The Union government banned exports of broken rice and imposed a duty of 20 percent on exports of non-basmati rice amid fears of a continuing rise in retail prices of the cereal, driven by lower output of the Kharif crop due to uneven distribution of the southwestern monsoon that affected sowing.

The announcement came after months of speculation that the government might take such measures to cool domestic food inflation. Earlier this calendar year, export restrictions were imposed on wheat after domestic prices surged when large quantities were committed for overseas sales and the maturing Rabi crop was damaged by a rapid increase in temperature in March.

Retail prices of rice have been creeping up for several months now, it is about 8 percent higher than a year ago, data collected by the price monitoring cell of the consumer affairs ministry show. Wholesale prices in July were 9 percent higher than a year ago. Fears of lower output this Kharif season could have exerted further upward pressure on prices of the grain in the open market if the tariff measures and restrictions on exports were not announced.

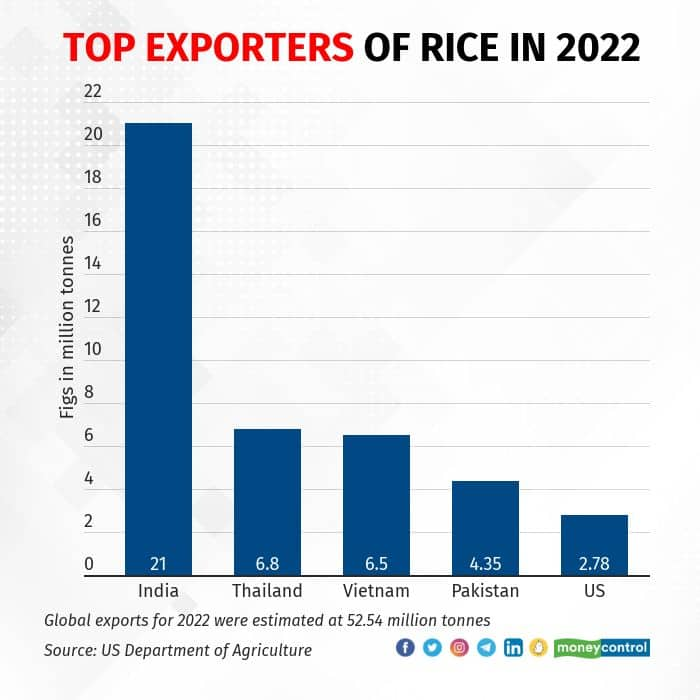

India is the largest exporter of rice, accounting for 40 percent of global shipments. The United States Department of Agriculture (USDA), in its August rice outlook report, estimated that India would export 22 million tonnes in 2023, up from about 21 million tonnes projected for the current year. This is more than the combined exports of rice from Thailand, Vietnam and Pakistan. The shipments may fall lower than these estimates due to the tariff measures.

In addition to whole-grain milled rice, India exports enormous quantities of broken kernels to China, West Africa and Vietnam. Thus, the ban on export of broken rice will be a big setback not just for traders but also for importers such as China. The USDA had estimated in its August report that China was expected to increase its import of brokens from India and other rice-growing countries.

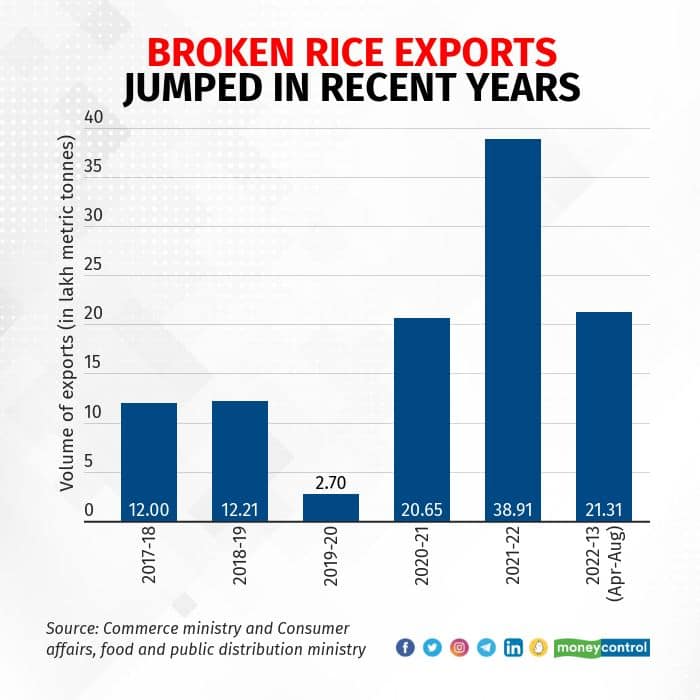

India’s exports of broken rice have grown rapidly in recent years. In the first five months of the current financial year, India exported more brokens than it did in 2020-21. A press statement issued by the ministry of consumer affairs, food and public distribution on Friday, explaining the rationale for a ban on brokens, stated that 21.31 lakh metric tonnes (2.1 million tonnes) were exported between April and August 2022. That’s equivalent to about 55 percent of the exports in 2021-22.

