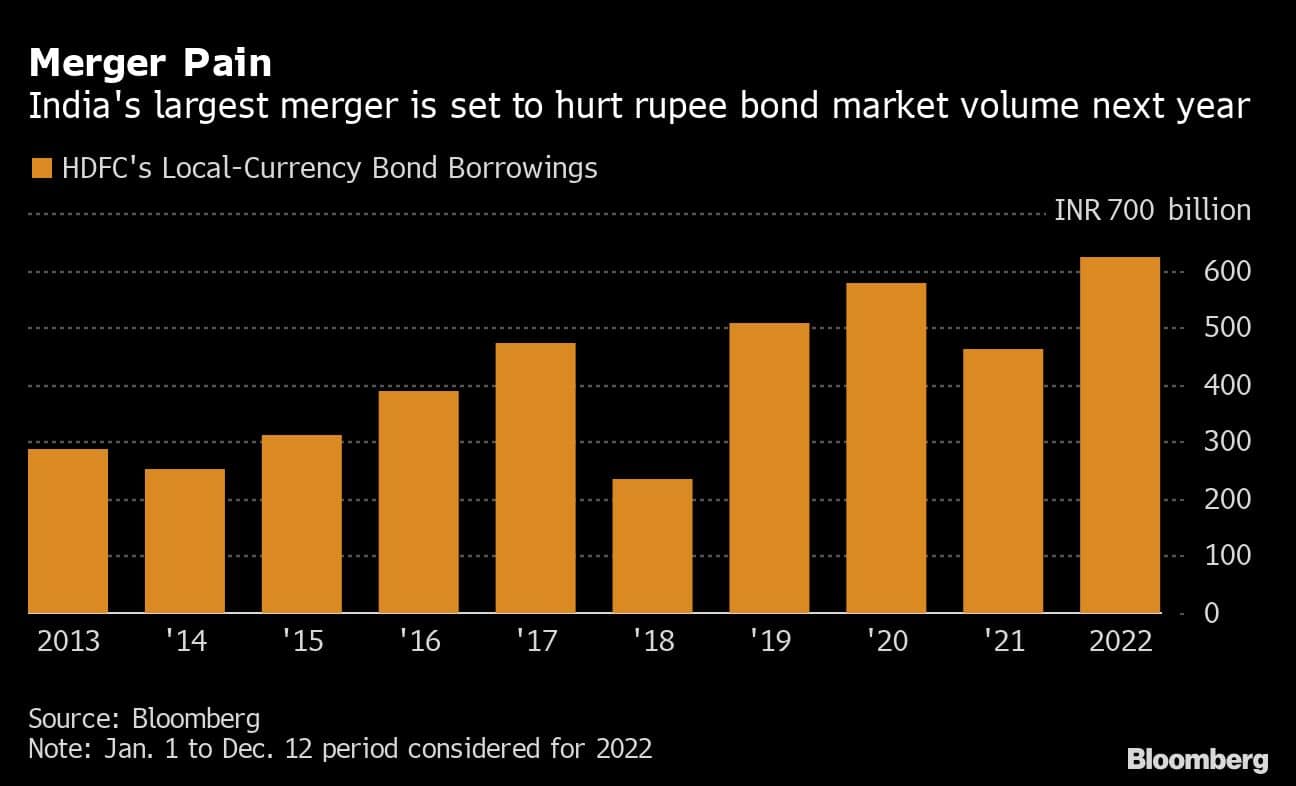

India’s biggest merger ever will likely take away from the rupee bond market one of its top issuers, an absence that may weigh on debt sales and arrangement fees for banks.

The consolidation of Housing Development Finance Corp. and unit HDFC Bank Ltd. will create a more than $200 billion financial services behemoth, and the parent will be able to tap the bank’s deposits to grow, rather than pile on more debt. That’s not all bad for India’s bond world as the hole created by the shadow lender may let new borrowers sell notes, helping India deepen its debt market.

The shadow lender is India’s biggest bond seller in 2022, with its issuance accounting for 7.7% of the country’s total issuance volume this year, higher than an average of about 6% in the last 10 years, Bloomberg-compiled data show. The merged entity will be a bank and is still likely to offer notes when needed to boost its capital buffers and fund infrastructure projects.

“HDFC’s exit will initially hurt overall sales volume next year,” said Jayen Shah, founder of Mavuca Capital Advisors Pvt., a fintech investment banking firm. “I expect a lot of first-time issuers, state and private companies tapping the bond market next year as yields stabilize, which may then gradually fill the void.”

