Madhuchanda DeyMoneycontrol Research

We had initiated coverage on the luggage sector a couple of months back and surpassing our expectations, VIP has come out with an extremely strong set of numbers for the first quarter of the fiscal.

The GST rate is a bit of a near-term dampener, but the company is taking the right initiatives to stay competitive. While the shift from the unorganised sector will be gradual, it remains a long term tailwind. The valuation looks reasonable for accumulation.

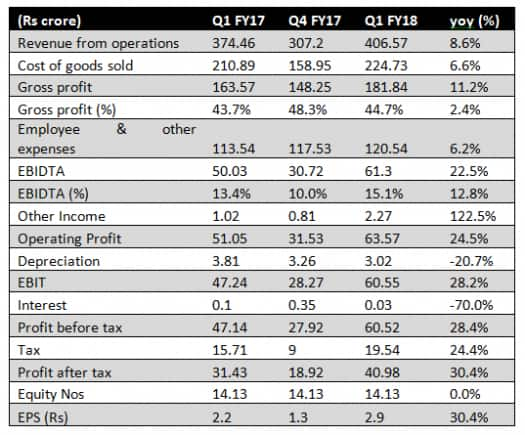

Result at a glance

The growth in revenue at 8.6 percent was driven by volumes in the Indian market. The company improved gross margin as well as operating margin that came on the back of rupee appreciation (since bulk of the raw material is imported), cost management and better product mix. VIP reported after-tax-profit of Rs 41 crore, a growth of over 30 percent.

Most channels doing well except CSD

The company didn’t experience the FMCG kind of de-stocking phenomenon. Most of the channels have done well in the quarter, including modern trade and e-commerce. The only disappointment was the Canteen Stores Department (CSD) channel, where offtake was negligible in June owing to ambiguity about GST.

Sales to Defence canteen stores that were fully tax exempt previously will now get only half tax refund under GST. But there wasn’t any clarity to start with and sales will be impacted till August. The management mentioned that till the stocks of CSDs are completely exhausted, resumption of new orders is unlikely.

Market share gains

While the first quarter is traditionally a seasonally strong one, the management acknowledged that volume growth came partially on the back of market share gains.

GST – the near-term pain

The GST rate at 28 percent from its erstwhile effective tax rate of 19.5 percent is clearly a negative. While the management has resorted to a price hike of close to 6 percent from June 15, it is not enough to completely offset the impact.

Brand positioning

VIP continues to operate across the value chain with Caprese and Carlton for the premium segments. These are not revenue spinners for the company but are important from the perspective of margin. The best performing brand continues to be the mid-market ones like the Skybags. The company is also investing to strengthen the positioning of the brand VIP. Aristocrat, the value brand, continues to be important for the mass market where the company is facing stiff price competition.

Capacity expansion

VIP industries also announced capex of Rs 25 crore to double capacity in its Bangladesh operations from the current 70,000 units. The project will be complete in the next one year and will diversify the company’s sourcing and should be a positive contributor to margin as labour cost in Bangladesh is very low.

Near-term weakness

The seasonally weak second quarter coupled with the price revision necessitated by GST might impact near-term volume. We do not expect the long-term GST benefits to show up anytime soon.

In the medium to long term, in addition to the broad macro drivers, we feel that organised players like VIP would be able to tide over the incremental taxes with smart management of costs. However, if GST gets implemented in true letter and spirit, unorganised players (sizeable share in the industry) might be at a disadvantage as pricing difference - their key tool of competitiveness would get considerably eroded should they be forced to adhere to the taxation norms.

Hence any near- 1term weakness would provide the opportunity for accumulation for a core long-term portfolio.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.