After seeing a stagnation in enrollments, PM Jan Suraksha Yojana insurance schemes have got 15 million new enrollments in H1 of the year. This was driven by a government nudge to the banks as well as zero premium increase.

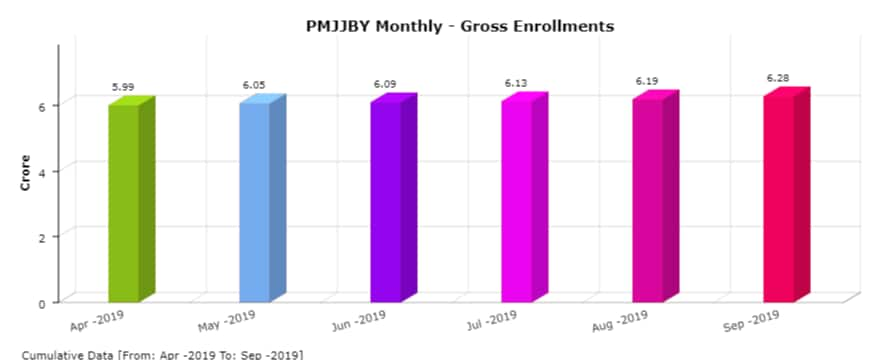

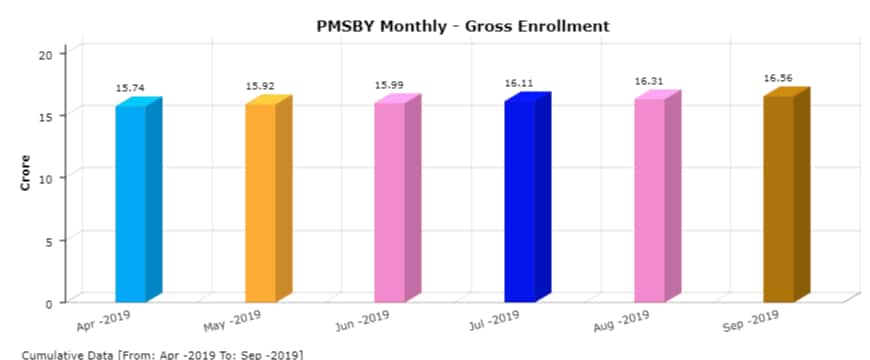

The insurance scheme saw some stagnation in FY18 and FY19 but enrollments picked up again from April 2019 onwards.

The personal accident scheme (Pradhan Mantri Suraksha Bima Yojana/PMSBY) and term insurance scheme (Pradhan Mantri Jeevan Jyoti Bima Yojana/PMJJBY) were launched in May 2015.

Both policies have a sum assured of Rs 2 lakh each and need to be renewed after one year. But their premiums are low at Rs 12 and Rs 330, respectively.

"During the initial phases of the scheme, banks had strict enrollment targets and hence the numbers saw a positive increase. However, with time they saw a drop in enrollments once the minimum figures were met. Now a nudge from the Centre has led to movement again," said an official.

In the April to September 2019 period, banks sold 10.9 million new personal accident policies under this scheme and 3.7 million term insurance products.

In the period immediately after the launch of these schemes, banks were focusing on enrolling more policyholders aggressively. In the first five months of the schemes' launch, around 120 million policyholders were enrolled.

But then stagnation set in. For PMJJBY, the enrollments remained at around 53-59 million in FY18 and FY19 while for PMSBY it was around 135 million-154 million in the two years. With premiums of Rs 12, PMSBY has seen a faster growth.

Since India does not have a social security initiative, the insurance programmes under PM Jan Suraksha Yojana are positioned as a mass insurance scheme for the country.

Industry sources said that people have also begun to buy the product due to the low premium. While insurance companies had sought a 20-25 percent increase in premium from FY19 on wards, the government wanted to keep the scheme affordable for the general public.

Claims settlement is also happening at a healthy pace. Till September 2019, a total of 34,965 cumulative claims were disbursed out of 45,132 received claims in PMSBY.

Till now in PMJJBy, a total of 1,49,004 cumulative claims were disbursed out of 1,62,333 received claims.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.