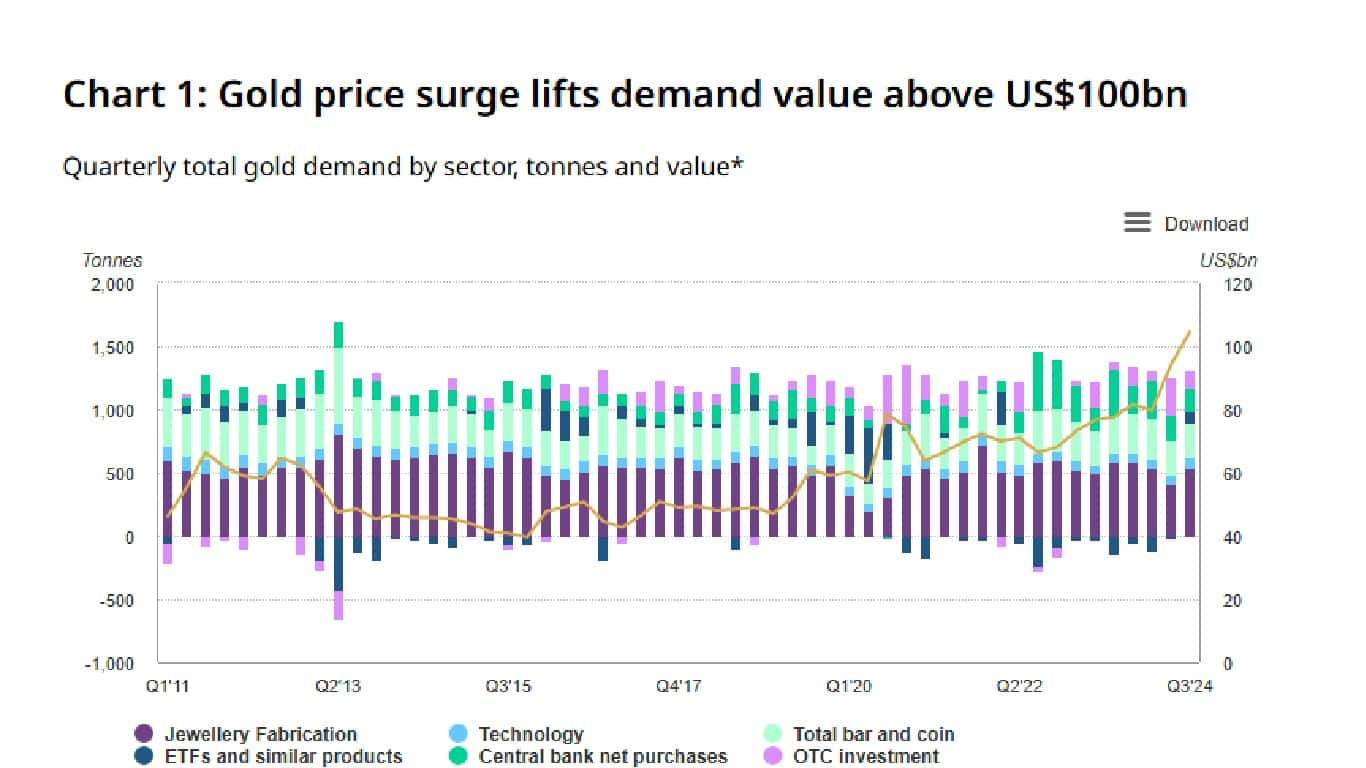

The value of gold's global demand in the September quarter has exceeded $100 billion for the first time ever, a sizeable 35% on year growth, World Gold Council said on October 30.

Strong Demand

The volume of gold rose by 5% on year to 1,313 tonne – a record for a third quarter.

This strength in the gold price and demand was backed by continued central bank buying, and safe haven demand in light of rising tensions in the Middle East and Ukraine. Portfolio diversification and momentum buying by investors were among the key drivers for growth, said WGC.

Global Gold Demand For Sept Quarter. Source: WGC

Global Gold Demand For Sept Quarter. Source: WGC

ETF Flows On Rise

Investment flows into gold supported the 13% growth gold prices in the September quarter. ETF flows into gold were a major factor for the growth in demand, with the September quarter seeing the first positive growth since the Russia-Ukraine war broke out in 2022. This, WGC said, should offset a weaker consumer demand and relatively slower central bank buying for 2024.

Demand Breakup

The volume growth for bars and coins was lower by 9% on year, offset by strong demand from India, while global jewellery purchases fell 12% on year, despite strong growth in India. In value terms, demand for jewellery was higher by 13% on year at over $36 billion for the September quarter.

As much as 83 tonnes of gold was in technology and AI-related end uses, which rose 7% on year, however WGC said the demand outlook remains cautious here.

Prices on the Rise

The soaring demand is reflecting in the gold price as well, which has hit a fresh high of over $2,775 an ounce, rising by over 33% so far this year. The precious metal has risen every month this year, expect in January and June. Prices of gold were also supported in the third quarter by a drop in US dollar after the US Fed announced a 50 bps rate cut.

The WGC continues to expect greater allocation to bullion, with geopolitical tensions and the upcoming US presidential election ensuring the safe haven demand for gold sustains.

India a Big Buyer

The pace of rise of gold prices in 2024 has meant that any dip has been quickly bought into. Back home, jewellers have reported brisk sales on Dhanteras and Diwali, fanning expectations of an extended rally. "People are still into gold big time, even with prices at record highs during Dhanteras. With gold giving better returns than the stock market, there's been solid demand for coins and bars," Saurabh Gadgil, chairman of PNG Jewellers told Reuters.

"In value terms, turnover during this year's Dhanteras is expected to be significantly higher than last year due to higher prices. In volume terms, it may be slightly lower or around the same level as last year," Reuters quoted Prithviraj Kothari, president of India Bullion and Jewellers Association (IBJA).

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.