Last week, the stock of Country Garden, one of China’s biggest developers by sales, took a huge hit in the markets. The property development company has been at the epicentre of the country's real estate market crash, which has caused Evergrande, another large developer, to file for bankruptcy. Investors have been worried, especially after Country Garden backed out of plans to put money into the business.

Last month, Moody’s Investors Service revised its outlook for China's property sector to negative from stable.

This week, Country Garden missed two bond payments, which put it in danger of default.

Also Read | Country Garden signals default, hires advisers as sales plunge

Meanwhile, Evergrande, the poster boy of China’s real estate boom for the last two decades, filed for bankruptcy protection in the United States in August. Founder and Chairman Xu Jiayin, known as Hui Ka Yan in Cantonese, was detained in China last week on accusations of committing crimes connected to the abrupt collapse of his company. Evergrande is the most indebted developer in the world. Its shares have dropped 99 percent since July 2020, losing around $47 billion.

Also Read | Lehman to Evergrande: The long shadow of real estate-led economic crises

Housing booms fuelled by urbanisation and a growing population propelled China's robust growth for decades.

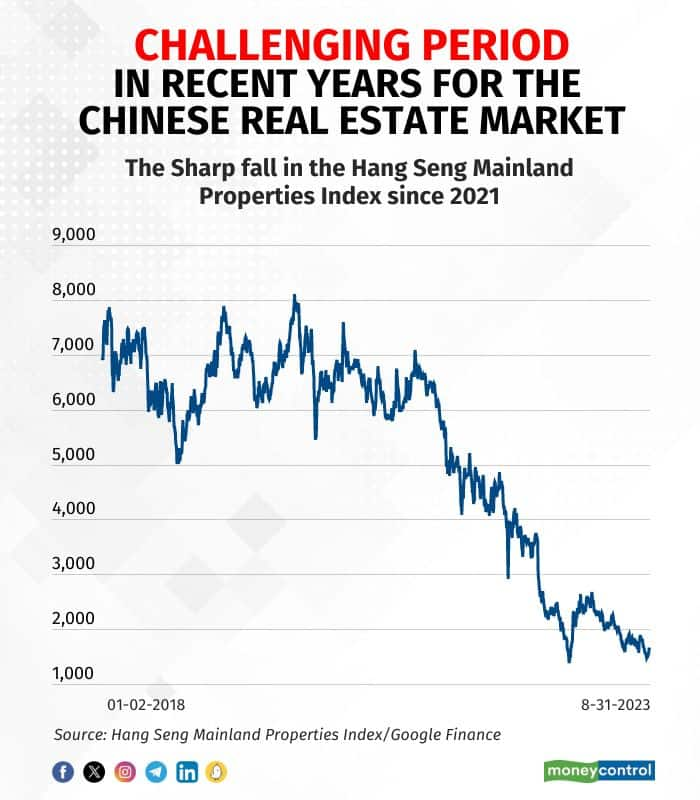

Around three years ago, the Chinese government began implementing stricter regulations, the so-called ‘Three Red Lines,’ to rein in the real estate sector’s excessive borrowing. The move hit the industry, which accounts for more than 30% of the economy, hard.

Also Read | Even China's 1.4 billion population can't fill all its vacant homes, former official says

Three red lines

In 2020, the Chinese government started cracking down on the property market on the grounds that property was meant to be used for living, not speculation. In August of that same year, the government instituted the “three red lines” to try and control the heavily leveraged property development industry. The rule determined how much developers could borrow based on three factors: how much money they had in cash, how much they had in equity, and how much they had in assets.

The crisis is affecting the wider Chinese economy, as real estate accounts for 80 percent of household wealth and 30 percent of China's GDP. In total, China’s property developers owe nearly $390 billion to various suppliers.

Prices are in Honng Kong Dollars

Prices are in Honng Kong Dollars

What led to the crisis?

For decades, many Chinese real estate developers sold apartments before they were even built. After China adopted market-driven reforms in the early 1990s, the country experienced a period of rapid urbanisation, which prompted regulators to institute the real estate development model in 1994. Real estate magnates were among the wealthiest individuals in the country, as they profited from the sale of their properties.

In addition, local governments depend heavily on land sales, property taxes, and other real estate fees for revenue, while households invest their wealth in property. All of this meant that developers and governments had to borrow heavily to finance new developments. When the government started to crack down on speculation and prices, it caused the market to cool down. It has been cooling ever since.

Also Read | China’s Real Estate Woes: How bad can things get?

New homes sold by China's top 100 developers in July 2023 dropped by 33% compared to the same time last year, according to data from the China Real Estate Information Corp. This has had a ripple effect on the entire Chinese economy. First, there has been a drop in demand for building materials and labour, which has caused hiring to slow down and people to be more careful with their spending. Local governments are struggling to make ends meet with less revenue, and some provinces have had to cut back on salaries and benefits.

Damage control: Is it working?

