There are two very clear aspects to the Agnipath scheme: strategic and financial. While it may be best to leave strategy to the experts, the numbers are more straightforward.

Much has been said and written about the new military recruitment scheme and its rather short four-year service term for the majority of sub-officer class recruits under it. In recent days, one ministry and corporate house after another has promised a certain percentage of jobs to those 'Agniveers' who seek employment following the completion of their service.

There are two pertinent questions here. One, why aren't these promised jobs being provided right now, rather than being dangled as some sort of a potential carrot? Second, why is the scheme even needed?

The first question is best answered by the state of the Indian economy. The second requires an examination of the government's finances.

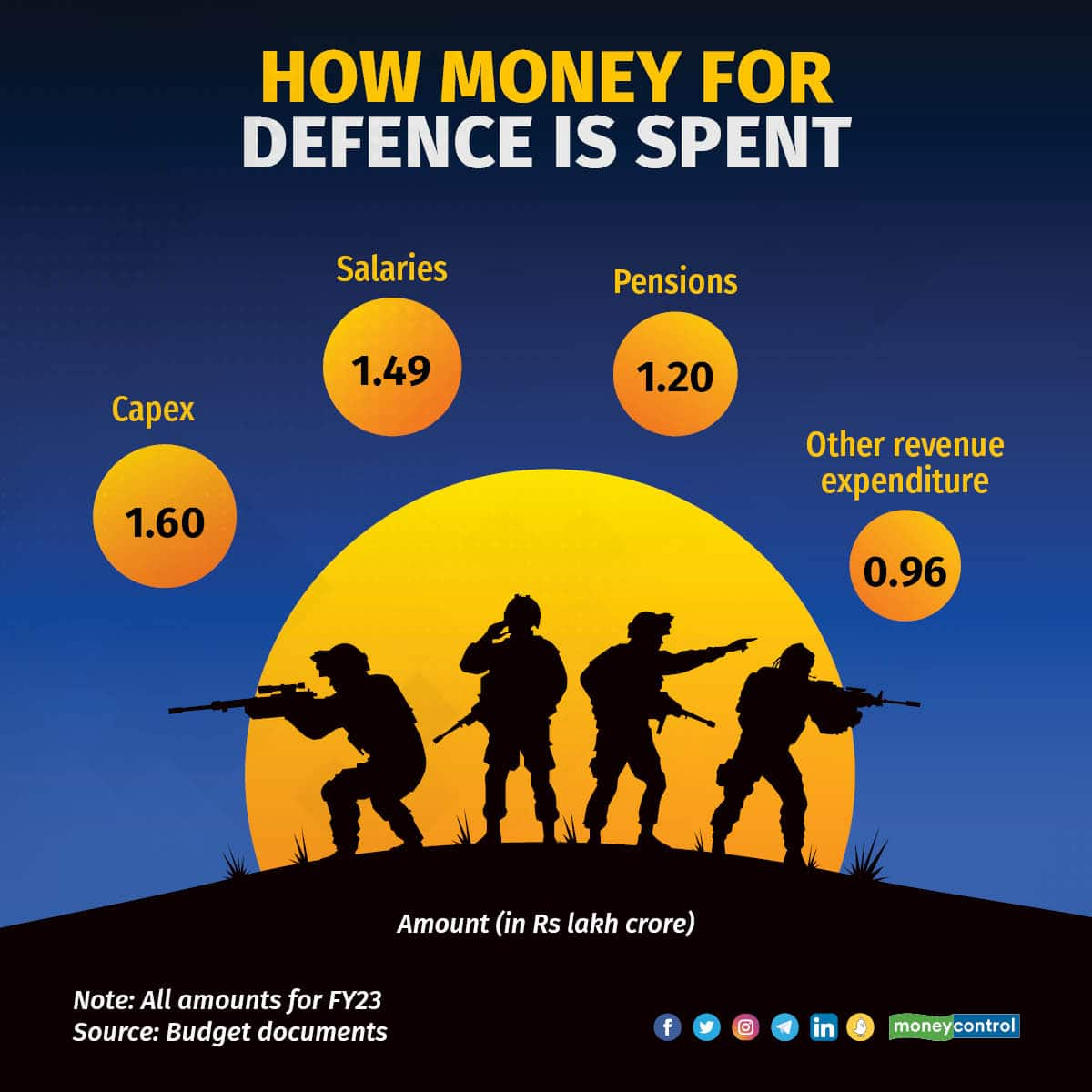

Fiscal unsustainabilityIn FY22, the Centre spent Rs 1.17 lakh crore on defence pensions. This number is estimated to rise 2.4 percent in FY23 to Rs 1.20 lakh crore.

Salaries for the army, navy, and air force accounted for another Rs 1.39 lakh crore in FY22. These are set to rise by 7.6 percent in FY23 to Rs 1.49 lakh crore.

In total, salaries and pensions for the armed forces account for 6.8 percent of the Centre's total budgeted expenditure in both FY22 and FY23.

