Some companies have started looking beyond employees’ health and mental wellbeing. Helping them plan their finances is the new trend. However, for some, this, too, is outdated as they are already disbursing salaries early, before the month ends.

Housing.com, Makaan.com and PropTiger.com let their employees take away a part of their salary on the 15th of every month. This initiative aims to provide financial liquidity so that people can enjoy a part of their salary as they accrue it and don’t necessarily have to wait for the month-end.

The shift was triggered by Covid-led challenges in 2021. Rohit Hasteer, Group CHRO of Housing.com, Makaan.com and PropTiger.com, first presented the concept to both the HR and finance teams. Subsequently, the finance team conducted several simulations to assess the impact on cash flow and the policy was subsequently implemented.

“We have got extremely positive feedback on the practice from our people, particularly from those who are new to the company and have experienced different practices at previous employers,” Hasteer said.

So far, around 50 percent of new recruits each month have opted for this benefit, he said.

Though technically different, a somewhat similar policy is also followed by PayPal and Infra.Market.

For instance, Infra.Market allows two pay advances per year, with exceptions on a case-by-case basis for extreme emergencies. “Our salary advance policy has been in effect since early last year and is available to all on-roll employees, irrespective of their position,” said Sheetal Bhanot Shetty, CHRO of Infra.Market.

The need

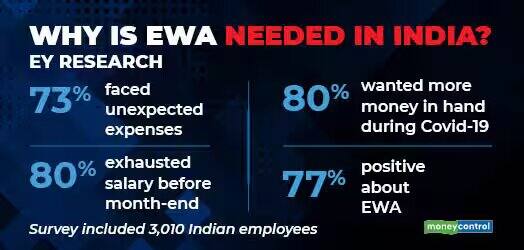

A comprehensive report on earned wage access (EWA) and financial well-being in India by Ernst and Young, in partnership with Refyne, noted that 81 percent of employees face a liquidity crunch between pay cycles.

The report, the first such in Asia, also noted employers who implemented EWA observed a significant drop in attrition, faster talent acquisition, enhanced workforce productivity, and improved employee net promoter score (eNPS).

ALSO READ | India Inc eyes job satisfaction with financial wellness programmes

EWA is a wage-payment system that gives employees access to their salary as and when required. EWA service providers such as Refyne and Ultimate Kronos Group tie up with companies to help them extend salary-on-demand options to their employees and reduce their need to seek out loans at high-interest costs.

A study by consulting major EY and startup Refyne

A study by consulting major EY and startup Refyne

Divya Agarwal, a professional based in Gurugram, found the concept useful and appropriate as it enables her to plan her expenses. “It also provides me with liquidity throughout the month, as I do not need to wait until the end of the month to receive my income,” the 26-year-old said.

KarmaLife, a financial solutions provider to the gig workforce, recorded over 19 percent growth in people availing early salary in the mobility sector, followed by flexi staffing (14 percent), and logistics (7 percent).

“As businesses recognise the value of early salary as a financial tool to enhance workforce productivity, retention, and satisfaction, they are increasingly utilising it to meet the needs of their employees,” said Rohit Rathi, co-founder and CEO of KarmaLife.

The challenges

Though releasing salary early on gives employees flexibility, it has its cons. Experts say releasing salaries early can be challenging for small businesses or startups as it can create cash flow problems.

Events such as the economic slowdown, funding winter, and SVB collapse can have a negative impact on a company’s finances if such a policy is active.

“If the company does not have enough cash on hand to cover early salary payments, it may need to take out loans or defer other payments, which can lead to financial strain in the long term,” said Aditya Narayan Mishra, MD and CEO of CIEL HR Services.

Besides, he said, data protection is another concern if a company such as PayPal ties up with a third-party provider to offer an early salary scheme to employees.

ALSO READ | Rs 1 lakh for an MNC job: How 'helpers’ game corporates

Another major risk that experts highlight is employees absconding after being paid in advance.

“One rotten apple can spoil the trust factor, leading to employers refraining from any early disbursal,” said Jayati Pardhy, Head of HR at payroll software firm Keka HR.

Pardhy said it is difficult to predict whether big companies will follow the trend of releasing salaries early as such companies often have well-defined structures in the Compensation and Benefits (C&B) department.

However, she pointed out this can work well for new-age startups, where talent attraction and retention remain a challenge and new strategies are always welcome to tackle it.

But a company’s culture has precedence over all other factors, she added. “Some companies may prioritise employee satisfaction and retention over financial considerations, while others may prioritise financial stability and profitability,” said Pardhy.

ALSO READ | Employees turning social media influencers is the next India Inc challenge after moonlighting

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.