Budget 2023 proposes to sharply increase the tax collected at source rate on money sent overseas under the Liberalised Remittance Scheme to 20 percent from 5 percent. To understand how this will impact you, let us first understand the concept of LRS and TCS.

The Reserve Bank of India introduced the LRS in February 2004 to allow Indians to send money outside the country easily. The maximum amount that can be remitted under the scheme has been revised periodically, based on the prevailing macro- and microeconomic conditions:

Under the scheme, currently, one can remit up to $250,000 per family member (including minors) in each financial year. So a family of four can remit up to $1 million in a financial year.

Money can be remitted overseas for expenses such as:

Remittances are also allowed for capital account transactions like:

The scheme has become very popular over the past five years as more Indians are sending money overseas for their children's education and to open bank accounts, purchase property, and invest in securities.

Earlier, it was very easy to remit funds under the LRS. All one had to do was approach your bank, fill up the A-2 form, specify the purpose of remittance, and sign the declaration form. The bank would then debit your Indian account and remit the funds abroad.

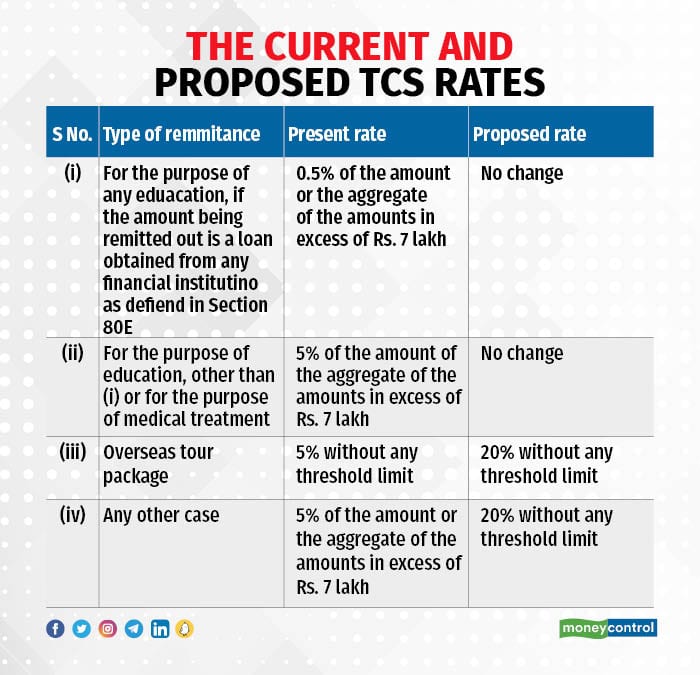

However, in Budget 2020, the government introduced TCS on remittances under LRS with effect from October 1, 2020. Since then, banks have been required to collect tax at 5 percent at the time of remitting funds under the LRS for an amount exceeding Rs 7 lakh.

TCS is not an additional tax. It is similar to TDS – tax deducted at source. The tax collected is credited to your account with the authorities and adjusted against your tax liability.

However, this causes inconvenience to the remitter. Firstly, you must provide more funds at the time of remittance. Secondly, if you are subject to TDS or have already paid advance tax, the excess TCS will have to be claimed as a refund while filing tax returns and the money will be blocked till you get the refund.

In the latest budget, the government has proposed a significant increase in the rate of TCS on foreign remittances to 20 percent from July 1, 2023, for certain such transactions:

This sharp increase will inconvenience people wanting to send money overseas, especially taxpayers subject to TDS. So now, if you wish to remit $250,000 outside India, you will have to provide $300,000 because $50,000 will be collected by the bank as TCS. This amount can be adjusted against your tax liability.

However, if you are subject to TDS or have paid advance tax, the excess TCS will be blocked until you get the refund from the income tax authorities.

A salaried employee earning Rs 50 lakh would be subject to TDS on his entire income. If he wants to remit $100,000, he will be subject to TCS of $20,000. This excess tax can be claimed as a refund, which will be returned only after a period of time. He will also lose some interest on the funds blocked.

The government has also proposed to remove the exemption limit of Rs 700,000 on foreign remittances under the LRS. A plain reading of the proposal suggests that even a payment of $10 in foreign currency for app subscriptions or online services will be subject to TCS. Since credit card payments in foreign currency are also covered under the LRS limit, how tax at source will be collected remains to be seen.

One fails to understand the rationale behind the concept of the TCS and, more importantly, the massive increase in the rate to 20 percent. Is it meant to deter people from sending money overseas?

The ostensible reason for the TCS seems to be that the government wants to track outward remittances and correlate them with the taxable income of the remitter. However, since banks link remittances with the PAN of the remitter, such data is already available to the government even without TCS. In case of a mismatch or doubt, the tax authorities can seek information from the remitter.

When the LRS scheme was introduced in 2004, it was considered a step towards making the rupee fully convertible on the capital account and allowing people to remit money outside India freely. However, today, after almost 20 years, we are moving in the reverse direction, trying to discourage the remittance of funds.

The sharp increase in the TCS rate and removal of the exemption limit seem to be a retrogressive step, especially considering the comfortable forex reserves of over $500 billion. As explained earlier, it causes hardship to honest taxpayers. Further, it could encourage more people to resort to unofficial routes for remittances. Hence, the government should seriously reconsider this proposal.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.