Madhuchanda DeyMoneycontrol Research

The shift from the unorganised to the organised sector that we had highlighted while recommending the “luggage sector” to the investors prior to GST, seems to be playing out as is evident from the quarterly results of VIP Industries.

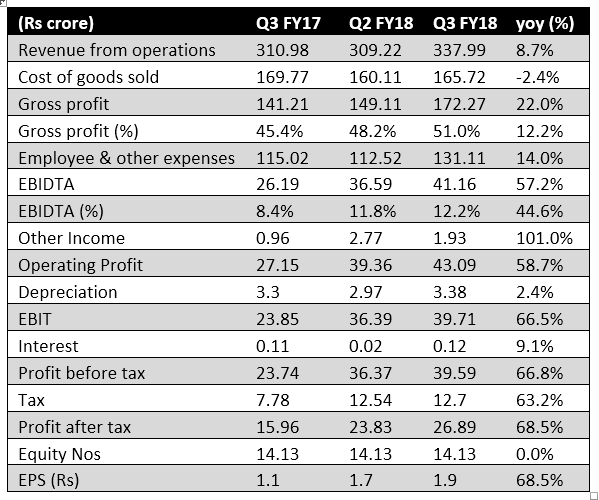

The company reported extremely encouraging quarterly numbers with expansion in gross margin (benefiting mainly from rupee appreciation), pick up in volume that also supported a surge in operating margin leading to 68.5% growth in after-tax profit.

Here are the key takeaways:

Healthy topline growth

While the reported topline growth was optically muted, it was on account of GST. Post GST, the entire taxation element is not a part of the revenue. Adjusting for that, the like-to-like revenue growth was 18% for the quarter. GST also distorted the operating margin (because of lower reported revenue) and the comparable operating margin growth was 100 basis points over the year-ago quarter.

Shift from the unorganised sector

VIP reported strong 18.8% growth in volume. The company attributed a large part of this gain to the shift in market share from unorganised to the organised players.

Over 50% of the market still belongs to the unorganised players and GST has reduced the price differential between the two segments. This was reflected in gain in market share in the dealer network.

The demonetisation led a shift in consumer behaviour that favoured the growth of the hypermarket, as well as the strong growth in e-commerce, also worked in favour of VIP.

Finally, the company gained market share from competitors like American Tourister and Samsonite.

Margin stability

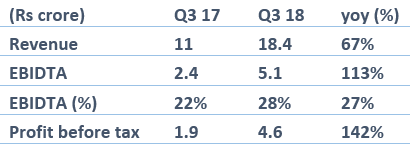

The benefits of operating leverage coupled with rupee appreciation have aided margins. While cost pressures are now inching up, the strength of the rupee and volume traction should lend stability to margins in the near term. The company is looking forward to margin stability with the help of its Bangladesh operations (as this facility ramps up capacity) where margins are higher.

Brand positioning and market segmentation

The company has positioned Carlton and Caprese brands in the premium category, VIP and Skybags in the medium range and Aristocrat in the value segment. All the brands appear to be doing well and gaining market share.

Skybags is the leading brand in the fastest growing category of backpacks. In this category, the company has launched Aristocrat range for the value segment and VIP range targeted at professionals.

Caprese is now Rs 100-crore brand and among the top five ladies handbag in India.

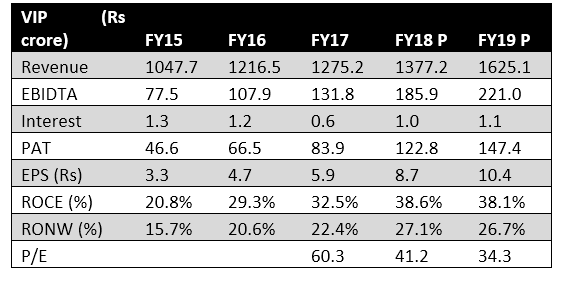

Given the strong macro tailwinds of increasing affluence, growing importance of travel and tourism in Indian life and the shift from unorganised to organised segment, the market leader VIP is definitely in a sweet spot. Despite the heady run-up in the stock that has rendered the valuation a tad expensive, we recommend a gradual accumulation of this stock as a core holding in the portfolio of a long-term investor.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.