Allegiant Air LLC, the American Ultra Low Cost Carrier (ULCC), last week placed an order for 50 Boeing 737MAX aircraft, with an option for as many more. It was the first deal Boeing managed to crack in the ULCC segment. The deal was also significant because Allegiant has an existing fleet of Airbus A319 and A320 planes.

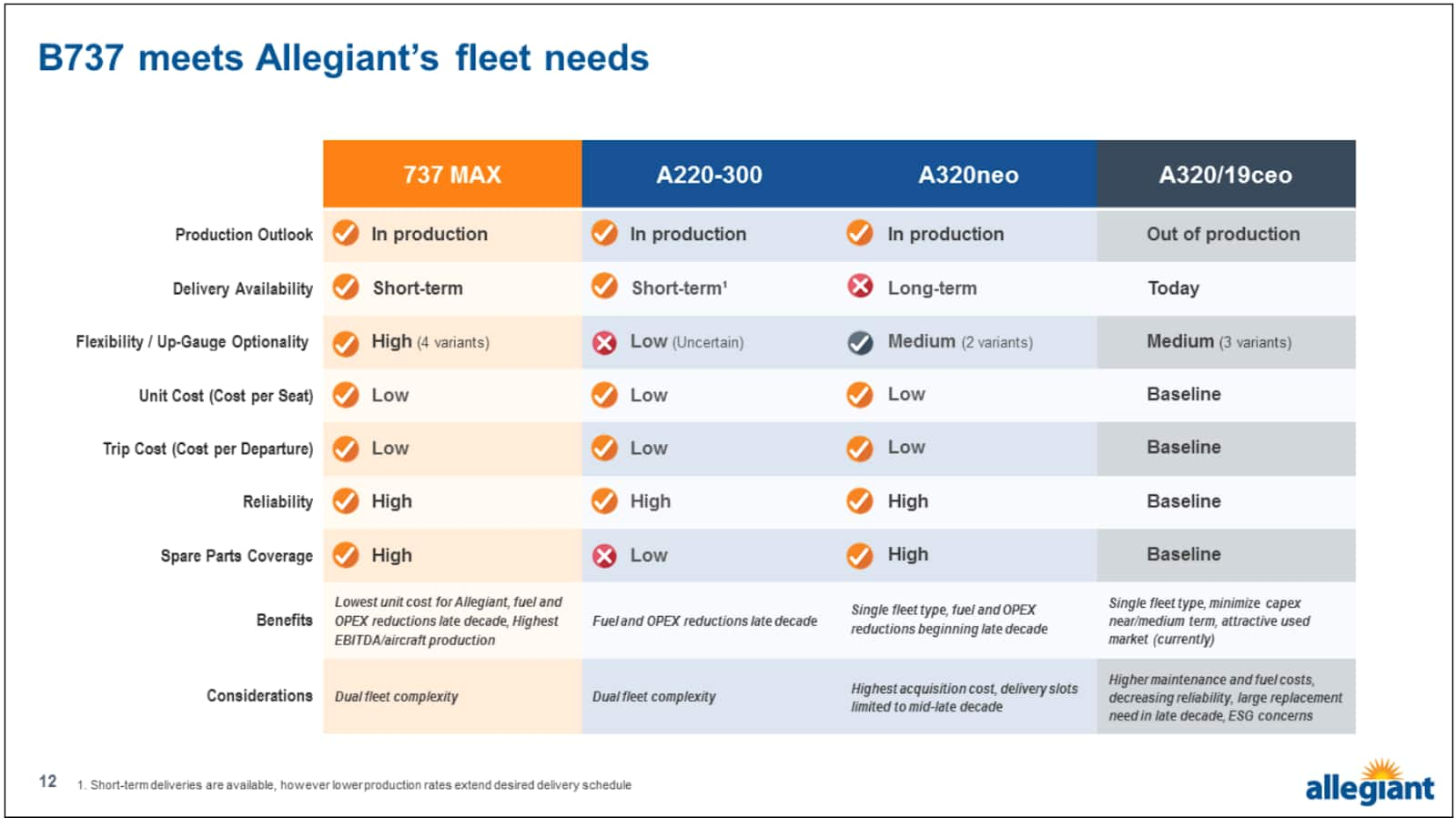

The airline put out a presentation to support its choice of the B737MAX over the A320neo, which would have made for commonality. One of the many factors that tilted the deal in favour of Boeing was availability.

