Physical insurance policies for most products could soon be on its way out, helping insurers save money and making it easier for customers to keep track of their investments.

This could happen sooner than expected with the insurance regulator, Insurance Regulatory and Development Authority of India (IRDAI), expected to issue further clarifications on insurance repositories in June.

As of now, while regulations mandate electronic insurance policies for certain product categories, several insurers continue to keep it optional.

Only about 1.5 million of the 300 million policies in force are said to be digitised in the country. Insurers have not yet disclosed official numbers on the number of policies that have been digitised.

IRDA's clarifications will be on policies that will have to be digitised, basic and premium services under the eIA, and penalties for non-compliance.

e-Insurance Account

e-Insurance Account is a platform offered to policyholders to store all their policies in a digital format. This is maintained by an insurance repository which stores it in an electronic format. In addition, the repository acts as a single stop for several policy service requirements.

This e-Insurance Account will facilitate the policyholder by providing access to the insurance portfolio at a click of a button on the internet.

Each e-Insurance Account will have a unique account number and each account holder will be granted a unique login ID and password to access the electronic policies online.

The eIA services were launched in 2013 by former finance minister P Chidambaram. This is touted as the first such service in the world. It is estimated that insurers could save almost Rs 100 crore annually from this initiative.

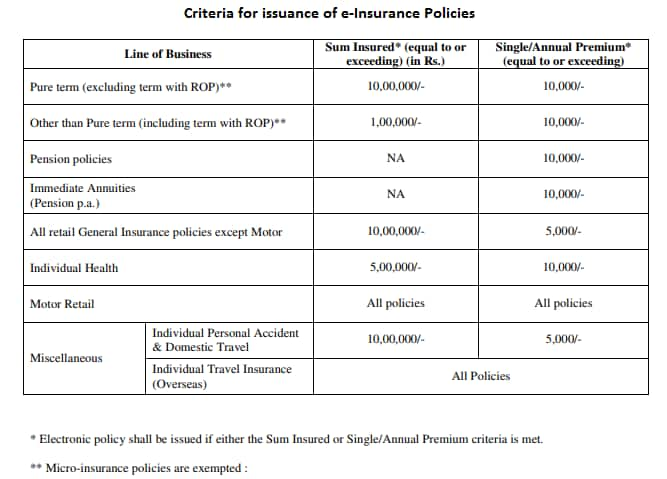

IRDAI regulations

Insurance Regulatory and Development Authority of India (IRDAI) has in its guidelines on insurance repositories and electronic issuance of insurance policies, specified that term insurance policies with premium above Rs 10,000 per annum or sum assured of Rs 10 lakh will need to have eIA. In general insurance, all retail motor policies are required to be available in a digital format.

The objective of creating an insurance repository is to provide policyholders a facility to keep insurance policies in electronic form and to undertake changes, modifications and revisions in the insurance policy with speed and accuracy.

The regulations also said that every insurer will issue electronic insurance policies in disaster-prone and vulnerable areas.

Further, policies that are sold online are also required to be issued electronically. S V Ramanan, CEO of insurance repository CAMSRep said that even policies sold using a tablet are also included in this list.

The practical challenges

Insurance companies said that apart from the cost concerns that are leading to dwindling numbers in terms of the issuance of the policies, Know-Your-Customer (KYC) norms are also a factor.

“Customers have been given an option to opt for digital policies because about 40-45 percent of them still request for a physical document. This increases costs by another 30 percent for us,” said the chief operating officer at a mid-size private life insurer.

For a basic e-Insurance Account (eIA), the customers do not pay for the services. However, per policy, the insurance company pays Rs 30-60 annually to the insurance repository. Premium services will be chargeable to the customers and will be offered by the repositories.

Further, opening an eIA would necessitate having customer KYC to be completed. For general insurance customers, in particular, who simply go online and buy a policy are not required to disclose any KYC details. However, once they have a digital insurance account, it is mandatory for them to do so.

“Contactability is a concern in general insurance. Having an eIA would mean that we will need identity proofs from the customer when they are opening the product and we have seen instances of customers dropping out when such details are sought,” said the head of underwriting at a private general insurer.

For vulnerable areas as well, insurers said that connectivity being an issue in several regions, accessing eIA would be a challenge. This is why all insurance companies have not yet started issuing insurance purely on a digital platform in such locations.

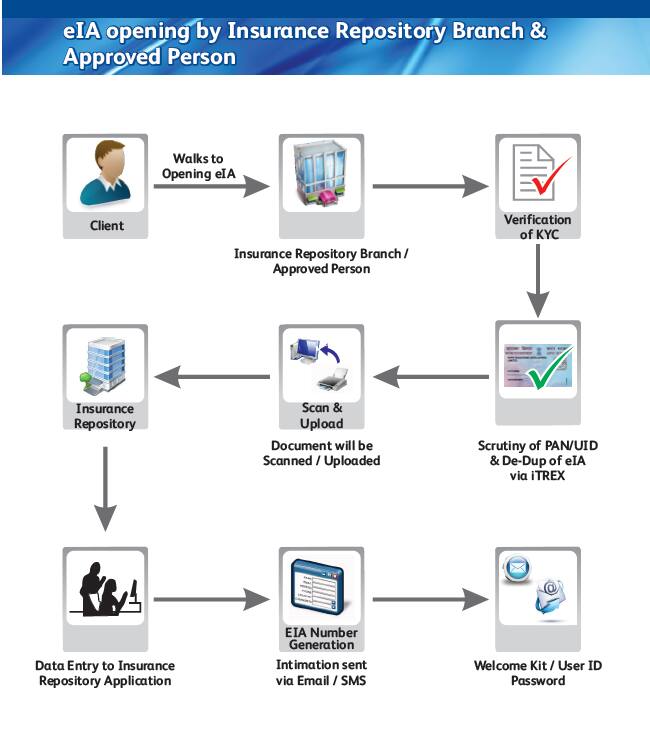

How to open an electronic insurance account

While eIA is mandatory in certain cases, policyholders can open the account at any time. Once the account is set up, every time a new policy is purchased, just the eIA number is required to be quoted.

After filling a form on the insurance repository’s website, an eIA will be opened within 7 days from the date of submission of application complete in all respects.

Premium for all the policies can be paid online and several service requests can be logged from the e-Insurance Account.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.