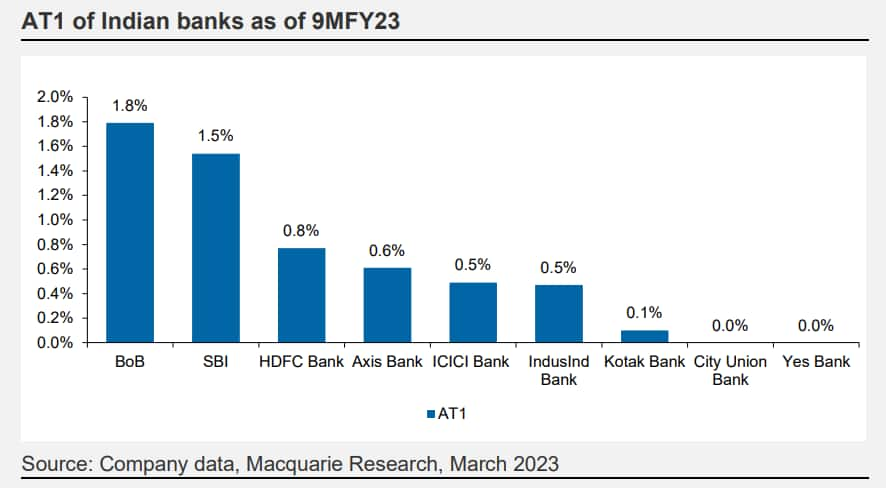

The decision by Swiss authorities to wipe out Credit Suisse's Additional Tier 1 (AT1) bonds has worried investors in India about the implications for Indian banks. However, according to brokerage house Macquarie, the exposure of Indian banks to AT1 bonds is relatively low.

Private sector banks have an exposure of around 0-1 percent to AT1 bonds, while PSU banks have an exposure of 1-2 percent, as per Macquarie note shared on March 21.

AT1 bonds are a type of bond issued by banks to raise money from investors. The Additional Tier 1 (AT1) bond is a regulatory classification of these bonds as a form of capital that can absorb losses in times of financial stress.

The report, authored by Suresh Ganapathy, head of Macquarie's financials research, highlighted that private sector banks are comfortable with their Common Equity Tier 1 (CET1) levels, and are unlikely to face any issues.

He further said that PSU banks have lower CET1 ratios, and a weak AT1 bond market could necessitate equity capital raising, especially for State Bank of India (SBI), whose CET1 ratio is currently at 9.3% as of 9MFY23.

As per the Basel-III rules, a trigger of PONV (point of non-viability) can result in regulator writing off AT1 bonds prior to equity, as was the case with YES Bank.

However, many of the AT1 bonds of YES Bank were sold as super FDs (Fixed Deposits) by relationship managers, and the matter is now sub judice.

The report underlined that due to the government support provided to PSU banks, they are unlikely to reach a state of PONV, and therefore, AT1 bond investments in them are deemed safe.

"There will be caution exercised by investors in AT1 bonds post the CS issue and hence AT1 bond markets could be weak for some time," the report noted.

It further predicted that PSU banks will likely raise equity capital over the next 12 months, as their CET1 ratios are lower than those of private sector banks but if loan growth slows down significantly, an equity capital raise may not be necessary.

In the meantime, PSU banks have already announced lower dividend payouts for FY23 to shore up their capital base.

Typically, payout ratios are around 20 percent, but if they give zero dividends, CET1 could be bolstered by approximately 30-40bps, the report said.

Also Read: A Rs 142,496-crore jolt for Credit Suisse's AT1 bondholders. Read what happened

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.