The merger, expected to conclude in the second quarter of 2023, will give HDFC access to 16.7 trillion rupees ($202 billion) of funds comprising so-called low-cost current and savings account deposits and time deposits of the bank. That will let it continue expanding its assets, which stood at 6.9 trillion rupees at the end of September.

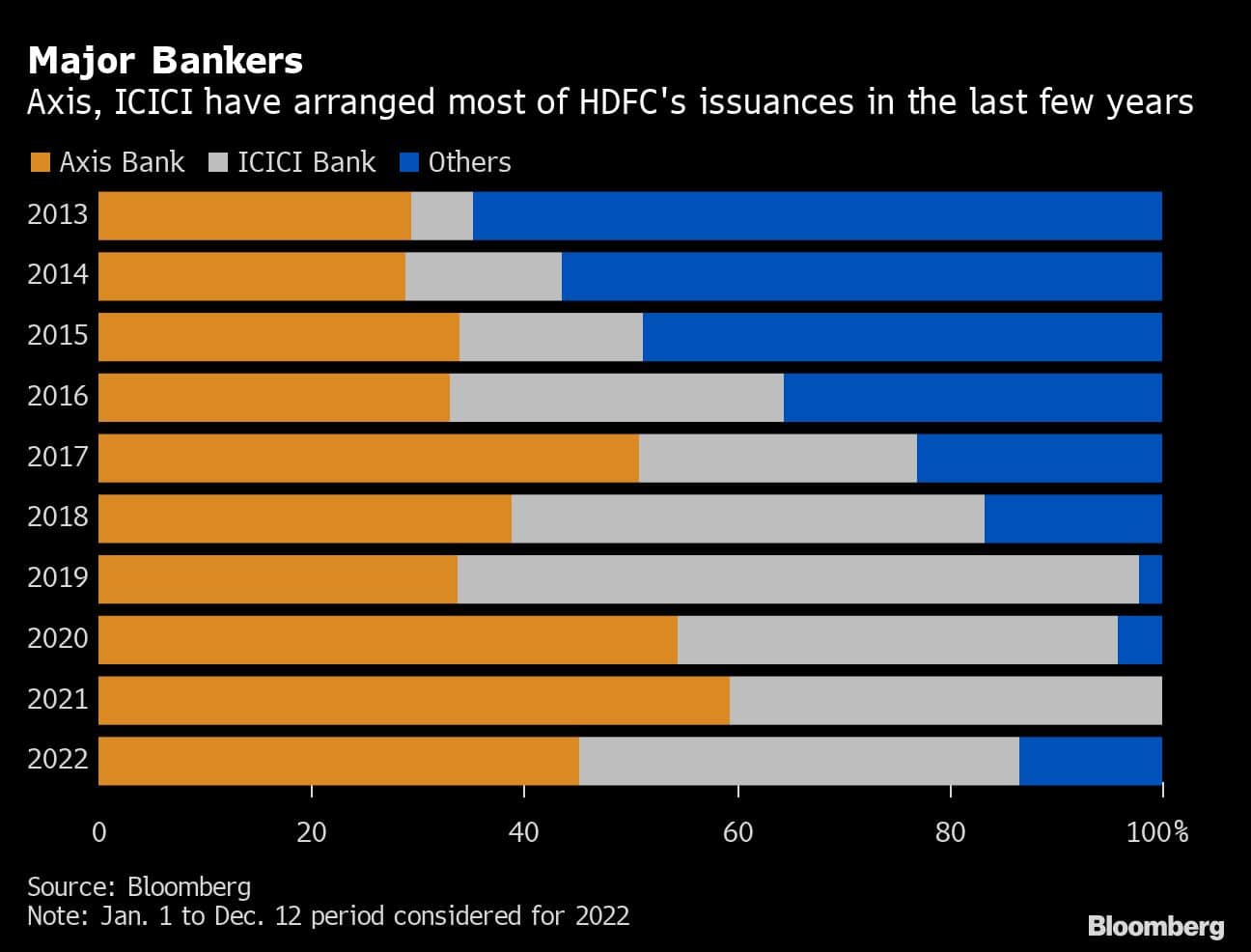

The exit of a debt issuer of that size risks hurting the fee income of bankers who have arranged HDFC’s various offerings. In the last few years, Axis Bank Ltd. and ICICI Bank Ltd. have overseen most of those sales, Bloomberg-compiled data show.

For HDFC’s competitors, though, the firm’s exit may be a positive in fundraising terms. “The departure of HDFC from the bond market would benefit its peers as it will give them access to a larger pool of credit,” Mavuca’s Shah said. “That in turn will cut funding costs of other top-rated housing finance companies.”

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!