It has been a mixed bag for newly listed companies amid heightened volatility in the Indian stock markets. In 2024, 54 companies launched their initial public offerings, collectively raising approximately Rs 51,000 crore. So far, 47 of these firms have been listed, with six currently trading below their price band.

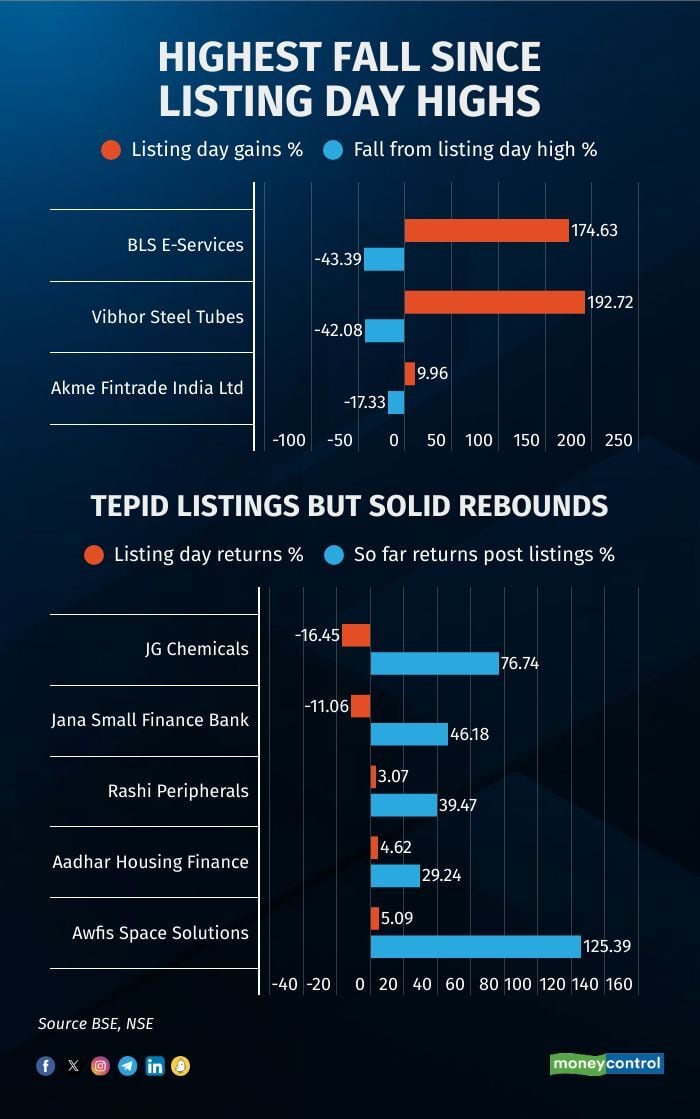

Data shows that some IPOs, despite strong debuts, failed to hold on to their gains. For instance, Vibhor Steel Tubes and BLS E-Services, saw impressive listing-day surges of 193 percent and 175 percent, respectively, but have since then given up about half of those gains.

In contrast, companies such as JG Chemicals and Jana Small Finance Bank, which initially listed at discounts of 16 percent and 11 percent, have rebounded sharply. These stocks are now trading 49 percent and 36 percent above their issue prices.

Some stocks, such as Rashi Peripherals, Aadhar Housing Finance, and Awfis Space Solutions, had flat debuts but have since risen by 33 percent, 25 percent, and 96 percent, respectively.

On the other hand, stocks like Dee Development Engineers, Bansal Wire Industries, Sanstar, Mukka Proteins, Le Travenues Technology, and Indegene made strong debuts but have seen little movement since then and are now trading close to their listing prices.

Several other listings, like Kronox Lab Sciences, Allied Blenders and Distillers, Apeejay Surrendra Park, Emcure Pharmaceuticals, and Vraj Iron and Steel, started at a premium but have since seen their gains fade only to trade near their issue prices.

Meanwhile, newly listed stocks such as Jyoti CNC Automation, Exicom Tele Systems, Platinum Industries Ltd, Bharti Hexacom, Ola Electric Mobility, Nova AgriTech, and JNK India made strong debuts with 20-40 percent gains and have continued to rise, now trading significantly higher, reflecting solid post-listing performance.

Analysts believe that IPO performance hinges on three key factors: business model, valuation metrics before and after the IPO, and the market's supply-demand dynamics.

Over the past eight months in 2024, markets have been highly volatile, influenced by three to four major events. These include geopolitical tensions, unexpected domestic election outcomes, and an unanticipated budget, all of which triggered immediate market reactions, leading to profit-taking and selling pressure from global investors.

According to Prashanth Tapse, Senior VP Research Analyst at Mehta Equities, IPOs with smaller market caps and reasonable valuations often list at over 100 percent above their issue price. However, post-listing, valuations adjust to reflect the company's earning potential, he says.

If earnings visibility is weak, prices typically correct. Conversely, IPOs with strong long-term fundamentals but slightly high valuations see moderate demand and may list at or below their issue price. Post-listing, these IPOs often gain traction due to their discounted valuations and solid earnings outlook, driving prices above the issue price.

In 2024 till date, India's benchmark indices, Sensex and Nifty, have each gained over 12 percent, while the BSE MidCap and SmallCap indices have surged by 30 percent each.

Analysts note that during every bull market, a variety of business models and promoters seize the positive sentiments to raise funds for capex or sell promoter stakes. Despite global volatility impacting the markets, domestic indices remained resilient, bolstered by steady retail inflows through SIPs and direct equity investments. This strong liquidity and the solid performance of recent IPOs suggest that a similar wave of IPOs is likely in the second half of 2024.

Apurva Sheth, Head of Market Perspectives and Research, SAMCO Securities believes that most IPOs were overpriced.

It's easier to find buyers for an IPO in a bull market as promoters get a price much more than they deserve for their shares in such a market and hence the flow of IPOs has increased recently, he says.

“We believe that a rate cut from the US Fed and RBI might add further fuel to this liquidity boom. We might see further momentum in IPO bound stocks in the remaining part of 2024 and 2025 until there's some kind of financial catastrophe,” said Sheth.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.