Unified Payments Interface (UPI) has been one of the best success stories worldwide. A complex multi-bank interoperable payment system made it easier for millions of users to pay each other using any UPI app.

Rough estimates peg the number of unique UPI users to around 120 million. But this still leaves close to 450 million smartphone users who are yet to experience UPI.

But the National Payments Corp of India (NPCI), India’s flagship payments processor, has decided to check UPI’s growth by introducing a new rule which restricts TPAP (Third Party Application Providers) from going beyond 30% market share.

The popular TPAPs are PhonePe (42% share currently) & Google Pay (36% share currently) while WhatsApp Pay and Amazon Pay are smaller players currently.

Any private app that offers UPI is classified as TPAP. UPI apps run by banks directly are exempted from this rule; which is why Paytm UPI App (which is run by Paytm Payments Bank) is exempted.

While this 30% cap is bad for TPAP, it is going to directly impact you and me as customers: New customers will be barred from onboarding if any app hits the 30% limit.

As a customer, we will be advised to use some other UPI App, which means you need to be savvy enough to download multiple apps and settle on the app works in this hit and trial method.

As a user, I won’t be allowed to use a popular app so I have to settle with a less popular one. This is taking away the choice of users, which is unheard of in this digital era.

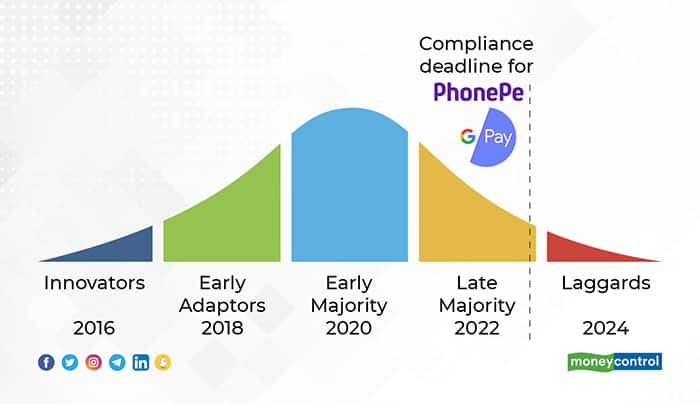

Now let's look at the impact it may have on the UPI adoption: If we map UPI to product adopters graph, we can safely assume that it has attained early majority.

By the time Gpay and PhonePe (assuming they continue to maintain their lead) have to comply with 30% rule, UPI would be entering the laggards phase.

Why is this graph important? Let me explain:

All the use cases and product innovations are mostly achieved by the time product gets adopted by the late majority. It’s all about sustaining the base after that. Laggards have hardly contributed to the fast scale of growth of any product in the world.

So if Gpay and PhonePe continue to corner 75% of the share, they would be the app-to-go for most users. They will be happy to implement moderated onboarding when UPI enters the last phase.Note: I am not inferring UPI growth will stall, just that the kind of users it will attract may not significantly contribute to its rapid growth.

Early and late adopters are the most important user base for any app as they eventually help in monetisation. While we all know UPI has 0% MDR (fee a UPI provider can charge a merchant when they receive money from a customer), these TPAPs hope to cross sell other products from insurance to lending to wealth management to make money in future.

Clearly PhonePe and GooglePay will now go all out and double down on their new user acquisition strategy so that by the time Dec 2022 deadline comes, they have enough and more to sustain. Post 2023, they can focus on cross selling to these users vs focusing on acquiring new users which will be entirely NPCI or UPI’s loss.

Why this 30% rule be difficult to implement:

While many players in the payments industry say the “quota system” is regressive & anti-growth, the on-ground implementation is not going to easy if we go by the methodology published by NPCI recently.

There are lot of exemptions given in the guidelines which may actually give both PhonePe and Gpay another year after December 2022. Let’s see how those exemptions will work:

January 2023: If a TPAP is above 30%, they need to start moderating new user onboarding. One way to do this could be to let only 50% onboard. If it can be proven to NPCI that TPAP stopped half of the users from onboarding and even then they continue to have more than 30% share, NPCI will give them an extension of six months.

July 2023: TPAP continues to implement graded onboarding. This six-month extension can be extended further. Please note that NPCI has not asked TPAP from stop onboarding any users even if they continue to breach the 30%.

December 2023: If the TPAP share still doesn’t come down, NPCI will review the situation and might introduce A few more restrictionS. That’s too far in future so let's not assume what those restrictions could be.

Now refer to the product adoption chart again, if by DecEMBER 2023, even if TPAP is totally restricted from onboarding new customers, they would have garnered most of the transacting users by then. Since this compliance doesn’t apply on existing users, chances are popular TPAP may continue with their >30% market share without any restrictions.

Dark horse—Whatsapp Pay or Paytm: Assuming the 20 million restriction on Whatsapp is lifted and it steps on the pedal, we may see a third large player emerging. That means the share of PhonePe and Gpay comes down automatically by December 2022.

That would make things lot easier for NPCI. Or Paytm may decide to recapture the UPI space with a bang, making it a four-player game. which would further ease the situation of implementing the complex 30% rule.

However, if Whatsapp Pay just takes off, they will be the worst affected party because they don’t qualify for this exemption and they will have to start taking corrective measure much before they reach 30%. Interestingly if Paytm decides to go all out, they can theoretically go well beyond 30% cap because Paytm is not a TPAP and hence this restriction doesn’t apply to them.

How could this have been implemented:

Stopping new users from onboarding is one of the worst ways to implement this. New users will suffer and it will impact the customer experience for UPI as a whole.

Why punish a user from trying UPI? Why force a user to try another app when they have made a choice to try out a particular App?

Easier way could have been to restrict each TPAP to bring the number of daily transactions down to 6/7/8 from currently 10. As of today, 10 transaction a day are allowed across all apps, NPCI could implement transaction per TPAP instead, thus allowing every user (new and existing) to transact. Users who do more than 6/7 transactions a day are evolved and would have multiple UPI apps anyway so it is easier to nudge them. A new user who is trying a product should not be forced to keep hoping from one app to another.

To summarise, the move by NPCI has been followed up by an SOP that will a see a lot of issues when this is being implemented on the ground. Not to forget, we may have a UPI competitor by 2022 (through a NUE or New Umbrella Entity) and these TPAPs may very well move to the NUE.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.