The upcoming Union Budget may assume nominal GDP growth of 12.8 percent in FY23, lower than the estimate for this financial year, according to economists.

The finance ministry may reduce the nominal GDP growth rate in FY23 by 480 basis points from the projected rate for the current financial year, according to the median of estimates by 10 economists surveyed by Moneycontrol. Their growth predictions ranged from 11.4 percent to 14.5 percent.

India's GDP is likely to grow 17.6 percent in FY22 in nominal terms, the National Statistical Office (NSO), a wing of the Ministry of Statistics & Programme Implementation, said on January 7.

The Union Budget is scheduled to be presented in Parliament on February 1.

"I think the budget will assume nominal GDP growth of around 13.5 percent, given the fact that broad guidance for next year's real GDP growth is 7.5 percent," said Indranil Pan, chief economist at Yes Bank. "You need to add around 5.5-6 percent of inflation considering Wholesale Price Index inflation continues to be on the relatively higher side."

India's GDP is expected to grow 7.6 percent in FY23 in real terms, according to the Reserve Bank of India's most recent survey of professional forecasters, released in December.

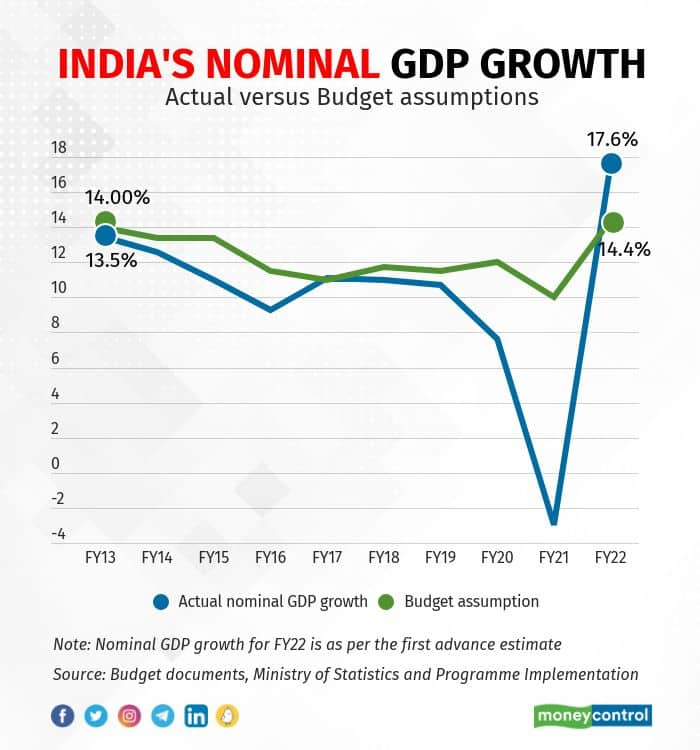

India's nominal GDP growth in FY22, as per the NSO's first advance estimate, was 320 basis points higher than the 14.4 percent assumed in the 2021 budget, following the double boost from an extremely favourable base effect and high inflation.

While Consumer Price Index inflation averaged 5.2 percent in April-December 2021, down from 6.2 percent in FY21, WPI inflation averaged 12.4 percent. WPI inflation had averaged 1.3 percent in FY21.

WPI is used extensively in India's national income aggregates to deflate nominal price estimates and arrive at real price estimates.

"We expect (FY22) revenue to surpass budget estimates as strong nominal growth buoyed tax revenue through FY22 and is likely to continue to do so in FY23," noted Rahul Bajoria, chief India economist at Barclays. "We estimate that overall tax revenue collected by the Central government will surpass budget estimates in FY22 quite considerably. The economy proved resilient through the second Covid wave and, coupled with higher inflation, nominal GDP has surprised to the upside."

Bajoria estimates India's nominal GDP will grow 13.6 percent in FY23.

The nominal GDP growth for FY23 to be assumed in the 2022 budget will be a sign of the finance ministry's degree of optimism. Apart from FY22, only once in the past 10 years has actual nominal GDP growth exceeded the estimate in the budget.

In the eight years before the pandemic, nominal GDP growth assumed in the annual budgets exceeded the actual figure each year by 150 basis points on average.

| ORGANISATION | ESTIMATE FOR FY23 NOMINAL GDP GROWTH |

| Axis Capital | 11.4% |

| Standard Chartered Bank | 12.0% |

| Bank of Baroda | 12-13% |

| ICICI Securities Primary Dealership | 12.5% |

| ICRA | 12.5% |

| Deutsche Bank | 13.0% |

| Yes Bank | 13.5% |

| Barclays | 13.6% |

| IDFC First Bank | 14.0% |

| Nomura | 14.5% |

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.