The initial public offering of Honasa Consumer Products, the parent of Mamaearth, is nothing short of historic. It is the first D2C firm to come to Dalal Street and also claims to be the largest digital-first beauty and personal care (BPC) company. Meaning, this is a company that built its own brands in the BPC segment and sold it to customers through its digital platform.

If chatter on the Street is anything to go by, the learning for other D2C companies from Honasa’s IPO will be an important one: first win customers’ trust with products, then approach the public to raise money, as an X user put it bluntly. That cynicism is not without reason.

Mamaearth has been around for seven years now. The company that started as toxin-free products for babies has evolved into a house of six brands today. But, customer loyalty has been hard to come by. Several of its products, especially the onion hair growth oil, has been the butt of jokes on social media for not producing any results.

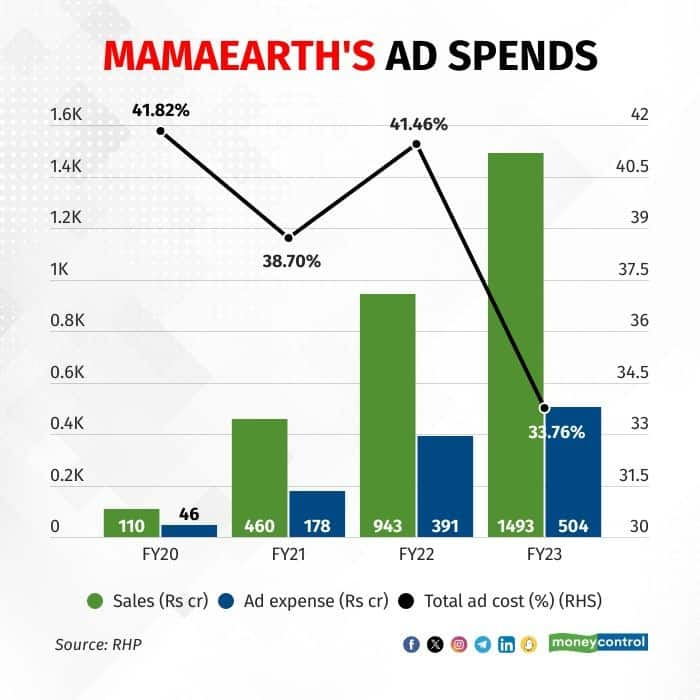

This is why the company has to spend on ads to acquire new customers. It spends anywhere between 30-40 percent of its sales on advertising, much higher than traditional consumer companies.

As if this was not enough, the company is planning to spend Rs 182 crore from the IPO proceeds on advertising expenses and brand visibility.

Sandip Sabharwal, a SEBI registered investment advisor, says that advertising expenditure for Honasa is eventually a revenue expenditure, which is unsustainable beyond a point. “Large consumer companies don’t spend more than 11-12 percent of their expenditure on advertising. Even advertising expenses for startups come down to 15-17 percent in a few years.”

Also read Mamaearth IPO Day 2: Issue subscribed 62%, retail portion booked 54% so far

No right to win?

Amit Jeswani of Stallion Asset Management, who does not shy away from investing in new-age tech companies, has also not looked at Mamaearth keenly. “Too much competition in the space,” he told Moneycontrol.

According to Redseer, the Indian BPC market is poised for rapid expansion, to touch $30 billion by 2027, comprising ~5 percent of the global BPC market. With more consumers seeking higher-quality products and adopting beauty and self-care routines, Honasa not only has to compete with new brands but also with the giants.

For instance, HUL has D2C platforms such as Simple, Dermalogica, and Love Beauty and Planet. Reliance Retail’s Tira, an omnichannel beauty retail platform, could also launch its own brands in times to come, believe analysts. In the digital space, it has firms such as Plumm, Minimalist and Chemist’s Play.

“With an IPO, I would now expect the company’s focus to shift to building hero products with R&D-led differentiation and perceived higher quality,” said Sreedhar Prasad, former partner at KPMG in India.

Chasing margins

BPC has the highest gross margin among the large consumption categories, at about 72 percent, similar to jewellery and watches, according to RedSeer. For Honasa, gross margins stand at 70 percent, but its EBITDA margin came in at ~2 percent for FY23. To scale up the operating margin, the company will have to cut commissions, focus on higher sales via its own channels, and reach a wider audience, all of which seem like a daunting task.

Also read Mamaearth raises Rs 765 crore from anchor investors ahead of IPO

Mamaearth’s sales from its own websites and apps are decreasing as a portion of total sales. While D2C sales constituted 46.73 percent of overall online sales in the June quarter of FY23, this share dropped to 35.65 percent in the corresponding period of FY24.

The share of online sales from marketplaces such as Amazon and Flipkart rose from 53.27 percent to 64.35 percent during this period.

“Profitability will improve only when the product itself drives sales with existing customers and referrals, primarily due to its quality and trust. Growth is not dependent only on the quantum of spends on marketing/ discounting,” added Prasad.

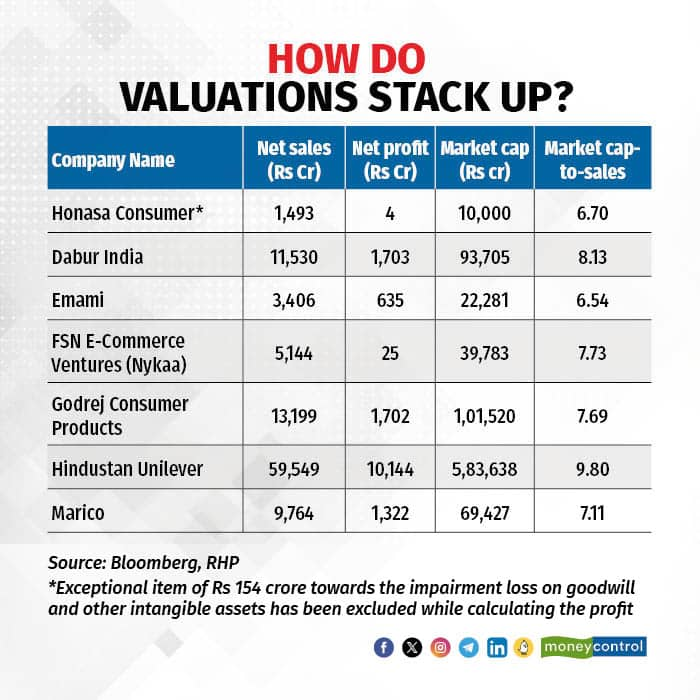

As per market chatter, the anchor investors in the Mamaearth IPO have come in expecting to make a quick buck from listing gains and they do not have constructive long-term view. Meanwhile, the chief investment officer of a domestic mutual fund, speaking on condition of anonymity, told Moneycontrol, “Rs 10,000 crore is too much. We might have looked at it at a Rs 7,000 crore valuation.”

Given the outrage on X and the dull subscription numbers on Day 1, investors seem to have taken cognisance of these notable risks, unwilling to bet blindly on the stock because of its digital focus. It’s also a sign of that the market is not in any state of euphoria where anything and everything sells.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.