Amidst the ongoing corrections and volatility in the secondary markets, the primary market has registered the best ever start for a calendar year as the cumulative fund raising in January and February hit an all-time high.

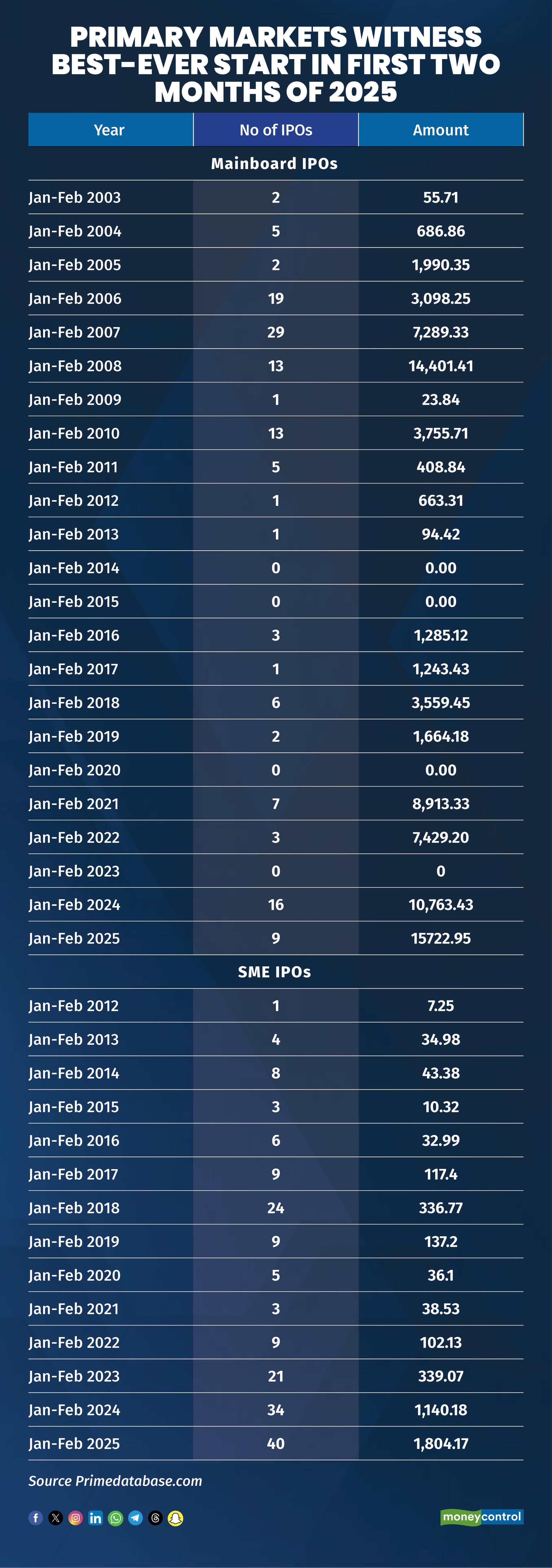

In the first two months of 2025, nine mainboard firms launched their IPOs, collectively raising Rs 15,723 crore, while 40 SMEs made their debut, securing nearly Rs 1,804 crore.

In comparison, the first two months of 2024 saw 16 mainboard IPOs, raising around Rs 10,763 crore, alongside 34 SME IPOs that raised Rs 1,140 crore. In 2023, there were no mainboard IPOs in the first two months even as 21 SMEs raised nearly Rs 340 crore.

Experts attribute this record fundraising to strong foreign investor participation, despite heightened market volatility and corrections. Foreign Institutional Investors (FIIs) remained net buyers in the primary market, investing nearly $825 million in February and $449 million in January. However, in the secondary markets, FIIs have been consistently selling shares, offloading nearly $4 billion in February and over $9 billion in January, as per data from NSDL.

Kranthi Bathini, Director - Equity Strategy at WealthMills Securities, noted that the early days of the calendar year witnessed strong momentum in the primary market, driven by IPOs such as Hexaware Tech and Dr. Agarwal’s Health Care. This followed a robust IPO year that concluded in 2024, even as selling pressure persisted in the secondary market.

He highlighted that despite continued selling in the secondary market, FIIs remained interested in IPOs, although retail investor participation was relatively lower. Looking ahead, IPO launches and fresh draft filings may slow down as global market selling persists with no signs of improvement.

A section of experts are of the view that IPOs are raising more capital on average, as managements seek to keep their war chests ready in response to heightened competitive intensity, market corrections, and rising geopolitical tensions.

Aditya Kondawar, Partner & Vice President, Complete Circle Capital said some IPOs still proceeded despite broader market corrections because management believed that markets might not become buoyant anytime soon. Therefore, they deemed it prudent to raise funds while they could, rather than risk their IPO approval lapsing and having to refile their DRHPs.

In the mainboard, Hexaware Technologies led the IPO market during the first two months of 2025, raising over Rs 8,750 crore, followed by Dr. Agarwal's Health Care Ltd and Ajax Engineering, which raised Rs 3,027.26 crore and Rs 1,268.93 crore, respectively. Other notable IPOs included Quality Power Electrical Equipments, Laxmi Dental, Quadrant FutureTek, Indo Farm Equipment, and Standard Glass Lining Technology. Of these, six firms are currently trading below their issue price, while the remaining are trading only marginally above their respective issue prices.

In the SME segment, Capital Numbers Infotech was the largest IPO during this period, raising over Rs 169 crore, followed by Chandan Healthcare, which raised Rs 107 crore, and Solarium Green Energy and Tejas Cargo India, each raising Rs 103 crore. Other IPOs included Rikhav Securities Ltd, EMA Partners India, Ken Enterprises, and more. Of the 40 SME IPOs, nearly 28 are trading below their issue price, four are trading flat, and eight are marginally higher than their issue price.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.