Broken rice, a by-product of the milling process, has a variety of uses. India produces about 50-60 lakh metric tonnes (5-6 million tonnes) of broken rice annually.

A small part of the production is used for preparing porridges and congees, making flour, baby food and savoury snacks. Being cheaper than whole kernel grain, it is also consumed by the poor. Besides human consumption, it is used as feed for poultry, livestock and aquaculture and for producing pet food, liquid glucose and laundry starch. Breweries use it in the manufacture of beer and also for making rice wine.

The consumer affairs ministry statement added that rising prices of broken rice were hurting the poultry and animal husbandry sectors. About 60-65 percent of the input cost for poultry feed can be attributed to broken rice and any increase in its price would raise costs for the poultry sector. The domestic prices of broken rice had climbed from about Rs 16 a kilo to Rs 22 as exports grew, the ministry statement added.

Demand for broken rice from China had increased after prices of traditional animal feed, such as corn and soyabean soared during the pandemic year after crop failures in many growing regions due to adverse climatic conditions. Drought conditions in China and elsewhere in the current year have increased the demand for broken rice from India.

A decision to use broken rice for ethanol production for blending with petrol has boosted domestic demand for the foodgrain. The consumer affairs ministry statement added that the low availability of broken rice had reduced the supply of ethanol by distilleries. Against a target of 36 crore litres to be supplied in the 2021-22 ethanol supply year, 16.36 crore litres had been supplied till late August. The ethanol supply year runs from December of one calendar year to November of the next.

Amid rising demand for rice and broken rice, fears of lower output in the Kharif season have influenced the tariff decision and export ban. A large shortfall of monsoon rain in the northern and eastern plains, which are also key rice-growing regions, has affected the total area under the Kharif paddy crop. Overall, the sown area of 384 lakh hectares at the beginning of September was about 4 percent below the average for the last five years and about 23 lower than last year.

The area under paddy was lower than normal in several states, including Jharkhand, West Bengal, Chhattisgarh and Odisha, and it was below last year’s level in many others, including Madhya Pradesh, Bihar and Uttar Pradesh. Thus, the total Kharif harvest will be lower than it was last year when it rose to a record 1,117.6 lakh metric tonnes (111.76 million tonnes). The government has estimated the production loss due to uneven distribution of rain at four to five million tonnes.

India is the second-largest producer of rice globally after China, and has large holdings procured at minimum support prices (MSP) to supply in the domestic market. Therefore, domestic supply will not be hit even if production falls short this year.

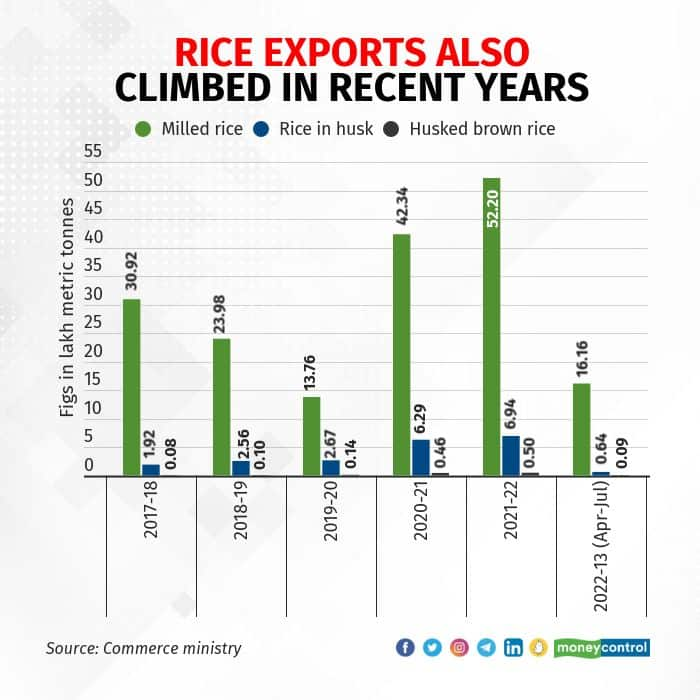

India’s exports of full grain rice have jumped in the last two years as it is more competitive in the global market than rice exported by other major producers, such as Thailand and Vietnam. The 20 percent export tax imposed on milled rice, husked brown rice and rice in husk will blunt that competitive advantage and slow India’s exports. India exported about 59.64 LMT (5.96 million tonnes) of full grain non-basmati in 2021-22. In the first four months, it had exported nearly 17 LMT of such rice or about 28 percent of last year’s volume.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.