HDFC Bank, one of the largest and most consistent private sector banks in the country, witnessed yet another quarter of solid net profit growth in March.

The lender's net profit grew 20 percent year -on-year (YoY), further underscoring its impeccable track record of consistent growth in earnings of over 25 percent in the last 10 years while maintaining pristine asset quality.

We expect the bank to keep reporting profitable growth over the next few years, as it enjoys dual moats (competitive advantage) on both the asset side and the liability side. High-margin retail loans constitute 57 percent of the bank's total loans and low-cost CASA deposits (current and savings accounts) account for 43 percent of its total deposits.The bank's recent decision to raise capital will adequately equip it to garner more market share in an environment where a large part of the banking system has been rendered weak due to asset quality woes.

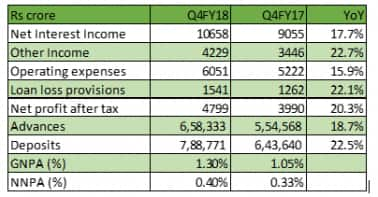

Operating performance further improvesHDFC Bank’s Q4 FY18 numbers were as consistent as ever. Net interest income (NII), the difference between interest earned and interest paid, increased 17.7 percent, driven by an expanding loan book that grew at pace much faster than that of the system. Net interest margin (NIM) came in at 4.3 percent.

The lender also witnessed a more-than-decent growth in other income, which rose 22.7 percent YoY. This was underpinned by a rise in fee income from third-party distribution of financial products, processing fees and credit card charges.

Operating leverage improved significantly as the core cost-to-income ratio declined to 40.6 percent from 42.4 percent in the same quarter last year, led by a controlled expansion of the bank's branch network and digital initiatives.

The lender continued to maintain its impeccable asset quality, with gross and net non-performing assets, as a percentage of total loans, coming in at 1.3 percent and 0.4 percent, respectively, as on March 31. Its capital adequacy, at 14.8 percent, remained well above the regulatory requirement of 10.875 percent.

HDFC Bank reported total advances of Rs 6.58 lakh crore as on March 31, an increase of 19 percent from the end of the previous fiscal year. Of all its advances, retail loans witnessed a growth of 27 percent on year, while the bank's wholesale loan book, which is made up of its loans to corporates, grew by 9.4 percent.

Deposit growth spiked 22.5 percent YoY, thereby easing the lender's loan-to-deposit ratio to 83.5 percent. This is actually quite good when you compare it with the system's average growth of 10.3 percent and 6.7 percent in loan and deposit growth, respectively. More importantly, this also demonstrates the bank’s ability to consistently increase its market share in loans and deposits on a higher base and across credit cycles.

For instance, in FY18, HDFC Bank’s share in the system's incremental deposit and credit growth stood at 20.2 percent and 12.8 percent, respectively. This clearly shows how the bank is gaining market share when competitors are vacating the space because of their weak capital position and their burden of non-performing loans.

Fresh capital will be a catalyst for future growthIn today's market, where public sector banks are saddled with huge non-performing assets and constrained by lack of sufficient capital, we expect HDFC Bank to strengthen its position in corporate lending by gaining market share from public sector banks, while maintaining its leadership position in retail segment.

The lender is is waiting for the government’s approval for its recently- announced plan to raise Rs 24,000 crore of capital, which will aid balance sheet growth and accelerate earnings.

Reasonable valuation and sustainable earnings growthHDFC Bank is one of the largest wealth-creating stocks on Indian bourses, having grown 127 times in value in the last 20 years (generating 27 percent of compounded annual returns (CAGR)). Given the consistent and steady price performance of the stock, one can't help wondering if investors should look at the stock incrementally now and if it could continue doing well. In our view, the answer is yes.

The stock currently trades at a one year forward P/B ratio (price-to-book) estimate of 3.6, which is in line with its historical range. We have seen small and mid-sized private banks with higher earnings growth getting sharply re-rated and enjoying premium valuations.

As such, the difference between HDFC Bank’s valuation and that of these private banks has narrowed, and the stock seems reasonably priced. The equally strong performance of its subsidiaries, HDB Financial Services and HDFC Securities, also lends some comfort. Overall, we expect HDFC Bank’s considerable moat to aid high and sustainable future earnings growth, notwithstanding its large size. This makes it a must-own stock among Indian equities.

For more research articles, visit our Moneycontrol Research Page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.