The government's Faceless Assessment Scheme has some way to go before becoming "truly faceless", according to Deloitte India Partner Rohinton Sidhwa.

The scheme, launched in August 2020, has been hailed by the government as a key facet of tax transparency as it ensures there is no discretion in the selection of cases to be assessed and removes the interface between assessing officers and assessees.

As of March 10, 2021, more than 80,000 assessment cases had been completed in faceless manner.

However, the scheme has been plagued with issues, with over six lakh appeals pending before tax commissioners and appellate tribunals.

Sidhwa, though, said companies were appreciative of the scheme – particularly companies with a turnover of Rs 3,000-6,400 crore, as per a survey by Deloitte India on income-tax digitalisation in India. But the process needs to be taken further, he added.

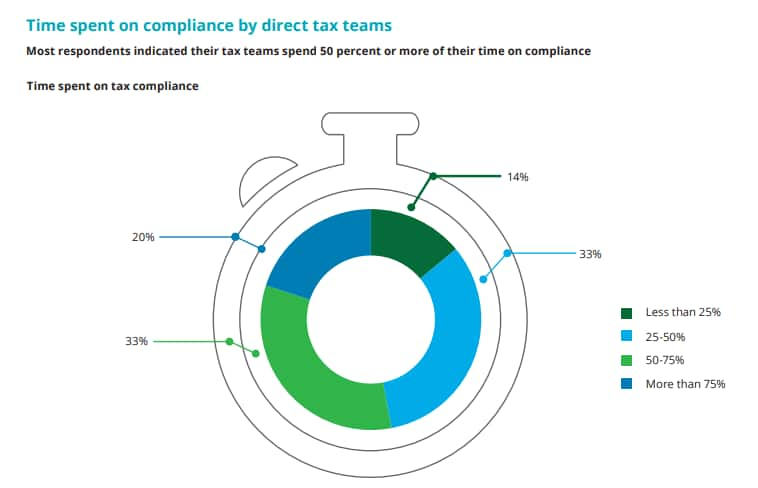

Source: Deloitte India

Source: Deloitte India

"I think the faceless process will truly be faceless and will truly be a computerised-run process once the SAF-T file is specified and the SAF-T file is used for raising queries," Sidhwa said in a discussion on May 9 on the aforementioned Deloitte India survey.

An SAF-T file, or Standard Audit File-Tax, is a way of transferring tax accounting data in a format that can be easily read by authorities.

Sidhwa said the audit process today worked largely the same way as before, with a human examining the tax accounting data e-mailed by a company and then raising queries.

"With the Standard Audit File, it will be a computer looking through the data and actually raising some of the questions. So all that subjectivity, all the things the government wanted to do vis-à-vis corruption around the audit process, all that can be taken away if we migrate to this new Standard Audit File," Sidhwa added.

“But where it (adoption of SAF-T) is, that is something which is internal within the tax department. But we do know that there is talk and that is probably something which is the eventual evolution of faceless process," he said.

The Organisation for Economic Co-operation and Development (OECD) has outlined the format for the production of SAF-T. In its guidance on the SAF-T, which has been adopted by several European countries, the OECD has also said that countries should not make significant changes to the format when implementing the SAF-T locally as it could make matters difficult for international software developers, among other issues.

"The news that we have is that Indian tax authorities are looking at that Standard Audit File which has been put out by the OECD and they are looking at customising it for Indian reporting specifically," Sidhwa added.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.