In comparison, the Centre will this year spend Rs 73,000 crore on the Mahatma Gandhi National Rural Employment Guarantee Scheme, Rs 64,568 crore on roadworks, Rs 60,561 crore on food subsidy for decentralised foodgrain procurement under the National Food Security Act, Rs 39,553 crore on the National Education Mission, and Rs 37,800 crore on the National Food Mission. Altogether, Rs 2.75 lakh crore is intended to be spent on these five crucial schemes in FY23—just Rs 6,402 crore more than what will be paid to defence persons as salary and pensions.

This is not to say that pensions and salaries of defence persons should be cut. But there clearly is an element of unsustainability, if one were to use the words of the late Bipin Rawat, India's first chief of defence staff.

Part of the wholeWorries over the defence outlay is the overall fiscal situation in a microcosm.

In its attempt to clean its finances, the government's fiscal deficit ballooned to 9.2 percent of GDP in FY21, before easing to 6.7 percent in FY22. The 2022 budget targeted further consolidation, with the fiscal deficit target for FY23 set at 6.4 percent. But the first quarter of the financial year has seen even the initial conservative fiscal math take a turn for the worse.

In late May, the government was forced to announce the second excise duty cut on petrol and diesel in seven months to rein in inflation. Other measures to ease price pressures were also announced, but not without cost. According to economists, the fiscal deficit may exceed the target and hit 6.9 percent of GDP this year. Defence spending must exist within this reality.

