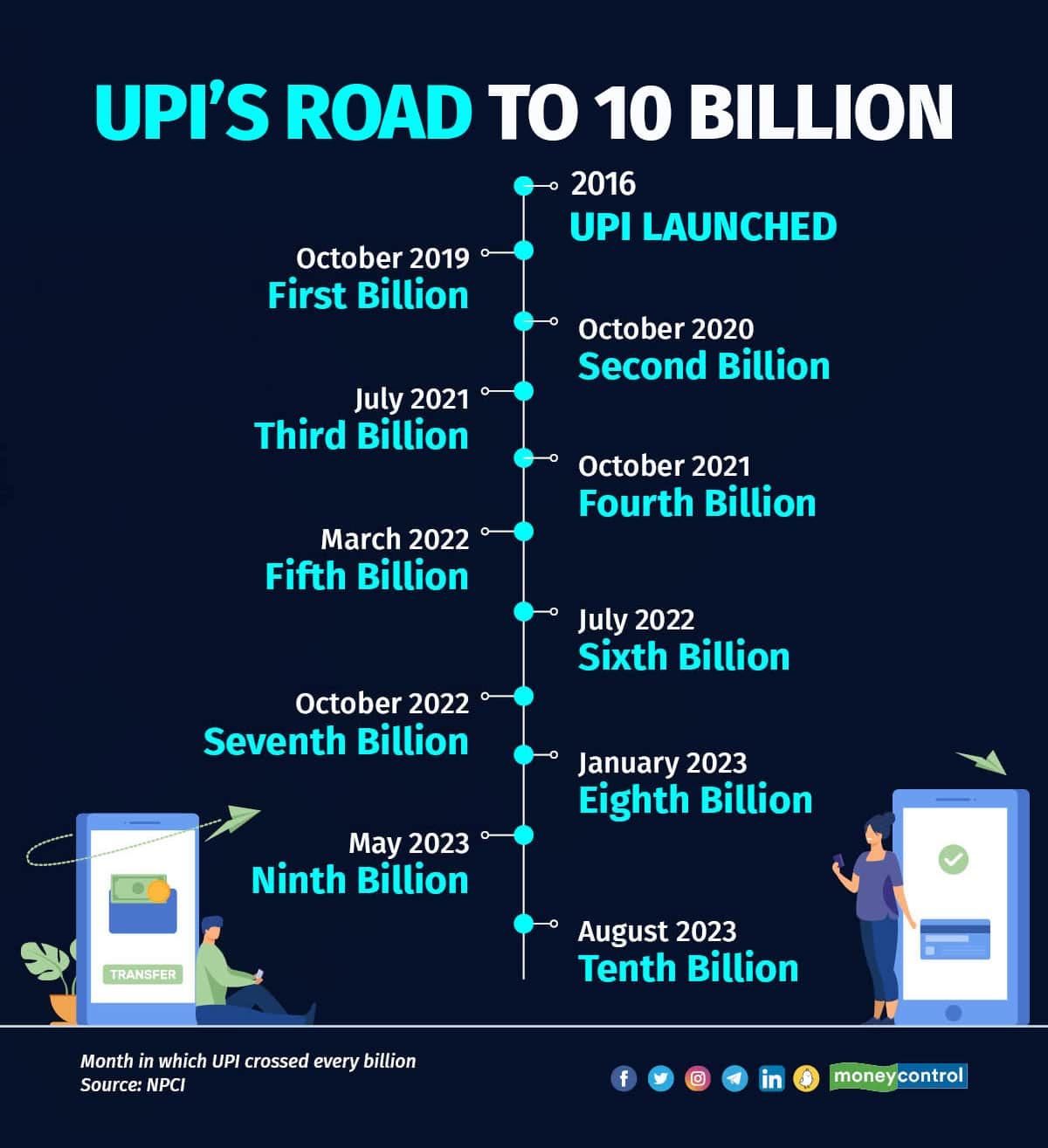

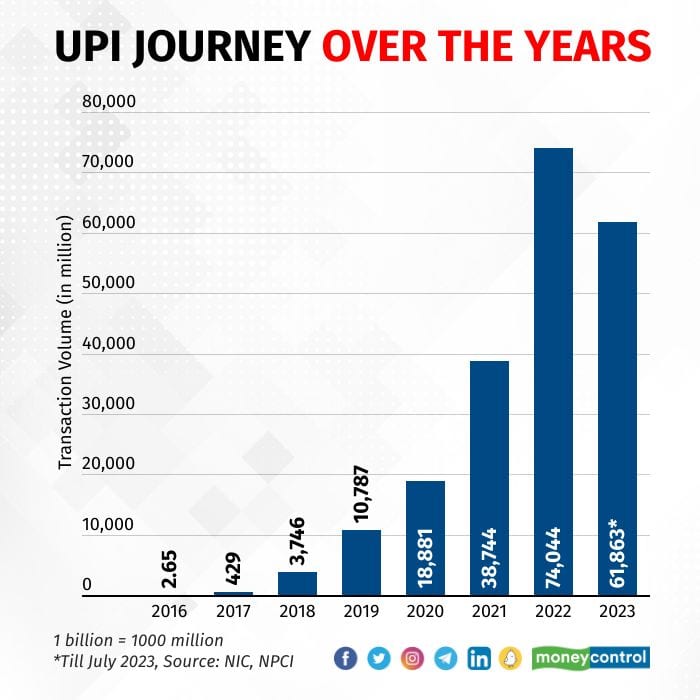

The mobile payments juggernaut, unified payments interface (UPI), crossed 10 billion transactions in a month for the first time in August, according to data from the National Payments Corporation of India (NPCI), which runs the real-time payments platform.

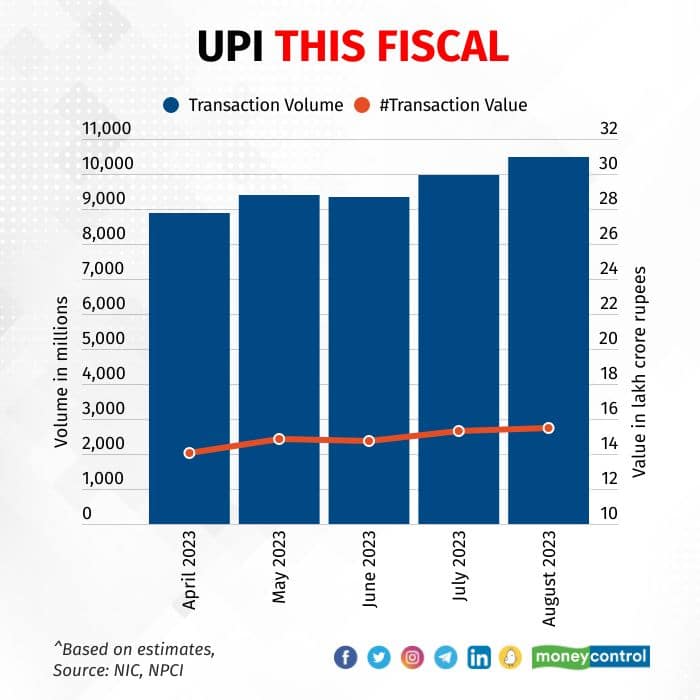

As of August 30, UPI reported 10.24 billion transactions during the month and the transaction value stood at Rs 15.18 lakh crore.

In July, UPI platform had seen 9.96 billion transactions.

During the month of August, UPI was doing around 330 million transactions a day. With that run rate, UPI should touch around 10.5 billion transactions in August, a month-on-month growth of 5 percent.

The value of transactions as of August is likely to settle around Rs 15.4 - 15.6 lakh crore by the end of this month, likely surpassing the July record of Rs 15.33 lakh crore.

Future target

The 10 billion milestone for August was a forgone conclusion when the platform reached 9.89 billion in July and the platform usually sees a marginal month on month growth, apart from the fact that both consecutive months have 31 days.

NPCI is targeting around 30 billion transactions a month or one billion transactions a day within the next two to three years.

During festive season months like in October and November, the platform sees outperformance compared to other months.

Demonetisation effect?

From what started as an inter-person money transfer system during the initial 2-3 years, UPI is increasingly driving commerce in the country, with around 57 percent of transactions now being merchant transactions.

The humongous growth is in no small measure powered by the ubiquitous QR code, which millions of merchants have adopted over the last two years. UPI is estimated to have over 330 million unique users and around 70 million merchants deploying over 256 million QR codes across the country.

UPI apps such as PhonePe, Google Pay, Paytm, Cred, and Amazon Pay have popularised the payment platform through incentives over the last 4-5 years. Demonetisation and the pandemic accelerated the digitisation of payments in the country along with proactive policy support.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.