ICICI Securities, the subsidiary of ICICI Bank, will open its initial public offering for subscription on March 22.

The book running lead managers to the offer are DSP Merrill Lynch, Citigroup Global Markets India, CLSA India, Edelweiss Financial Services, IIFL Holdings and SBI Capital Markets. ICICI Securities is acting as the book running lead manager to the offer.

Equity shares are proposed to be listed on BSE and NSE.

Here are 10 key things you should know before investing:

Company Profile

Headquartered in Mumbai, ICICI securities offers a wide range of financial services including brokerage, financial product distribution and investment banking and focuses on both retail and institutional clients. It has been the largest equity broker in India since fiscal 2014 by brokerage revenue and active customers in equities on the National Stock Exchange, as per CRISIL report.

Its significant retail brokerage business, which accounted for 90.5 percent of the revenue from brokerage business (excluding income earned on funds used in the brokerage business) in fiscal 2017.

As of December 31, 2017, ICICIdirect, the electronic brokerage platform, had approximately 3.9 million operational accounts of whom 0.8 million had traded on NSE in the preceding 12 months, as per NSE. Since inception, it acquired a total of 4.6 million customers through this platform as of December 2017.

Also Read - ICICI Securities IPO opens: Should you subscribe?

Its retail brokerage and distribution businesses are supported by nationwide network, consisting of over 200 of own branches, over 2,600 branches of ICICI Bank through which electronic brokerage platform is marketed and over 4,600 sub-brokers, authorised persons, independent financial associates and independent associates as at December 2017.

For the period from April 1, 2012 to September 30, 2017, it was the leading investment bank in the Indian equity capital markets by number of primary issuances managed, as per CRISIL report.

About the Issue

The issue consists of an offer for sale of up to 7,72,49,508 equity shares by promoter ICICI Bank, which includes reservation of up to 38,62,475 shares for purchase by the ICICI Bank shareholders.

The offer would constitute 23.98 percent of the post-offer paid-up equity share capital.

The broking firm has fixed a price band of Rs 519-520 per share. Bids can be made for a minimum lot of 28 equity shares and in multiples of 28 equity shares thereafter.

The issue will close on March 26.

Fund Raising

The country's largest private sector lender is targeted to raise Rs 4,009.25-4,016.97 crore through the issue of ICICI Securities, at a price band of Rs 519-520 per share, respectively.

Out of which, ICICI Securities already raised Rs 1,717 crore through anchor investors' portion by making allotment of 3,30,24,165 equity shares to 28 anchor investors at a price of Rs 520 per share.

Objects of the Issue

Promoter selling shareholder ICICI Bank will be entitled to entire proceeds of the offer after deducting the offer expenses and relevant taxes thereon. Hence, ICICI Securities will not receive any proceeds from the offer.

The objects of the offer are to achieve the benefit of listing the equity shares on stock exchanges and for the sale of equity shares by the promoter selling shareholder.

Further, the company expects that the listing of equity shares will enhance its visibility and brand image and provide liquidity to its existing shareholders.

Strengths

> ICICI Securities has been the largest equity broker in India since fiscal 2014 by brokerage revenue and active customers in equities on the

National Stock Exchange (Source: CRISIL), powered by significant retail brokerage business and proprietary technology platform: ICICIdirect.

> Its strong brand name, large registered customer base, wide range of products across asset classes and complimentary advisory services position the firm to be the natural beneficiary of these transformational changes in the Indian savings markets.

> It has a strong and growing distribution business with an 'Open-Source' distribution model, where it distributes third-party mutual funds, insurance products, fixed deposits, loans and pension products to retail customers for commission income.

> It has a history of product and technology innovation to satisfy the needs of customers. It delivers the benefits of these innovations to customers through electronic brokerage platform, ICICIdirect.

> As a strategic component of the ICICI Group ecosystem, it has mutually beneficial agreements with various companies in the ICICI Group.