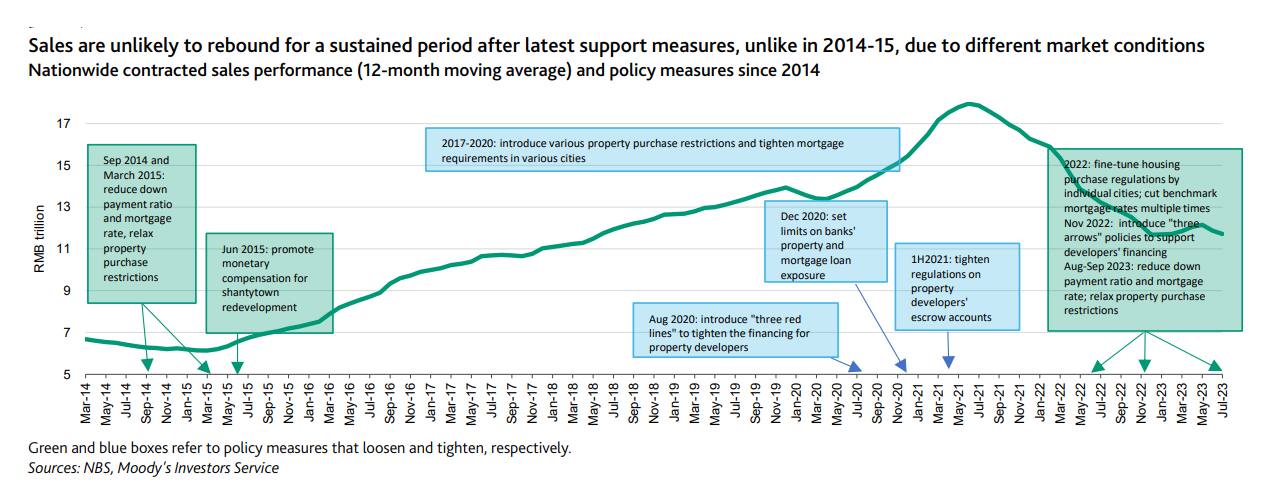

China is currently trying to encourage home purchases by slashing borrowing rates, imposing mandatory deposits, and cutting red tape. In August, the People's Bank of China implemented a significant interest-rate reduction, the largest since 2020. The PBOC's one-year lending facility, or MLC, saw a further reduction of 15 basis points, taking the rate down to 2.5% for the second time in a row.

Also Read | China’s Real Estate Woes: How bad can things get? — Part 2

The problem is that, for buyers to see real estate as a good investment again, house prices must decline. But falling prices could threaten social stability and hit investor confidence, and are anathema to local governments. Land is state-owned, with local governments selling usage rights to real estate developers. Hence, the plunging sales of land-use rights, which are the largest source of non-tax revenue for local governments, pose a threat to their budgets.

As a result, real estate developers can’t cut prices by more than 10-15 percent. Developers who do so more than that are booked under malicious price-cutting charges. Consequently, prices are still high.

According to Pierre-Olivier Gourinchas, the IMF’s chief economist, the problem is a “complex” policy challenge.

"If China's real estate prices decline too rapidly, the balance sheets of banks and households will worsen, with the potential for serious financial amplification," Gourinchas said on October 10. At the same time, while artificially supporting real estate prices could temporarily protect balance sheets, it would crowd out other investment opportunities, reduce new construction, and hurt local government revenues through reduced land sales, he said.

A potential liquidation of Country Garden could hit households and shatter confidence in the already battered real estate market, setting back Beijing’s efforts to revive the sector and prevent bigger economic problems.

Also Read | Once a symbol of China’s growth, now a sign of a housing crisis

Overall, the property sector has contracted severely as it adjusts to the collapse in demand. In 2020, 2021 and 2022, new construction starts measured by floor area dropped by 2 percent, 11 percent and 39 percent, respectively, compared with the year prior, according to American news channel CNN, which cited official data. As per Moody’s, nationwide contracted sales will fall by 5 percent over the next 6-12 months.

Source: Moody's Investors Service.

Source: Moody's Investors Service.

Households' bank deposits reached an all-time high of $132 trillion Yuan ($18 trillion) in June, more than China's entire GDP in 2021, according to the People's Bank of China. Savings also skyrocketed in 2022, rising by 80% over 2021. Despite this, China’s net household wealth contracted in 2022 for the first time in more than 20 years by 4.3 percent, according to London-based Capital Economics, an independent economic research firm, due to falling home prices and the stock market.

The IMF has warned that China’s financial stability is in danger as the country's real estate market continues to spiral out of control, leading the multilateral agency to lower its growth forecast for the country by 20 basis points to 5 percent for 2023 and by 30 basis points to 4.2 percent for 2024. It has urged the Chinese government to contain the crisis and revive people's confidence in the real estate market. But overall, it has called for the world’s second-largest economy to “pivot away from growth that relies on credit for the real estate sector”.

In an attempt to tackle these issues, China is looking to run a bigger budget deficit in 2023 and launch a fresh stimulus package. These measures are aimed at finishing up projects and restructuring weak developers to reinstil confidence in the industry.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.