Krishna Karwa

Moneycontrol Research

Highlights:-

- India's footwear industry is on a strong footing

- Store additions and product launches will drive sales growth

- Margins will be predominantly determined by product mix

- High competitive intensity is a key risk

- Relaxo Footwears is our top pick

--------------------------------------------------

Despite the economic slowdown, the space that has turned out to be relatively insulated is the footwear sector.

Network expansion, increasing spends on marketing, adoption of an asset-light business model and greater impetus towards premium products are key trends that characterise the branded footwear sector in India.

Nevertheless, a few sectoral challenges need to be taken note of. These include stiff competition, sluggish same-store sales growth, high raw material costs and the inability to normalise promotional expenses (as a percentage of sales).

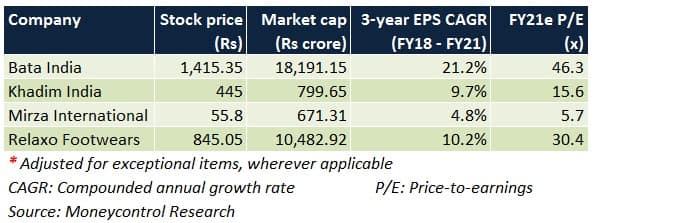

Relaxo Footwears is our top pick in this space, whereas Bata India is the most expensive pick of the lot. Khadim India and Mirza International, despite their comparatively undemanding valuations, have some crucial issues to resolve.

Going forward, here's what investors can expect:

Bata India

To drive revenue growth, the management plans to open 150-200 stores each fiscal. To attract higher customer footfalls, experience centres and kiosks may be set up in some exclusive brand outlets. New products will be made available in categories such as women, youth and sports. Nearly Rs 90/150 crore will be spent on advertisements in FY19/FY20, respectively.

The company's product range is gradually moving towards premium variants (contributed about 30 percent to FY18 topline). To curtail overheads, most of the new stores will be franchise-operated and rental agreements in respect of existing properties are being renegotiated. These measures would translate into better margins.

Khadim India

To penetrate markets in southern India, the company is entering into tie-ups with distributors in the region. The store count in retail/distribution segments, which deal in premium/economy footwear, respectively, is anticipated to increase too.

To facilitate margin accretion, the management is working towards increasing the contribution of high-value premium brands from the current mark of 70-75 percent of yearly sales. The management aims to gradually cut down on the number of discounting days as well.

Mirza International

At this point, we are relatively less bullish on this stock because of the following reasons:-

- Exports, comprising approximately 30-40 percent of annual sales, are going through a rough patch

- Build-up of inventory across trade channels has resulted in a strain on working capital

Relaxo FootwearsTo boost topline, the company is expanding its reach in southern and western India. Since the product range primarily includes economically priced footwear, a significant chunk of this growth will be led by higher volumes. Celebrity-backed endorsements may gain momentum as advertisement budgets increase and product launches are undertaken periodically.

Free cash flows are slated to improve since there will be no significant capital outlays over the next two-to-three years. Existing distribution framework is being consolidated to save costs. By virtue of these steps, margins are expected to move up.

Which stocks should you pick?

After a steep re-rating in the last 12 months, the Bata stock is close to its 52-week high. Its heady valuations may not be sustainable if topline and margins don't improve consistently. We advise buying on corrections.

A glance at Relaxo's stock price reveals a rangebound trend (typically in the Rs 700-800 range) since the past nine months. The downside in our view is limited from current levels. The stock's expensive valuations, coupled with a sharp price rally since the last four-to-five trading sessions alone, limit the scope for a major multiple re-rating in the immediate future. Notwithstanding this fact, we are optimistic about the company considering its strong brand appeal in an unorganised market and robust fundamentals.

Khadim India’s stock, more often than not, has been on a downward price trajectory over the past one year. The counter trades at a 39.5 percent discount to the upper end of its IPO price band (i.e. Rs 750 per share). This was largely on account of market volatility and a weak set of numbers since the last four quarters. In the short-term, suppressed margins in case of premium products, high advertisement costs (owing to subdued media visibility) and lower-than-envisaged store footfalls are a worrisome sign. If turnaround strategies on these fronts bear fruit, the stock can deliver a healthy upside in the long run.

Though Mirza International's 'Red Tape' footwear brand enjoys a decent brand recall, the company is in the midst of quite a few challenges. For now, we don't foresee a recovery in the stock price.

For more research articles, visit our Moneycontrol Research page

Disclaimer: Moneycontrol Research analysts do not hold positions in the companies discussed here

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!