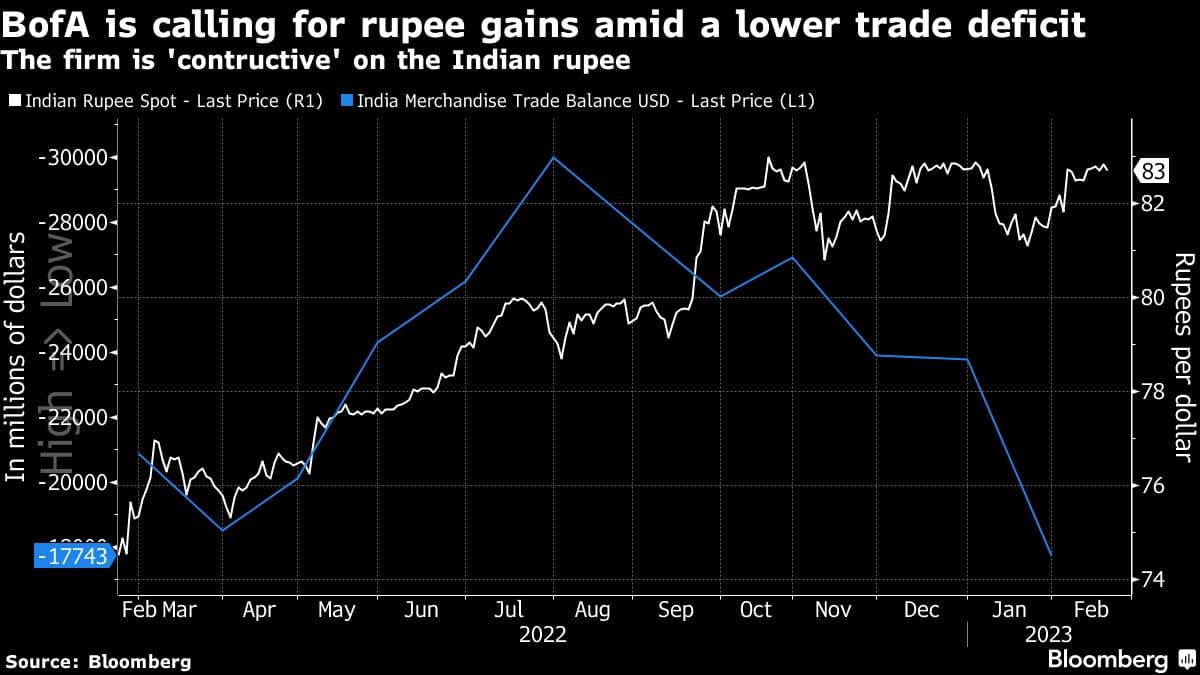

Bofa Securities Inc. is predicting more gains for the Indian rupee in the near term, joining Citigroup Inc., as the narrowest trade deficit in a year augurs well for the nation’s external finances.

“The recent correction in rupee valuation and near-term improvement in current-account and capital flows tilt the risk-reward in favor of rupee appreciation,” Abhay Gupta, a strategist at BofA Securities, wrote in a note. The firm has turned ‘constructive’ on the rupee.

The currency was the worst performer among emerging Asian peers last year, weighed by concerns over a wider current-account deficit and a stronger dollar spurred by rate hikes by the Federal Reserve. The outlook is now changing after a surprise drop in India’s trade deficit prompted economists to cut their forecasts for the shortfall.

The rupee is up 0.1% against the dollar this year and is in the lower pack among Asian currencies, while its high-yielding counterpart, the Indonesian rupiah is up 2.6%. It is closing in on its record low of 83.2912 to a dollar seen in October.

Citigroup Inc. last week recommended a tactically bullish relative rupee exposure as it expects seasonal outperformance and the rupee’s nominal effective exchange-rate to strengthen into the end of its fiscal year, it said in a note.

The “rupee’s carry-to-vol is attractive within EM, RBI’s reserves have recovered, REER index declined and INR volatility is lower,” Gupta wrote. “Debt inflows have started to trickle-in as India bonds still offer better carry compared to the region with low currency volatility.”

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.