The rising fear about death and illnesses caused by COVID-19 has seen a rise in the enrollments in the Pradhan Mantri Jan Suraksha Yojana insurance schemes.

Though there was a stagnation in the enrollments in FY19 and FY20, the COVID-19 outbreak has helped it pick up speed. The PM Jeevan Jyoti Bima Yojana (PMJJBY) provides Rs 2 lakh term insurance cover at Rs 330 annual premium and is the cheapest life product available in the Indian market.

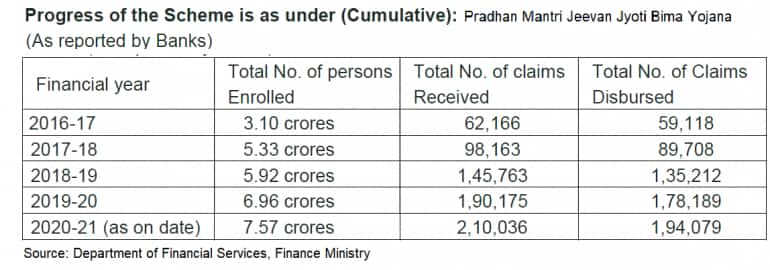

Latest data from the Department of Financial Services showed that 6.1 million new policies have been sold in FY21 between April 1 and October 9 under PMJJBY. This shows that 1.01 million policies have been bought every month in FY21.

In FY20, this number was 0.8 million policies every month. Insurance executives told Moneycontrol that while Jan Suraksha schemes lost the initial surge seen in FY17 and FY18, COVID-19 has led to a revival in business.

PM Jan Suraksha Yojana includes PMJJBY, which is a pure term insurance plan and Suraksha Bima Yojana (PMSBY), an accident insurance scheme. These schemes were launched in May 2015.

Pure term insurance scheme is one in which the claim is paid only in the event of death of the policyholder during the policy term. Premiums are deducted through an auto debit facility at the banks on a yearly basis.

Why is there a rise in enrollments?

“After the launch, there was a lot of pressure on banks to distribute these products to the public. But after one to two years, bank executives were also not too keen to sell these and instead were involved in selling their own (joint venture or bancassurance) insurance plans. But now, customers themselves are asking for PMJJBY since it is much cheaper,” said the head of distribution at a mid-sized private life insurer.

Another factor that is attracting customers to this product is that the annual premiums have stayed unchanged since inception.

“Your regular insurance policies have premiums going up every one to two years, depending on the past claims experience. But PMJJBY has the same premium, and, hence, it works to be way cheaper. While we insurers had sought premiums of around Rs 600-700 per annum, the government stuck to Rs 330 since they wanted the product to be accessible,” added the vice president-sales at a bank-led insurer.

Term insurance premiums have gone up between 20-30 percent in FY21 due to rising claims and reinsurance costs. Considering COVID-19 death claims, the protection plan premiums are expected to see rise another round of increase in FY22 as well.

Claims rise worry for insurers

While there is a rise in enrollments, insurers have been troubled by the rise in claims amidst the Coronavirus outbreak.

In FY20, 44,412 claims were received under PMJJBY. Government data showed that there have been a total of 19,861 claims received so far (in FY21), taking the total claims to 2,10,036.

“Coronavirus-related death claims are on the rise. We expect more claims over the next two quarters. This will make it tough to run this scheme at Rs 330 per annum,” said the claims head at a large private life insurer.

He added that the industry will again request the Finance Ministry to allow increasing the premium from FY22 onwards, so that the business is sustainable under PMJJBY.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.