IndiaMart InterMesh, the largest online B2B marketplace for business products and services, is set to open its initial public offering for subscription on June 24.

The issue, which will remain open for three working days till June 26, is an offer for sale by promoters and selling shareholders.

The book running lead managers to the public issue are ICICI Securities Limited, Edelweiss Financial Services Limited and Jefferies India Private Limited. Equity shares of IndiaMart are proposed to be listed on both BSE and NSE.

Here are 10 key things to know before subscribing the issue:

Company Profile

IndiaMart provides a robust two-way discovery marketplace connecting buyers and suppliers. Buyers locate suppliers on its marketplace, both Indian small and medium enterprises or SMEs and large corporates, by viewing a webpage containing the supplier's product and service listings, or a supplier storefront, or by posting requests for quotes called RFQs or BuyLeads.

The company primarily operates through its product and supplier discovery marketplace, indiamart.com or IndiaMART. Its online marketplace provides a platform for mostly business buyers, to discover products and services and contact the suppliers of such products and services.

It had 82.70 million registered buyers and 5.55 million supplier storefronts in India as of March 2019. The Indian supplier storefronts have 60.73 million listings of which 76 percent are products and 24 percent are services.

As of March 31, 2019, the company has 129,589 paying subscription customers on the IndiaMart platform. Suppliers on its platform include Indian SMEs and large businesses who are manufacturers, wholesalers, exporters and retailers.

Additionally, it has a number of large suppliers and leading brands including Agfa HealthCare India Private Limited, Case New Holland Construction Equipment (India) Private Limited, Hilti India Pvt. Ltd, JCB India Ltd, Nobel Hygiene Pvt. Ltd.

The top 10 percent of customers accounted for 40 percent of revenue, as of March 2019.

About Public Issue

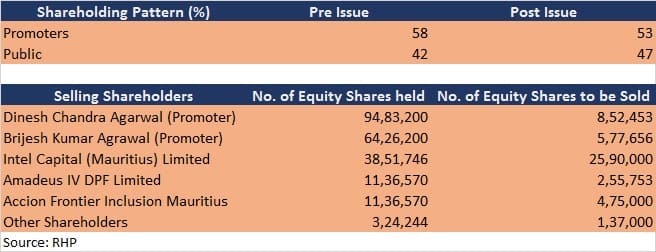

The IPO of up to 48,87,862 equity shares is an offer for sale by promoters and investors.

Existing investors including Intel Capital (Mauritius) Limited, Amadeus IV DPF Limited and Accion Frontier Inclusion Mauritius will together offload around 33.21 lakh shares.

Promoters Dinesh Chandra Agarwal and Brijesh Kumar Agrawal will sell around 14.30 lakh shares through the OFS, while 1,37,000 shares will be sold by other selling shareholders.

The offer includes a reservation for subscription by eligible employees of 10,000 equity shares.

Company has set a price band of Rs 970-973 per share. Bids can be made for minimum 15 equity shares and in multiples of 15 equity shares thereafter.

Eligible employees will get shares at a discount equivalent to Rs 97 per share on final offer price.

Funds to be Raised

IndiaMart aims to raise Rs 474.12 crore at the lower end of the price band and Rs 475.6 crore at higher end of the price band.

Objects of issue

Company will not receive any proceeds from the offer and the entire proceeds from the offer will go to the selling shareholders, in proportion to the equity shares offered and sold by the respective selling shareholder in the offer for sale.

Strengths

> IndiaMart's strong network effects and brand recognition drives leadership in the B2B marketplace in India.

> Its offerings are well suited to the needs of buyers and enable them to receive comprehensive information on a variety of products and services, and communicate effectively with a large number of suppliers.

> Its service offerings are well-suited to the needs of suppliers seeking to search newer markets in an effective and economical platform to market their products and services.

> It has deep understanding of online trade and commerce in India that drives innovative solutions.

> Robust mobile platform.

> Experienced management team and large sales and service representatives team with proven track record of performance.

Strategies

Here are the company's strategies to drive future growth and development:

> Continue to increase the size of IndiaMART marketplace

> Attract larger suppliers and leading brands while growing our core SME segment supplier base.

> Continue to enhance our buyers’ experience

> Improve supplier engagement, services, retention and monetisation

> Continue investing in mobile platforms and capabilities.

Competition

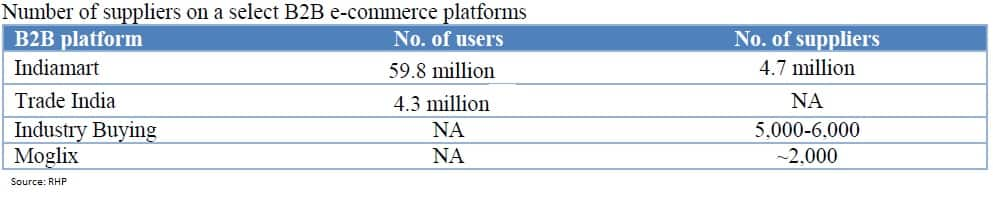

Tradeindia.com and Alibaba India are some of the key competitors for IndiaMART. Its other indirect competitors include:

> Just Dial, a provider of business-to-consumer phone and web-based local search services in India, typically based on the immediate geographic proximity of businesses to the consumer.

> Google and other search engines – these services allow buyers to locate suppliers, provided such suppliers have a web presence

> B2B transaction-based platforms i.e. Industry Buying, Power2SME, Moglix and Bizongo.

> Traditional trading channels i.e. trade show organisers, trade magazine publishers, the yellow pages, classified advertisements and outdoor advertising.

Shareholding Pattern

Financials

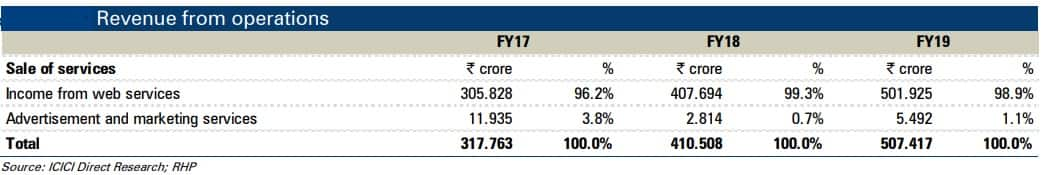

In fiscals 2017, 2018 and 2019, substantially all of its revenue from operations was earned through the sale of subscription packages, and a minor portion of total revenue was earned through advertising, facilitation of payment and sale of RFQ credits.

Key Risks

Here are key risks highlighted by brokerage houses:

> General demand slowdown for the types of products and services listed by the suppliers on IndiaMART online marketplace.

> Higher competitive intensity.

> Highly dependent on Indian suppliers purchasing paid services on India.

> The company incurred losses in the preceding financial years.

> Risk of technological advancement.

> Higher employee costs may impact the business.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.