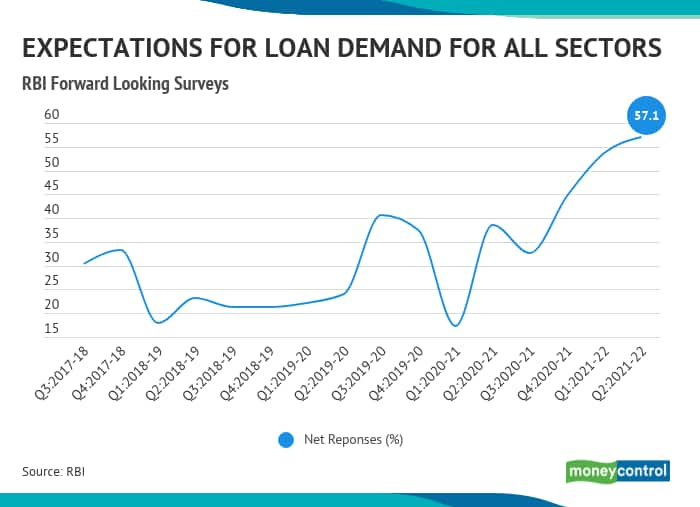

The Reserve Bank of India (RBI) released the results of the 14th round of its quarterly Bank Lending Survey on February 5. This forward-looking survey is being conducted to capture the qualitative assessment and expectations of major scheduled commercial banks (SCBs) on credit parameters for major economic sectors.

The survey questionnaire is canvassed among major 30 SCBs accounting for more than 90 percent of bank credit in India.

An additional block was included in this round of the survey for assessing the outlook for three quarters ahead, owing to uncertainty driven by the COVID-19 pandemic.

Assessment: Loan demand conditions revived further during Q3FY21, as reflected in an increased level of optimism for all major sectors. Banks assessed the easing of terms and conditions of loans to all sectors barring the infrastructure sector.

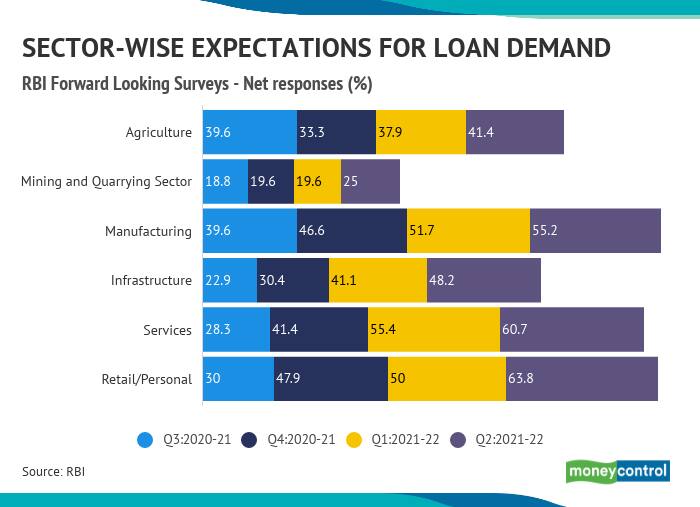

Loan Demand: Bankers expect further improvement in loan demand in Q4FY21; higher optimism is reported especially for manufacturing, infrastructure, services, and personal loan sectors. Banks also expect further sequential improvement in loan demand conditions across all sectors till Q2:2021-22.

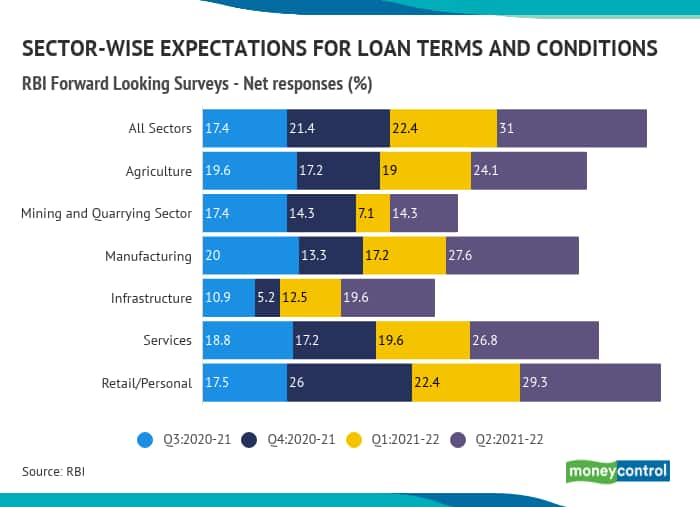

Loan Terms and Conditions: Banks expect to continue with easy loan terms and conditions, with further softening expected for the personal loan segment. Easy loan terms and conditions are expected to continue in the first half of 2021-22.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.