An analysis of supply chain pressures by Reserve Bank of India (RBI) staff has found that the current upside risks to inflation and downside risks to exports may persist.

The findings were drawn upon from the index of supply chain pressures for India - or ISPI - developed by RBI staff, including RBI Deputy Governor Michael Patra.

"...our ISPI...displays lead indicator properties in respect of export volumes and inflation. This suggests that the prevailing upside risks to inflation and downward risks to export performance may persist," said the article released by the RBI on April 18.

Also read: RBI Bulletin: Spurring private investments key to sustaining growth

"Looking ahead, co-ordinated actions are required to fast track consensus-based supply chain protocols, gaps in the physical and digital infrastructure, labour shortages and shortfall in investment in capacity creation," the article added.

The other authors of the article are Harendra Behera and Dhirendra Gajbhiye, economists with the central bank. The views expressed in the article don't necessarily represent the views of the RBI.

Earlier this month, the RBI made sharp upward revisions to its inflation forecast for FY23 to 5.7 percent from 4.5 percent in light of Russia's invasion of Ukraine and the impact it continues to have on global commodity prices via supply chain disruptions.

The central bank's biannual Monetary Policy Report, released on April 8, revealed the RBI's forecasts assumed a price of $100 per barrel for India's crude oil basket. However, such are the upside risks that the RBI's Monetary Policy Committee (MPC) may fail to meet its inflation mandate if the average price of the crude oil basket exceeds the assumption of $1o0 per barrel by 10 percent for FY23.

The index of supply chain pressures for India, or ISPI, constructed by the RBI trio is based on 19 indicators ranging from railway goods traffic and the Baltic Dry Index to air freight rates to and fro from Asia to the US. The full list of variables can be found here (page 183, external PDF link).

According to the article, monitoring supply chain pressures is key to understanding what they might mean for the Indian economy and how the future of international manufacturing and trade might be shaped.

"Our ISPI appears to track supply pressures on the Indian economy quite well, as evident in the close co-movement with indicators such as inflation, the growth of industrial production, export volume and GDP, especially through the period of the pandemic," the authors said.

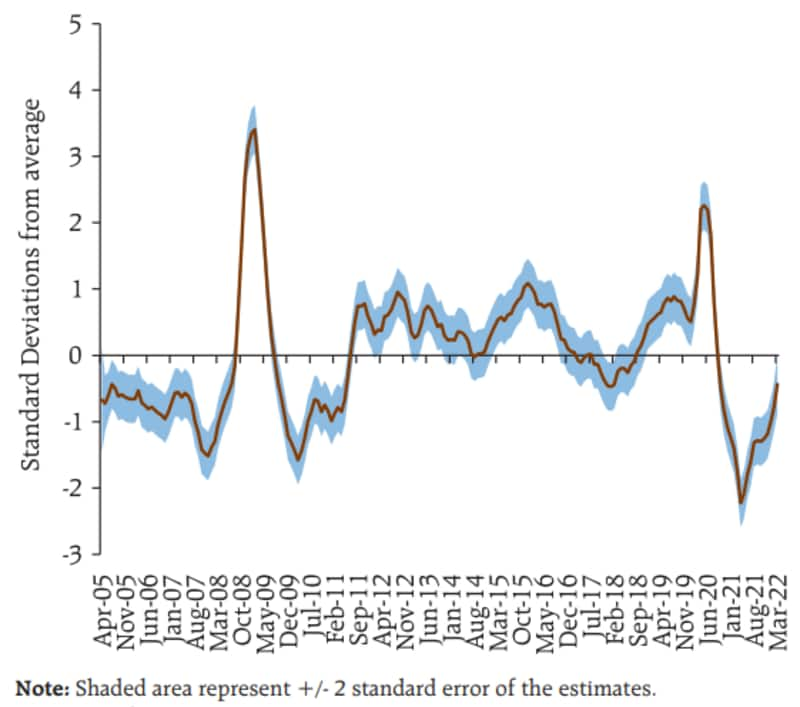

Evolution of index for supply chain pressures for India (source: RBI staff article)

Evolution of index for supply chain pressures for India (source: RBI staff article)

The index has been constructed using data from March 2005 to March 2022.

The authors noted that the ISPI started rising following the onset of the second wave of the coronavirus pandemic in May 2021, although it remains below zero.

"The most recent elevation in the ISPI warrants careful monitoring of supply chain pressures, highlighting the importance of the ISPI in a macroeconomic early warning system for the Indian economy," the authors added.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.