Reports of a country-wide waiver of farm loans by the central government, on the lines of the Agricultural Debt Waiver and Debt Relief Scheme announced by the UPA-II government in 2008, have been doing the rounds.

It’s hardly surprising, in view of the belief that it is widespread rural distress that unseated the BJP governments of Chhattisgarh, Madhya Pradesh, and Rajasthan. The perception that the promise of farm loan waivers helped the Congress win Madhya Pradesh and Chhattisgarh have added fuel to the speculation. That a farm loan waiver scheme by the Vasundhara Raje government couldn’t stave off defeat is of course airily brushed away.

The Reserve Bank of India says total farm loan waivers amounted to 0.32% of the country’s GDP in 2017-18 and states have already budgeted for waivers to the extent of 0.2% of GDP this fiscal. Since 2014, we have seen agricultural debt relief announcements in Andhra Pradesh, Telangana, Tamil Nadu, Maharashtra, Uttar Pradesh, Punjab, Rajasthan, and Karnataka.

What is the impact of farm loan waivers?

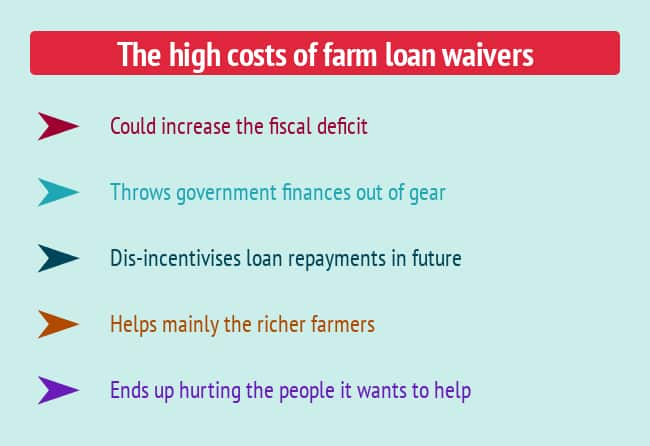

The impact of such waivers on state finances is obvious. Former RBI governor Urjit Patel had pointed out that loan waivers often result in higher than budgeted revenue expenditure, which has to be financed by additional market borrowings, which in turn pushes up interest rates. He also pointed to the inflationary consequences of higher deficits. He warned that even if the loan waiver is accommodated within the budgetary provisions, it will force cutbacks in other heads of expenditure, most probably in much-needed capital expenditure.

"In turn", said Patel, "this will entail deterioration in the quality of expenditure and inter alia lead to adverse implications for productivity as asset forming investment, including for the sector itself - e.g., irrigation works, cold storage chains etc., - is foregone."

In other words, loan waivers could end up hurting the agricultural sector and farmers.

A paper by Sankar De and Prasanna Tantri found that apart from the direct monetary costs, farm loan waivers involved other substantial costs for the economy. It represented a massive transfer to the agricultural sector at the expense of other activities and services of the government. The researchers estimated that the UPA-II’s debt relief programme cost the exchequer 1.3% of India’s GDP in 2008-09.

Do banks benefit?

After all, banks are reimbursed by the government for writing off the loans. An RBI report pointed out, 'While waivers may cleanse banks’ balance sheets in the short term, it may dis-incentivise banks from lending to agriculture in the long term. Consequently, loan waivers can have a dampening impact on rural credit institutions. Moreover, they impact credit discipline, vitiate credit culture and dis-incentivise borrowers to repay loans, thus engendering moral hazard.’

Do agricultural households benefit?

Yes, they do, in the short-term. But research has shown that banks are wary to lend to them later on. The De and Tantri research paper cited above says small and marginal farmers fare the worst, as they are cut off access to future credit. Another study showed that farmers may factor in future credit constraints and reluctance of formal institutions to lend to them following waivers, and in turn, they may shift to informal sources of credit.

In any case, as a National Sample Survey Office report that mapped the income, expenditure and indebtedness of agricultural households in India in 2013 has shown, it is the bigger farmers who have the highest proportion of bank loans. Many small and marginal farmers, on the other hand, borrow from moneylenders and they do not, therefore, benefit from bank loan waivers.

Debt relief is just a band-aid for rural distress. Other schemes, such as income support for farmers, have been mooted, especially after the electoral success of the ruling party in Telangana, which implemented the popular Rythu Bandhu scheme.

These measures will buy time, but the real solution is to shift the underemployed population in agriculture to more productive urban employment. That, of course, is easier said than done.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.