Remittances by Indians working abroad fell to a four-quarter low in April-June, although economists don't see any issues in the financing of the country's current account deficit (CAD), which is expected to widen further.

According to data released on September 28 by the Reserve Bank of India (RBI), India's CAD surged to $9.2 billion in the first quarter of 2023-24 from $1.3 billion in January-March. However, it has almost halved from $17.9 billion in April-June 2022.

Also Read: Current account deficit surges to $9.2 billion in June quarter

At the same time, workers' remittances declined to $14.47 billion last quarter, down 1.4 percent from January-March, on a net basis. Compared to April-June 2022, net workers' remittances were down 0.1 percent.

"The fall in remittances, both on-quarter and on-year, is worrisome and will bear watching, more so because of slowing global growth," said Dharmakirti Joshi, CRISIL's chief economist.

While net workers' remittances were the lowest in five quarters in April-June, on a gross basis they were at $17.15 billion, the lowest in four quarters.

Remittances are a key component of India's balance of payments. In 2022, remittances into India rose to a record $100 billion, up 12 percent from 2021, as lifting of pandemic-related work and travel restrictions meant workers could return to the key Gulf region, with a rise in crude oil prices also allowing them to send more money back home to their families.

According to Rahul Bajoria, Barclays' head of EM Asia (ex-China) Economics, the fall in net remittances is not surprising.

"This was expected, as outbound remittances had increased in June (as per RBI data) possibly ahead of the deadline for the increase in TCS (tax collected at source) on foreign remittances to 20 percent, which was supposed to come into effect from July," Bajoria said in a note on September 28.

CAD to widen

With oil prices on the rise again, remittances could increase. However, so will India's CAD. Ratings agency ICRA expects the deficit to more than double the current figure to $19-21 billion in July-September given the higher merchandise trade deficit in the first two months of the current quarter and the surge in crude oil prices in September.

Also Read: India's trade deficit widens to 10-month high of $24.16 billion in August

For 2023-24 as a whole, ICRA expects the CAD to increase to $73-75 billion, or 2.1 percent of GDP, up from $67 billion (2.0 percent of GDP) in 2022-23, assuming an average crude oil price of $90 per barrel in the second half of the year.

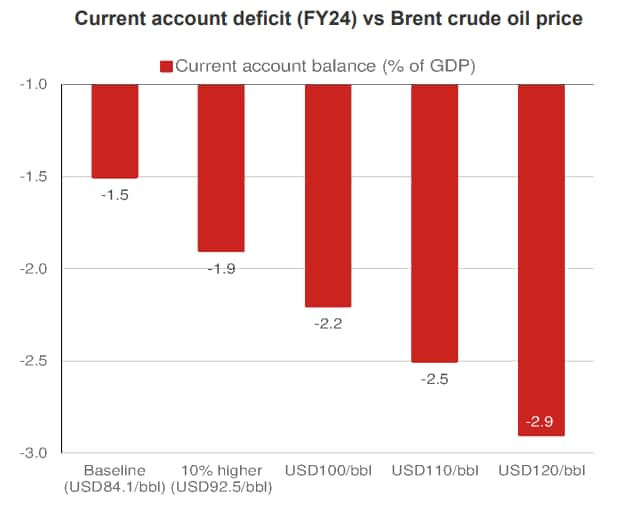

While ICRA's estimate for this year's CAD is among the highest, others with lower forecasts admit rising crude oil prices are an issue. Nomura, for instance, has maintained its CAD forecast of 1.5 percent of GDP, but acknowledged upside risks to it.

"Our baseline forecast for 2023-24 assumes crude oil prices averaging around $84/barrel and despite the recent surge, the 2023-24 year-to-date average is still tracking around $81/barrel. However, if oil prices remain similarly elevated or escalate further, the current account deficit could widen sharply," Nomura economists Sonal Varma and Aurodeep Nandi said in a note.

Source: Nomura

Source: Nomura

QuantEco Research has raised its CAD forecast for 2023-24 to $67 billion, or 1.9 percent of GDP, from $53 billion (1.4 percent of GDP), while Motilal Oswal Financial Services has nearly doubled its forecast to 1.3 percent of GDP from 0.7 percent.

Despite the expected widening of the CAD in July-September and the full-year number possibly exceeding the 2022-23 level, economists are not concerned about how it will be financed thanks to a surge in capital inflows. In April-June, net foreign portfolio investment inflows rose to $15.7 billion following net outflows of $1.7 billion in January-March and $14.6 billion in April-June 2022.

Also Read: A decade in the making, India's global bond index inclusion journey finally ends

"CAD funding so far has been quite smooth and we believe January-June 2024 could enjoy some frontloaded FPI inflows, ahead of India's bond index inclusion, which could offset CAD funding risks from higher (than assumed) oil prices," said Madhavi Arora, lead economist at Emkay Global Financial Services, although she added that global risk appetite and external growth could also impact inflows.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.