> For the period from April 1, 2012 to September 30, 2017, it was the leading investment bank in the Indian equity capital markets by number of equity capital market issuances managed, as per CRISIL report.

> It has a management team with extensive experience in the financial services sector.

> It has an established track record of strong financial performance with significant operating efficiency.

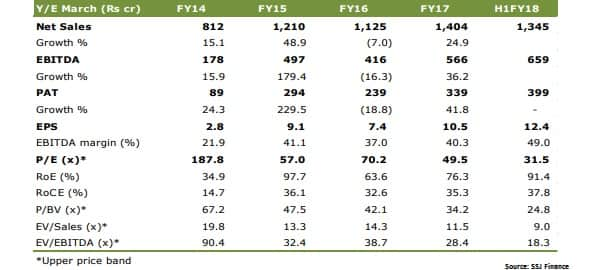

Financials

ICICI Securities has reported a CAGR of 18.8 percent and 47.4 percent on revenue and net profit fronts respectively over FY13-17.

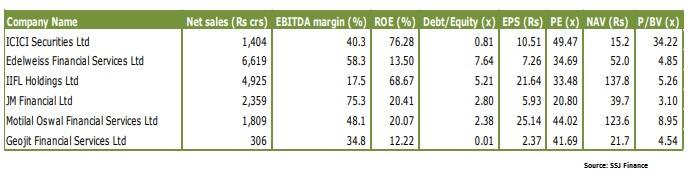

Peer Comparison

Promoter

The promoter of the company is ICICI Bank that currently holds 32,21,41,400 equity shares, equivalent to 100 percent of the pre-Offer issued, subscribed and paid-up equity share capital.

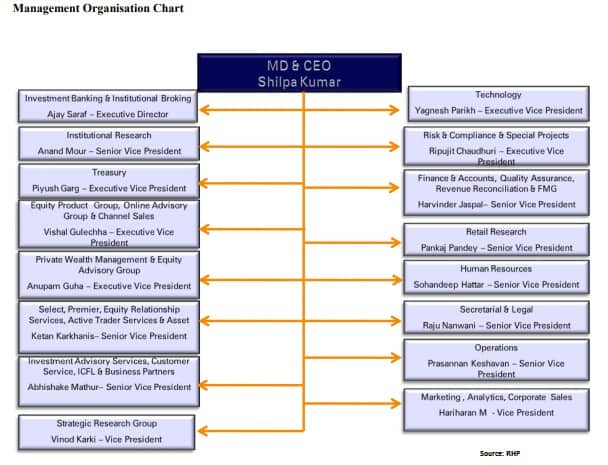

Management

Chanda Deepak Kochhar is the chairperson of board and nominee director of ICICI Bank. She has been the Managing Director and Chief Executive Officer of ICICI Bank since 2009.

Shilpa Naval Kumar has been the Managing Director and Chief Executive Officer of the company since November 3, 2016. She has previously worked with ICICI Bank for over 27 years in the areas of planning, project finance, corporate banking and treasury at ICICI Bank.

Risks and Concerns

Here are some risks and concerns highlighted by brokerage houses:

> ICICI Securities faces intense competition in its businesses, which may limit its growth and prospects.

> Business activities of the company are subject to extensive supervision and regulation by the Government and regulatory authorities, such as SEBI, IRDAI and PFRDA.

> It relies on brokerage business for a substantial share of its revenue and profitability. Any reduction in its brokerage fees could have material adverse effect on its business, financial condition, cash flows, results of operations and prospects.

> General economic and market conditions in India and globally could have a material adverse effect on its business, financial condition, cash flows, results of operations and prospects.

> The company relies heavily on its relationship with ICICI Bank for many aspects of the business, and such dependence leaves it vulnerable to any change in the relationship with the bank.

> The operation of ICICI Securities' businesses is highly dependent on information technology and they are subject to risks arising from any failure of, or inadequacies in, their IT systems.

> For some services, it relies on third-party intermediaries, contractors and service providers and their dependence on them expose to third party risk.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!