Rates on these instruments fell on comments made by the RBI governor on the liquidity in the monetary policy. In his address, Governor Shaktikanta Das said liquidity in the banking system continues to be in surplus and the central bank will keep a close eye on liquidity management.

Rates on short-term debt instruments have eased since the start of October on demand from investors after liquidity in the banking system turned into a surplus. The surplus is estimated at more than Rs. 1 lakh crore, according to a dealer with a large state-owned bank.

Rates on these instruments have fallen by 10-15 basis points.

Way ahead

Dealers said banks are expected to tap markets in October to raise funds on an uptick in credit growth and may roll over the commercial paper due for maturity. This is because the rates have dropped marginally are expected to fall after the cut-off yield on the treasury bills eased in the last auction.

In the last weekly bond auction, the cut-off yield on the 91-day T-Bills eased by 10 basis points, 182-day by 5 basis points, and 364-day by 1 basis point.

Srinivasan added that considering both banks’ working capital loan rates and money market rates are simultaneously increasing, borrowers are left with little choice and are forced to borrow funds at higher rates.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.