Finance Minister Nirmala Sitharaman today announced a mammoth bank consolidation in which 10 banks would be amalgamated into four.

Addressing a press conference, FM Sitharaman laid out the list of banks that will be combined:

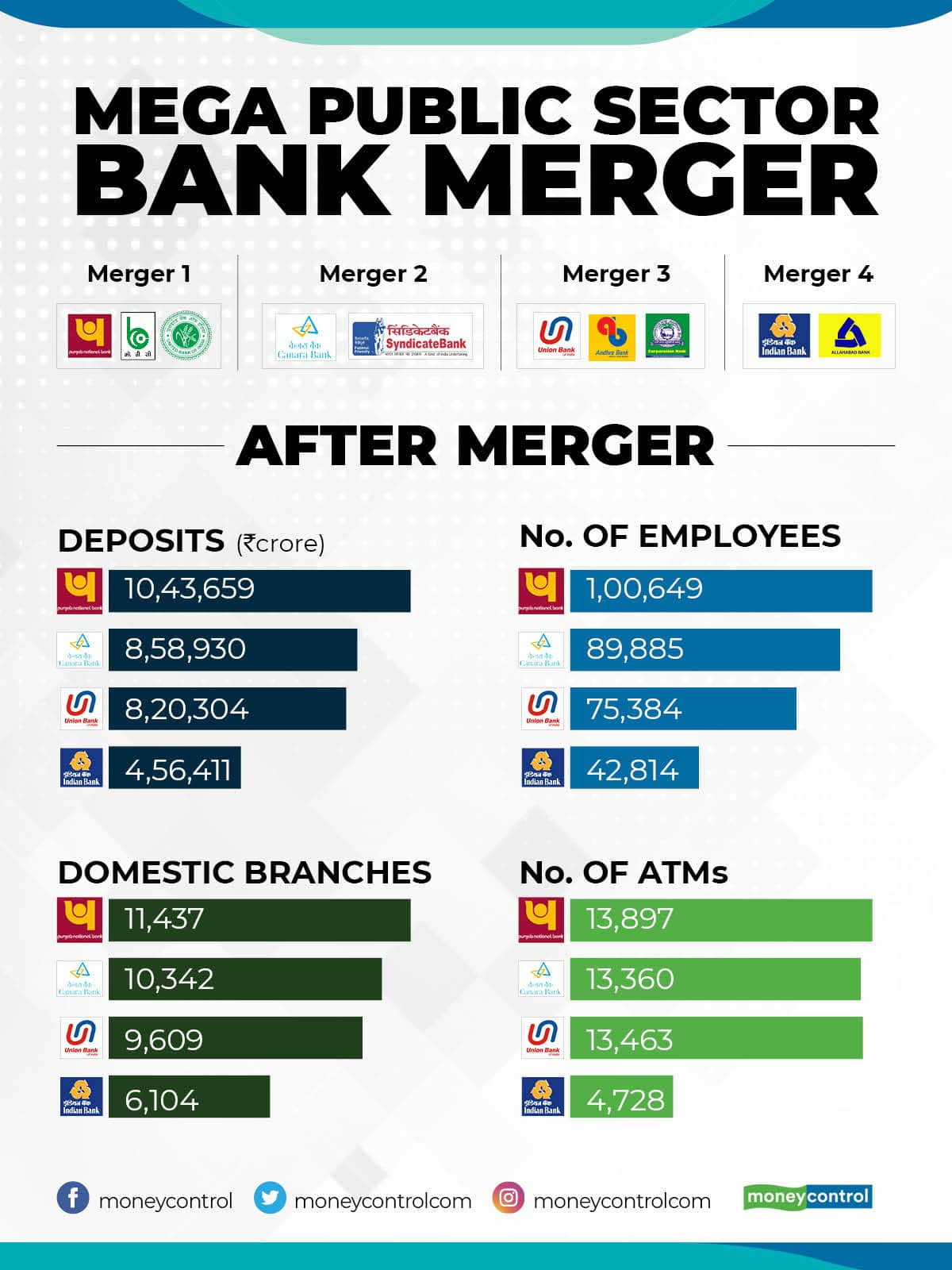

#Punjab National Bank will be merged with Oriental Bank of Commerce and Union Bank of India.

#Canara Bank will be merged with Syndicate Bank.

#Union Bank of India is to be merged with Andhra Bank and Corporation Bank.

#Indian Bank: is going to be merged with Allahabad Bank.

The government's decision to merge small banks with a larger bank stems from the thinking that larger banks will benefit from economies of scale.

Bank consolidation was first mooted by the Narasimhan Committee report in the early '90s after which a slew of banks were merged in that decade.

The 2000s and the early part of this decade saw few bank mergers being announced when the UPA was in power.

The NDA made it clear that consolidation would be high on its agenda.

During its previous term, it merged SBI with its associate banks, along with the Bharatiya Mahila Bank.

The second round of consolidation took place when Dena Bank and Vijaya Bank were merged with Bank of Baroda.

As a result of this, India will now have only 12 public sector banks, compared to 27 in 2017.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.