Although it produces over 50 aircraft per month, Airbus has a long waiting period for the A320neo. Boeing, on the other hand, has a large number of B737MAX planes for delivery because of the aircraft’s grounding for two years+ on account of two crashes in 2018 and 2019. Additional delivery slots will become available in the near future.

Allegiant, for example, will start receiving its MAX planes from next year. Similar is the case of the Indian start-up Akasa, which is due to get its first MAX in the first quarter of financial year 2023, having placed an order at the Dubai air show last year.

The fact that it is going to take longer for aircraft to be delivered from the Airbus stable prompts a question --- is another mega order due from India or does this open the way for Boeing to make its mark in the Indian market?

Time for a big IndiGo order?

In an interview with Moneycontrol, IndiGo Chief Executive Officer Ronojoy Dutta said the airline has a six-year lease on the A320neo family, with a few having been leased for 12 years. Dutta also mentioned that about 50 aircraft were coming in each year and almost an equal number of A320ceos being phased out from the fleet.

The airline’s first A320neo (VT-ITC) was inducted in March 2016 and would complete six years of operations in the next couple of weeks. The airline inducted 14 A320neos in 2016, 18 in 2017 and 34 in 2018, 39 in 2019 and 44 in 2020.

The airline has 344 A320neos and 386 A321neos on order, of which 140 and 52 have been delivered as of the end of December. With over 50 A320ceos still in its fleet, which will go out in the next five quarters, and the redelivery of the A320neo also likely to start, the replacements would be to the tune of 14 aircraft in 2022, 18 in 2023, 34 in 2024, 39 in 2025 and 44 in 2026.

While 538 aircraft are pending for delivery to IndiGo, nearly half of those would be replacements.

With a six-to-seven-year lead time anticipated by many analysts, IndiGo would have to look at its fleet requirements right now for deliveries slated at the end of the decade.

Tata group needs a fleet refresh as well

The Tata group, which is due to take control of Air India and Air India Express in the next few days, will have to take a long view of fleet requirements. Its immediate focus would be to plug losses, improve service levels and address current hardware issues in the aircraft. The current fleet is made up of older generation aircraft and would need replacements sooner or later with fuel-efficient options for both wide-body and narrow-body planes.

The wide-body segment is open to the Boeing B787, called Dreamliner, or the Airbus A350, with both planes in the midst of trouble. Boeing has not delivered a Dreamliner for long, awaiting approval from the US regulator Federal Aviation Administration; Airbus is locked in a legal battle with Qatar Airways over peeling paint on the A350.

A window for Boeing or better Airbus slots?

Airlines are known to switch aircraft types. For some like AirAsia, it is early in the cycle. It moved to Airbus from Boeing when it had less than five aircraft. Silk Air, a subsidiary of Singapore Airlines, opted for the B737MAX over the A320 family, of which it had been a long-term operator. The Lion Air group. which operates multiple airlines, has a heady mix of both Boeing and Airbus narrow-body aircraft. A few others like VietJet have the B737MAX on order and deliveries of which were delayed by the grounding of the aircraft. Larger airlines like United or American have a mix of both Airbus and Boeing narrow-body aircraft.

Will the early availability of slots give a window to Boeing to make a mark in India? The manufacturer has been trying to get a foothold in the narrow-body market - which is dominated by Airbus. The Tata group, which will inherit the A320ceo, A320neo and the B737NG of its group airlines, could well opt for an aircraft type that is available early to ensure fleet renewal kicks off soon.

Air India has 49 A320ceo family aircraft while Air India Express has 24 B737NG ones, most of which are due for replacement in the next few years for want of next generation aircraft that save on costs.

While it does open a window of opportunity for Boeing, a possible increase in production, changes by existing customers necessitated by the pandemic or an airline or two shutting shop could lead to better slots being available with Airbus.

Either way, to meet fleet needs beyond 2027 for IndiGo and over the next few years for the Tata group, an order looks imminent in 2022 from India.

Source: Allegiant Investor Relations

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.