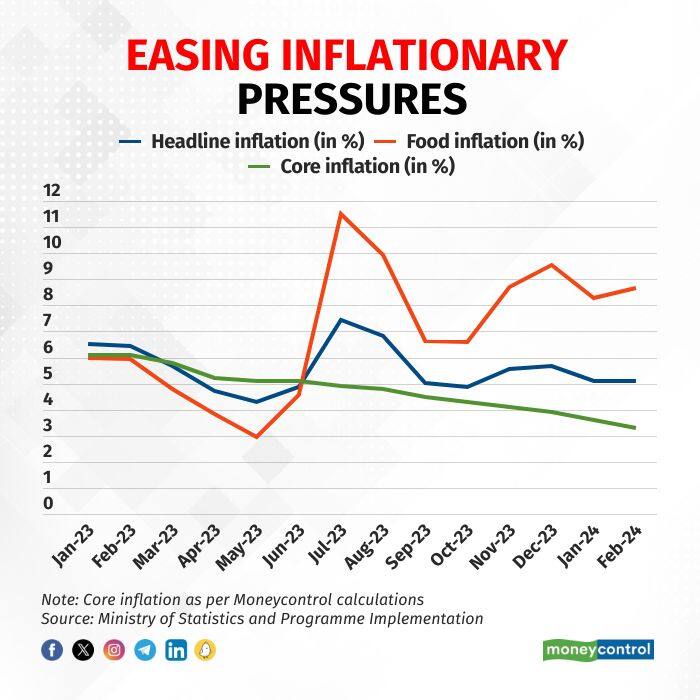

India's headline retail inflation rate was largely unchanged at 5.09 percent in February, according to data released by the Ministry of Statistics and Programme Implementation on March 12.

The Consumer Price Index (CPI) inflation print in January was 5.10 percent.

Also Read: India Inc's inflation expectation settling around 4.3%, shows IIM surveyAt 5.09 percent, the latest headline retail inflation figure is as per expectations, with economists having predicted prices likely rose 5.1 percent year-on-year according to a Moneycontrol survey.

While CPI inflation has extended its stay inside the Reserve Bank of India's (RBI) tolerance range of 2 percent to 6 percent to a sixth consecutive month, it has now spent 53 months in a row above the medium-term target of 4 percent.

The latest inflation data comes weeks before the RBI's Monetary Policy Committee (MPC) meets again on April 3-5. On February 8, the rate-setting panel left the policy repo rate unchanged at 6.5 percent for the sixth meeting in a row.

According to the central bank's latest forecast, CPI inflation is seen at 5.0 percent in the current quarter before easing to 4.0 percent in July-September. However, it is then set to rise to 4.7 percent in the first quarter of 2025.

Also Read: Barclays hikes India GDP growth forecast for FY24 to 7.8% after blowout Q3 dataWhile India's policy rates are at their highest level in nearly eight years, economists think the continued better-than-expected growth performance of the economy could mean the MPC will take its time to ensure inflation falls to acceptable levels on a durable basis.

"The upward revision in the NSO's (National Statistical Office) GDP growth estimates for Q1-Q2 2023-24, along with the three successive quarters of 8 percent plus GDP expansion, and the CPI print of 5.1 percent for February 2024, suggest status quo on the rates and stance in April," Aditi Nayar, chief economist at ICRA, said.

Also Read: Explained – 'Discrepancies' in GDP data and how they affect headline growth rate"Unless growth posits a negative surprise in the intervening months, we now see a dimmer possibility of the stance (of monetary policy) being changed in the June or August MPC reviews," Nayar added.

February CPI internalsIn February, a combination of forces kept the headline inflation rate steady from the previous month's level. While the month-on-month (MoM) price of certain key food items fell in February compared to January, others saw an increase.

On the up were prices of cereals (0.5 percent higher MoM) and meat and fish (2.3 percent). Meanwhile, spices (down 1.9 percent MoM), eggs (down 1.2 percent), and edible oils (down 0.6 percent) were the key decliners.

| FEB 2024 INFLATION | INDEX CHANGE, MoM | |

| CPI | 5.09% | 0.2% |

| Food | 8.66% | 0.1% |

| Cereals | 7.60% | 0.5% |

| Meat, fish | 5.21% | 2.3% |

| Edible oils | -13.97% | -0.6% |

| Fruits | 4.83% | -0.3% |

| Vegetables | 30.25% | -0.1% |

| Pulses | 18.90% | -0.8% |

| Clothing, footwear | 3.14% | 0.2% |

| Housing | 2.88% | 0.5% |

| Fuel, light | -0.77% | -0.1% |

| Miscellaneous | 3.57% | 0.2% |

Prices of vegetables were largely steady, with their index down a marginal 0.1 percent in February compared to January. On the whole, the Consumer Food Price Index rose 0.1 percent MoM, with food inflation - which measures the year-on-year change in the price index - rising to 8.66 percent from 8.30 percent.

"Daily retail prices from NHB (National Horticulture Board) and consumer affairs (department) indicate continued decline in vegetable prices MoM in the first two weeks of March," said Gaura Sen Gupta, India economist at IDFC First Bank.

"Meanwhile, prices of cereals and edible oils are also tracking lower MoM. The impact of the reduction in LPG price by Rs 100 per cylinder is likely to reduce headline inflation by 0.1 percentage point in March," she added.

Food apart, the sequential price momentum was largely subdued in February, with only the price index for housing rising by 0.5 percent MoM. The other groups of the CPI basket posted MoM increases in the range of 0.1-0.2 percent.

As a result, core inflation - or inflation excluding food and fuel - fell further to 3.3 percent from 3.6 percent in January, according to calculations done by Moneycontrol.

"The moderation in core inflation continues to provide respite," said Upasna Bhardwaj, chief economist at Kotak Mahindra Bank.

"We retain our view that RBI will remain cautious on volatile food inflation trajectory and hence prefer to remain in pause mode on rates till August policy. However, with RBI already having continuously fine tuning liquidity and easing overnight rates closer to repo rate, we see room for a shift in stance in the June policy," she added.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.