-------------------------------------------------

Shaily Engineering Plastics (market cap: Rs 757 crore, stock price: Rs 910.1), a high-precision polymer processing player, has corrected 40 percent from its 52-week high and trades at a reasonable valuation of 18.3 times its FY20 projected earnings. Revenue traction across segments, a differentiated business model and healthy fundamentals are some of the key positives that make it investment-worthy.

It is on the radar of marquee investors as well:-

Exports constitute 70-75 percent of its annual turnover. It supplies products to some of the world’s most renowned original equipment manufacturers.

A Swedish home furnishing major (SHFM), the world’s largest designer-cum-retailer of ready-to-assemble furniture and home/kitchen accessories, opened its first store in India in Hyderabad in August 2018. In line with its objective to invest over Rs 10,000 crore in the country by FY25, two more stores (Mumbai, Bengaluru) are likely to be set up in the next two years.

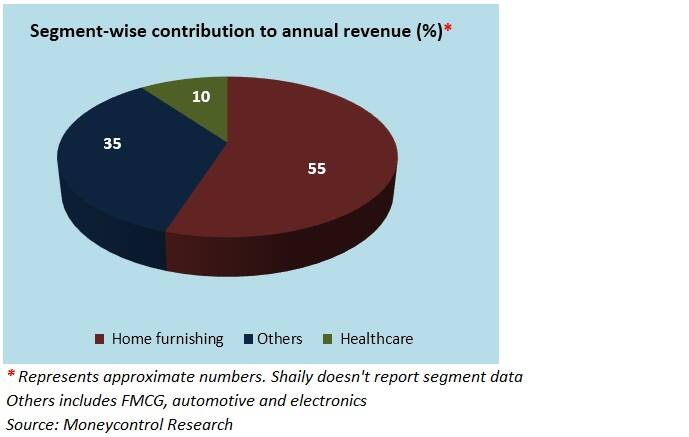

This assumes importance for Shaily, which derives 50-60 percent of its revenue from the SHFM alone. Shaily’s over a decade-long relationship with the SHFM would come handy since it has the technological expertise to meet the product standards set by the latter. This ensures client stickiness.

To meet the increased demand from the SHFM for domestic and export orders, Shaily will ramp up its manufacturing capacities to cover more SKUs (stock-keeping units). In Q2FY19, Shaily received a business confirmation to supply two new products to the SHFM, thus taking the total SKU count to 40.

In Q1FY19, Shaily received an order from the SHFM to supply six new 'carbon steel furniture' products such as cabinets, shoe racks and tables. For this, a capex of Rs 40 crore will be incurred for a factory, which will be commissioned in H2FY20. The management expects sales of up to Rs 100 crore from this project over a 3-4 year period.

Additionally, Shaily received orders worth Rs 10-12 crore from another large global department store, for which supplies will commence in Q3FY19.

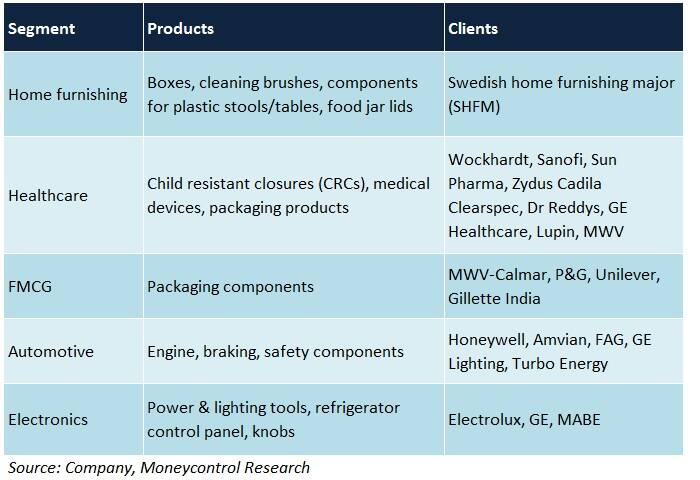

Growth opportunities in the medical spaceThe healthcare segment is divided into two sub-segments -- devices (insulin pens, dermatological pens) and packaging (child-resistant closures and bottles). Competitive intensity is low in both cases because of high entry barriers, steep compliance costs and clients' intolerance towards errors. As a result, Shaily gets some leeway on the pricing front to maintain its margins.

Some of India's leading export-focussed pharma names procure packages from Shaily, which have to be USFDA-compliant. Going forward, the aim is to notch up utilisation rates at these package manufacturing facilities in tandem with the growth in the order book. New medical devices for different applications will be introduced periodically as well.

Higher use of plastics in auto, FMCG and lightingIn the auto segment, the use of plastics for manufacturing critical components is on the rise. India’s FMCG industry (comprising beauty, wellness and food products) is a secular growing one. Increasing electrification coverage pan-India has helped boost LED lighting demand.

Shaily, by virtue of its business associations with leading brands in these segments, possesses the ability to manufacture niche products (auto) and packages (FMCG, lighting) of varied specifications.

Operational difficulties to easeHigh employee costs and an increase in power expenses took a toll on Shaily’s operating margins in H1FY19. This will impact the overall EBITDA for FY19. Nevertheless, requisite steps have been taken to address these roadblocks from Q3FY19.

Debt repayment on the cardsAs on September 30, 2018, Shaily’s debt stood at approximately Rs 110 crore. On the back of improving free cash flows, Rs 65-70 crore of debt will be repaid in 3 years (FY19-21).

Key risksTo achieve its ambitious revenue target of nearly Rs 650 crore by FY20-end, the management will spend close to Rs 100 crore in capex in 2 years (ie. FY19 and FY20). If order visibility in connection with this (presently stands at 80 percent) fails to materialise, there will be some strain on the financials.

Delays in bagging orders from the clients’ side, especially in medical packaging, may lead to low utilisation rates and restrict margin expansion.

Crude price volatility can disrupt short-term margins and cash flows.

Outlook

After witnessing a steep price dip from July 31 to October 24, 2018, the stock hasn’t recovered substantially yet. So, it does offer some good upside from current levels.

For more research articles, visit our Moneycontrol Research Page.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!