State-owned Indian Railway Finance Corporation will open its initial public offering for subscription on January 18 and the same will close on January 20.

This will be the first IPO in 2021. Indigo Paints is scheduled to launch its IPO in the latter part of the coming week.

The book running lead managers to the issue are DAM Capital Advisors, HSBC Securities and Capital Markets (India), ICICI Securities and SBI Capital Markets.

Also Read - Indian Railway Finance Corporation IPO opens today: Should you subscribe?

Here are 10 key things you should know before subscribing the issue:

1) Public Issue Details

The dedicated market borrowing subsidiary of the Indian Railways will launch initial public offering of up to 1,78,20,69,000 equity shares. The IPO comprises a fresh issue of 1,18,80,46,000 equity shares and an offer for sale of 59,40,23,000 equity shares by the government.

The issue includes a reservation of equity shares worth Rs 50 lakh for subscription by eligible employees. The issue will constitute up to 13.64 percent of the post issue paid-up equity share capital of the company.

2) Price Band

The company, in consultation with merchant bankers, has fixed price band for its public issue at Rs 25-26 per share.

3) Fund Raising

IRFC targets to raise Rs 4,455.17 crore - Rs 4633.38 crore at a price band of Rs 25-26 per share. The company already garnered Rs 1,390 crore through anchor book on last Friday.

4) Objectives of the Issue

The net proceeds from its fresh issue are proposed to be utilised towards for augmenting equity capital base to meet future capital requirements arising out of growth in business; and general corporate purposes.

The proceeds of the offer for sale will be received by the selling shareholder i.e. the Government of India only and hence, the company will not receive any proceeds from the offer for sale.

5) Company Profile

IRFC is the dedicated market borrowing arm of the Indian Railways. Its primary business is financing the acquisition of rolling stock assets, which includes both powered and unpowered vehicles (for example locomotives, coaches, wagons, trucks, flats, electric multiple units, containers, cranes, trollies of all kinds and other items of rolling stock components, leasing of railway infrastructure assets and national projects of the Government and lending to other entities under the Ministry of Railways.

The company is registered with the Reserve Bank of India as a NBFC (systematically important) and are classified under the category of an 'Infrastructure Finance Company'.

As of September 2020, its total assets under management (AUM), consisted of 55.34 percent of lease receivables primarily in relation to rolling stock assets, 2.25 percent of loans to central public sector enterprises entities under the administrative control of MoR and 42.41 percent of advances against leasing of project assets.

The total value of rolling stock assets financed by IRFC as of March 2020 and as of September 2020 was Rs 2,23,810.78 crore and Rs 2,34,627.16 crore, respectively, while the value of rolling stock assets financed in FY20 and in the six months ended September 2020, was Rs 33,544.1 crore and Rs 10,816.38 crore, respectively.

6) Strengths

Indian Railway Finance Corporation believes that the following are its competitive strengths:

a> Company played a strategic role in financing the operations and growth of the Indian Railways.

b) Competitive cost of borrowings based on strong credit ratings in India and diversified sources of funding

c) Consistent financial performance and cost plus model

d) Low risk business model

e) Strong asset-liability management

f) Experienced senior management and committed team

7) Business Strategies

Principal business strategies include the following:

a) Diversification of borrowing portfolio

b) Broaden financing portfolio

C) Continued focus on asset-liability management

d) Provide advisory and consultancy services and venture into syndication activities

8) Financials

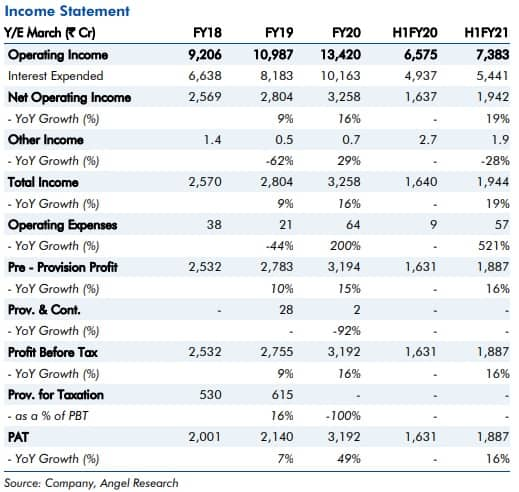

IRFC has posted strong growth in operating income of 20.7 percent CAGR between FY18-20 while net profits have grown at a CAGR of 26.3 percent during the same period.

Company's AUM has grown at a CAGR of 27 percent since FY18-FY20 while disbursements during the same year has grown at CAGR of 40 percent.Company has posted NIM of 1.59 percent in FY20 while return on equity stands at 12 percent during the same year.

9) Rating

For any NBFC, credit rating holds utmost importance & company enjoys highest credit rating for an Indian issuer from ICRA, CRISIL & CARE. Also, company source funds from diversified avenues like taxable and tax-free bonds issuances, term loans from banks/financial institutions, ECB's, internal accruals, asset securitisation and lease financing in addition to equity infusion from time-to-time.

Company has received the highest credit ratings from CRISIL – AAA and A1+, ICRA – AAA and A1+, and CARE – AAA and A1+. It has also been accorded with Baa3 (Negative) rating by Moody's, BBB- (Stable) rating by Standard and Poor’s, BBB- (Negative) rating by Fitch and BBB+ (Stable) rating by Japanese Credit Rating Agency.

10) Shareholding and Management

Promoter is the President of India, acting through the Ministry of Railways. Promoter, along with its nominees, currently holds 100 percent of the pre-issue paid-up equity share capital of the company. After this issue, promoter will hold 86.36 percent of the post issue paid-up equity share capital.

Amitabh Banerjee is the Chairman and Managing Director of the company, while Shelly Verma is the Director (Finance) and Chief

Financial Officer.

Amitabh Banerjee is an officer of the Indian Railways Accounts Service (1988 batch). Prior to his current position, he was associated with Konkan Railway Corporation as well as the Hindustan Paper Corporation in the capacity of director (finance). Additionally, he has also been associated with Delhi Metro Rail Corporation Limited in the capacity of General Manager (Finance).

Baldeo Purushartha and Bhaskar Choradia are the Part-time Government Director while Chetan Venugopal is the Part-time Non-official Director and Ashok Kumar Singhal is the Non-official Director (Independent Director).

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.