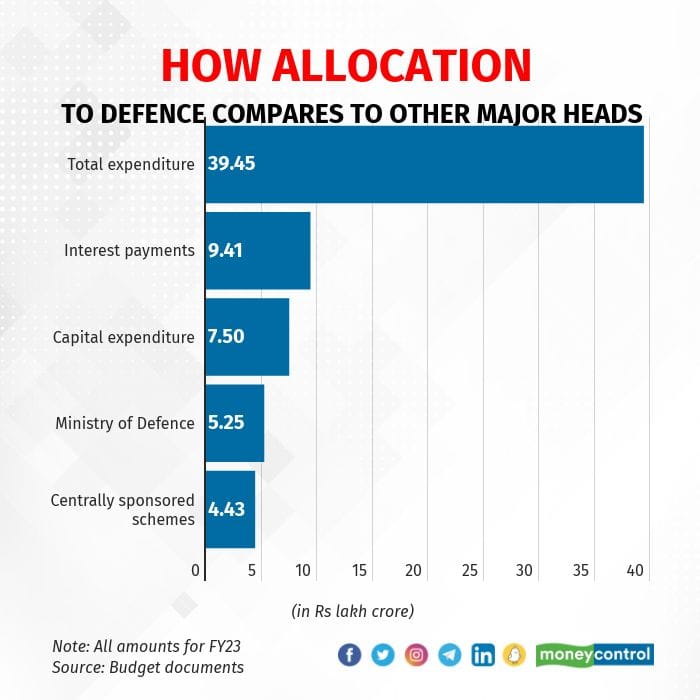

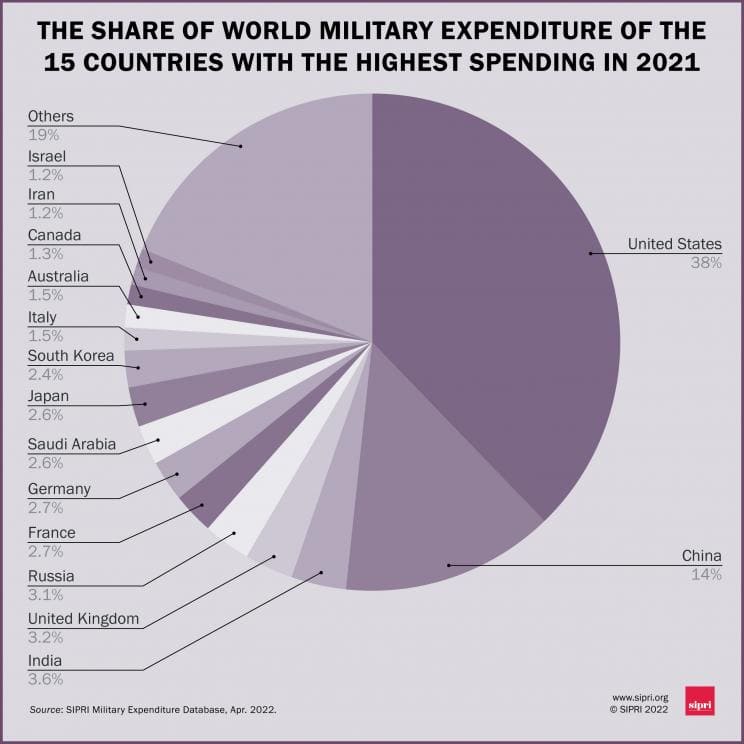

At over 10 percent of total spending, defence is already the Centre's second-largest expenditure item—after interest payments. And according to the Stockholm International Peace Research Institute (SIPRI), India's military spending in 2021, at $76.6 billion, was the third-highest in the world.

While fiscal realities dictate care must be taken when it comes to spending, the government is also increasing its focus on capital expenditure. For FY23, the Centre has set itself a huge capex target of Rs 7.5 lakh crore. While this includes a 50-year interest-free loan to states, the intent to crowd in private investment and boost economic growth is apparent.

When it comes to defence services, the Centre's capital expenditure for FY23 is Rs 1.60 lakh crore. This pales in comparison to the Rs 2.69 lakh crore that will be spent on pensions and salaries for defence persons.

However, global circumstances mean the government wants to spend more and more on munitions.

According to SIPRI, total global military expenditure crossed $2 trillion in real terms in 2021. While the US remains by far the biggest defence spender, developments closer to home would have caught the Centre's eye.

"China's growing assertiveness in and around the South and the East China seas have become a major driver of military spending in countries such as Australia and Japan," a SIPRI official said in April.

China spent the most, after the US, on defence in 2021. At $293 billion, its military spending in 2021 was up 4.7 percent from 2020, rising for the 27th consecutive year.

Given the strategic nature of the issue, the Indian government wants to reduce its heavy dependence on defence imports.

In her 2022 budget speech, Finance Minister Nirmala Sitharaman had said the government wanted the country to become 'atmanirbhar' even in defence. As such, 68 percent of the capital procurement budget was earmarked for the domestic industry in FY23 as against 58 percent in FY22.

The bottom line, then, is this: overall fiscal constraints mean even defence as a sector is not sacrosanct. The need for modernisation of equipment and arms mean new priorities have emerged. How this situation is tackled is finally the government's decision, and it has chosen to walk down the Agnipath route.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.