A possible peak of 6 percent for US interest rates is rippling through markets, as more investors start to weigh the knock-on effect of such a scenario on stocks, bonds and currencies.

Funds are contemplating this prospect after Fed Chair Jerome Powell said authorities may have to move more aggressively than previously thought to quell rising prices. The remarks set off a repricing of US rates and spurred a rally in the dollar while equities and developing currencies took a tumble.

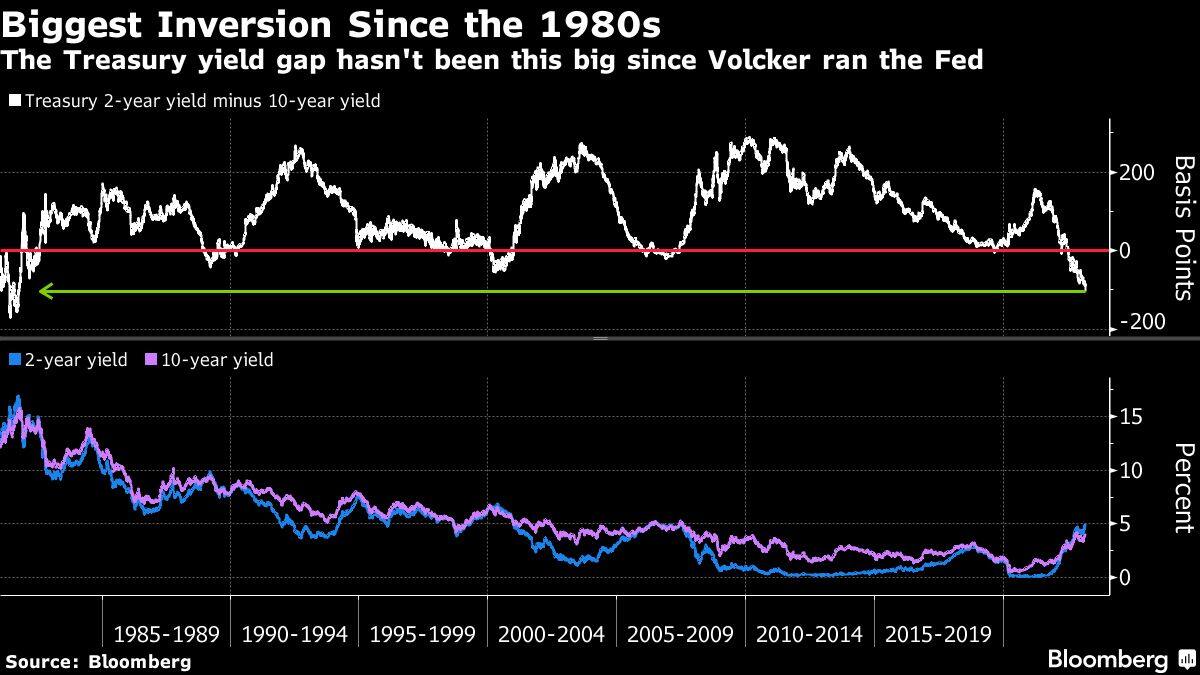

Powell’s comments set the stage for the Fed to revert to a half-point hike and put the central bank at odds with some of its peers which are preparing to halt their tightening campaign. The bond market is also telegraphing the growing odds of a recession, and US non-farm payroll data due Friday may be key in shaping expectations.

Given the robust job market and sticky inflation, “we think there’s a reasonable chance that the Fed will have to bring the Fed Funds rate to 6 percent, and then keep it there for an extended period to slow the economy and get inflation down to near 2 percent,” Rick Rieder, chief investment officer for global fixed income at BlackRock Inc, said in a Tuesday note.

Traders upgraded the odds of a half-point rate increase on March 22 from about one-in-four to around two-in-three. The impact of the repricing continued to be felt on Wednesday, with most Asian currencies weakening and a gauge of regional equities edging lower.

“Higher-for-longer is becoming the base-case scenario, and if that scenario materializes, EM can suffer,” said Brendan McKenna, emerging markets strategist at Wells Fargo in New York. “Markets were really hoping for an early Fed pause and cuts this year, so far that scenario is not unfolding.”

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.