Pharmaceutical chemicals manufacturer Chemcon Speciality Chemicals will launch its initial public offering on September 21.

The issue will close on September 23 and anchor investors' book will open for bidding on September 18, only for a day.

Intensive Fiscal Services and Ambit Capital Private are the book-running lead managers to the issue.

Here are 10 key things one should know before subscribing to the public issue:

1) Price Band

The company has fixed the IPO price band at Rs 338-340 per equity share.

2) Public Offer

The book-building IPO comprises a fresh issue of up to Rs 165 crore and an offer for sale of up to 45 lakh equity shares by promoters.

The offer for sale consists of a sale of 22.50 lakh equity shares each by promoters Kamalkumar Rajendra Aggarwal and Naresh Vijaykumar Goyal.

Bids can be made for a minimum 44 equity shares and in multiples of 44 shares thereafter. Maximum bid size is 13 lots, which means retail investors can bid for a maximum of 572 equity shares.

CAMS sees over 30% premium in grey market ahead of IPO

3) Issue Size

The company plans to raise Rs 317.1 crore at lower price band and Rs 318 crore at upper price band.

4) Objects Of Issue

Chemcon Speciality Chemicals will utilise fresh issue proceeds for capital expenditure towards the expansion of manufacturing facility, working capital requirements, and general corporate purposes.

But, the company will not receive any proceeds from the offer for sale, which will go to selling shareholders.

Angel Broking IPO to open on September 22; price band set at Rs 305-306

5) Company Profile

Chemcon manufactures specialised chemicals, such as Hexamethyldisilazane (HMDS) and Chloromethyl Isopropyl Carbonate (CMIC) which are predominantly used in the pharmaceuticals industry, and inorganic bromides, namely calcium bromide, zinc bromide and sodium bromide, which are predominantly used as completion fluids in the oilfields industry (oilwell completion chemicals).

Frost & Sullivan Report said the Chemcon was the only manufacturer of HMDS in India and was the third-largest manufacturer of it worldwide.

The company also exports products to countries including the US, Italy, South Korea, Germany, People's Republic of China, Japan, United Arab Emirates, Serbia, Russia, Spain, Thailand and Malaysia.

Its key customers in pharmaceutical chemicals segment include Hetero Labs, Laurus Labs, Aurobindo Pharma, Sanjay Chemicals (India), Lantech Pharmaceuticals, Ind-Swift Laboratories, Vivin Drugs & Pharmaceuticals and Macleods Pharmaceuticals, while its key customers in oilwell completion chemicals segment include Shree Radha Overseas, Water Systems Specialty Chemical DMCC and CC Gran.

Its manufacturing facility currently comprises of seven individual operational plants with an aggregate volumetric reactor capacity of 374.85 KL, as on July 2020.

6) Financials

The company has reported revenue from operations of Rs 262.05 crore with EBITDA of Rs 70.26 crore and profit Rs 48.85 crore in FY20. In FY18-FY20, company's revenue from operations grew at a CAGR of 28.93 percent, EBITDA 24.82 percent and profit after tax at a CAGR of 36.08 percent.

In FY20, FY19 and FY18, its exports business (including deemed exports) contributed 39.78 percent, 31.99 percent and 47.84 percent, respectively, to revenue from operations.

In FY20, FY19 and FY18, pharmaceutical chemicals segment contributed 63.75 percent, 63.14 percent and 62.18 percent to total revenue, while oilwell completion chemicals business contribution to revenue stood at 33.47 percent, 35.30 percent and 35.63 percent respectively.

As of March 2020, its total borrowings was Rs 44.51 crore, while the debt-equity ratio was 0.31.

7) Strengths

>> Chemcon is a leading manufacturer of pharmaceutical chemicals;

>> It has a diversified customer base along with long standing relationships;

>> The specialty chemicals industry in which it operates has high entry barriers;

>> Company has delivered consistent financial performance with a strong financial position;

>> It has an experienced senior management.

8) Strategies

>> Expansion of total installed production capacity;

>> Augmenting growth in the current geographic markets and expanding into new one;

>> Exploring newer applications of existing products as well as focusing on new products that are in synergy with current operations;

>> Continue to strive for cost efficiency.

9) Management and Promoters

Kamalkumar Rajendra Aggarwal is the Chairman and Managing Director of the company. Navdeep Naresh Goyal is the Deputy Managing Director. Along with Shubharangana Goyal, both are also promoters of the firm.

Rajesh Chimanlal Gandhi is the Whole-time Director and Chief Financial Officer of the company.

Himanshu Purohit and Rajveer Aggarwal are Whole-time Directors, while Lalit Chaudhary, Bharat Shah, Neelu Shah, Devendra Rajkumar Mangla and Samir Chandrakant Patel are Independent Directors.

10) Shareholding

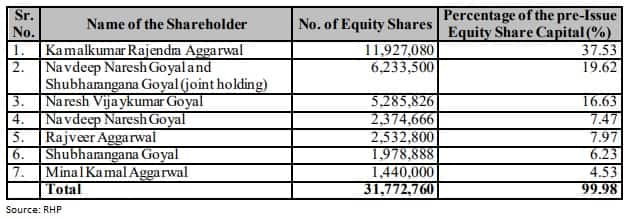

Currently, pomoters hold 100 percent stake in the company. As of September 12, the filing date for red herring prospectus, the company has seven shareholders.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!